Some common tasks that a freelance financial analyst could perform include the following:

- Preparing financial forecasts

- Analyzing trends in financial data

- Providing investment recommendations

- Assessing risk and return profiles

- Helping clients with budgeting and financial planning

Because of course, strong communication abilities are a must in this role since you will be required to simplify complicated ideas into easy language. Being an effective freelancer financial analyst means that one must always remain forward-looking and adjust according to the indidual requirements for every client.

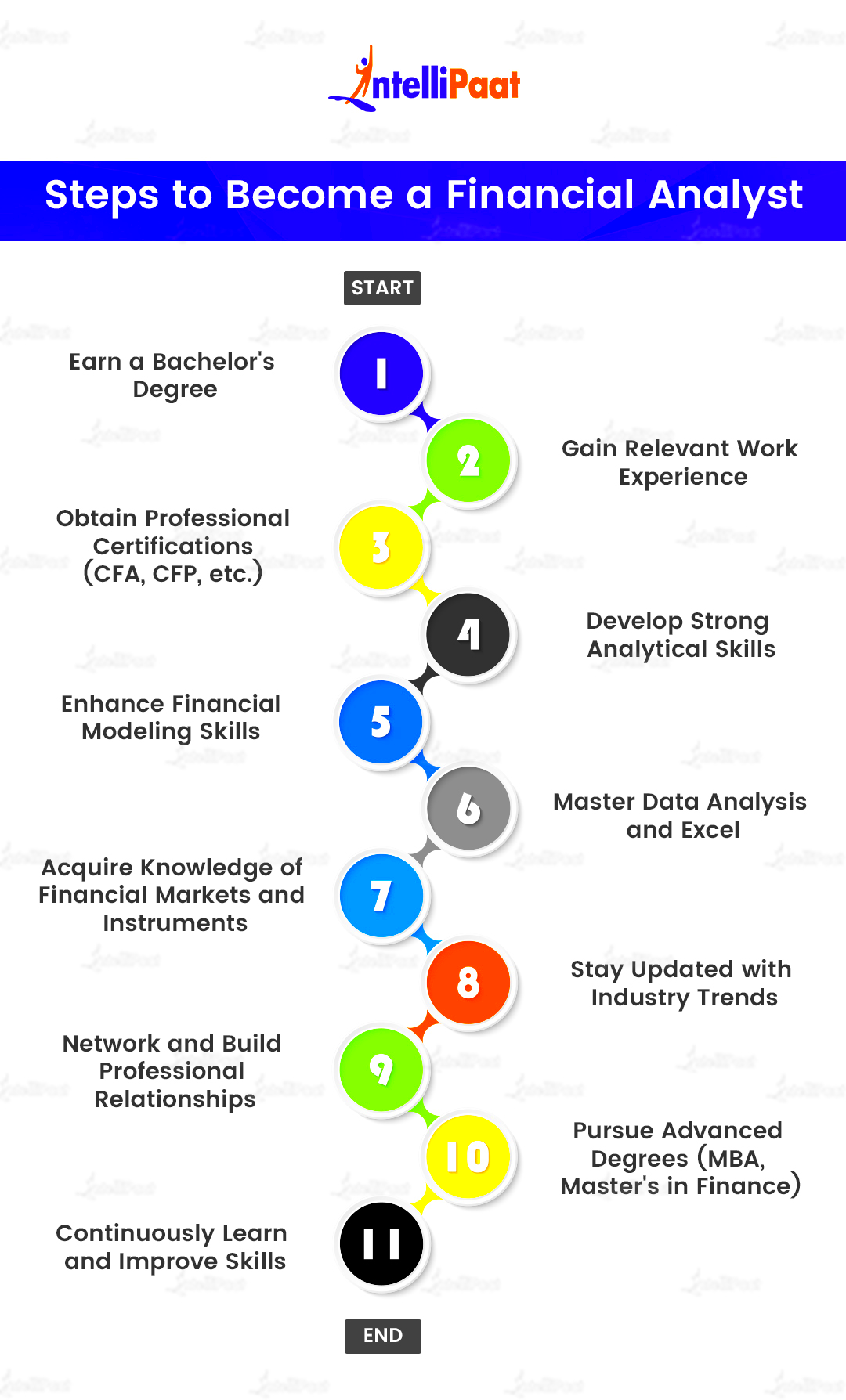

Identifying Necessary Skills and Qualifications

If you want to be successful as a freelance financial analyst, there are certain basic skills and qualifications that you need to emphasize. Though academic background can give you a strong base, on-hand experience and soft skills are of equal importance. The following are the major competencies worth taking note of:

- Analytical Skills: You need to be able to interpret complex financial data and extract meaningful insights.

- Attention to Detail: Accuracy is crucial in financial analysis; even small errors can have significant consequences.

- Communication Skills: You must clearly present your findings to clients who may not have a financial background.

- Technical Proficiency: Familiarity with financial software and tools like Excel, QuickBooks, and various data analysis programs is essential.

- Problem-Solving Ability: Clients will look to you for solutions to financial challenges; your ability to think critically is vital.

As far as qualifications are concerned, a number of financial analysts possess a baccalaureate degree in finance, accounting or economics. Additionally, advanced credentials like Chartered Financial Analyst (CFA) or Certified Public Accountant (CPA) could assist boosting one’s standing within the profession.

Also Read This: How Does Fiverr Pricing Work?

Building a Strong Portfolio to Attract Clients

As a freelance financial analyst, you possess the most effective promotional instrument known as portfolio. It depicts your potentials, past undertakings and value to your future customers. Below are ways of establishing an impressive portfolio:

- Gather Your Work Samples: Include any reports, analyses, or case studies you have completed. Ensure these samples demonstrate your analytical abilities and clarity of presentation.

- Highlight Client Testimonials: Positive feedback from previous clients can greatly enhance your credibility. Ask satisfied clients for testimonials and include them in your portfolio.

- Include a Personal Statement: Write a brief statement about your approach to financial analysis, your values, and what you can offer to clients.

- Organize Your Portfolio Professionally: Make it easy to navigate, using clear headings and sections. You might consider using a digital format, such as a PDF or a website, to make sharing easier.

Your portfolio should be organized and all encompassing for purposes of standing out in a competitive market. This is an indication to potential clients that you not only possess competence but, most importantly, consider your freelance job as a serious venture.

Also Read This: Is Fiverr Worth It for Artists?

Setting Your Rates and Pricing Strategy

How are you going to charge your services as a freelance financial analyst? Pricing is very vital, which is why it should be given utmost consideration. Therefore, this article gives helpful tips that can enable you come up with appropriate rates for your services and develop a sound pricing strategy that suits you best; no matter who they say you are: expert or not in the field of freelance financial analysis.

Factors to consider when establishing your rates include:

- Your Experience: If you’re just starting out, you may need to set lower rates to attract clients. As you gain experience and build your portfolio, you can gradually increase your rates.

- Market Rates: Research what other freelance financial analysts in your area charge. Websites like Glassdoor or PayScale can provide useful salary data.

- Service Complexity: The more complex the service you provide, the higher your rate can be. For example, in-depth financial forecasting may warrant a higher fee than basic data analysis.

- Client Budget: Some clients have strict budgets, while others are willing to pay more for high-quality services. Be flexible, but don’t undervalue your work.

Different pricing models might be employed, for instance:

- Hourly Rate: Charge for the time you spend working on a project.

- Project-Based Fee: Set a fixed fee for specific projects, which can be appealing to clients who prefer predictable costs.

- Retainer Agreements: This involves charging a regular fee for ongoing services, providing you with steady income.

You should consider the pricing scheme which is the best match for your skills, market requirement, and customers’ needs. Re-evaluate your fees frequently to ensure that they represent your increasing knowledge and experience.

Also Read This: Best 10 Fiverr Gigs for Podcast Production in 2024

Finding Clients and Networking Opportunities

One of the hardest parts about being a freelance financial analyst is finding clients. You can establish a strong network and use different strategies to reach potential customers, which will help you in growing your business. The following are some useful tips on how to find clients:

- Utilize Your Existing Network: Start by reaching out to friends, family, and former colleagues. They may know someone in need of financial analysis services.

- Attend Industry Events: Participate in finance-related workshops, conferences, or seminars. These gatherings offer valuable networking opportunities and can help you meet potential clients.

- Join Online Forums and Groups: Websites like LinkedIn and Reddit have groups focused on finance and freelancing. Engaging in discussions can help you connect with potential clients.

- Offer Free Workshops or Webinars: Sharing your expertise through free educational sessions can attract potential clients. This also showcases your knowledge and skills.

Keep in mind that it’s all about building relationships; please be real and of assistance. These connections when maintained may result in recommendations as well as continuous sales.

Also Read This: What is a Good Fiverr Username?

Utilizing Online Platforms for Freelance Work

Freelance financial analysts can greatly benefit from online platforms. Such platforms give them access to numerous clients as well as projects, which makes their searching for jobs simple. Here’s how to utilize these platforms effectively:

- Choose the Right Platform: Popular freelance sites like Upwork, Fiverr, and Freelancer cater to different niches. Research which platform aligns best with your expertise.

- Create a Strong Profile: Your profile should clearly showcase your skills, experience, and portfolio. Include a professional photo and a compelling bio that highlights your strengths.

- Bid on Relevant Projects: Regularly browse available projects and submit tailored proposals that address client needs. Highlight how your skills can solve their problems.

- Ask for Reviews: After completing projects, encourage satisfied clients to leave positive reviews. Good ratings will enhance your profile and attract more clients.

- Stay Active and Engaged: Regularly update your profile, engage with the platform community, and respond promptly to client inquiries. This shows your dedication and professionalism.

There is a possibility of increasing your visibility and client base by using online platforms. Just hang in there, it takes time to get established.

Also Read This: Best Fiverr Sellers for Digital Marketing in 2024

Managing Your Time and Projects Effectively

Freelance financial analysts need time management skills because they are often busy serving several clients and working on different assignments at once. One can easily become disoriented or fail to deliver promptly if he/she does not have an orderly way of doing things. This article outlines a few techniques that you may use in order to manage your time and projects effectively.

Initially, consider putting into practice these strategies:

-

- Set Clear Goals: Define what you want to achieve each day, week, and month. Having clear goals will give you a sense of direction.

- Use a Calendar: Keep track of deadlines and appointments with a digital or physical calendar. Tools like Google Calendar can send reminders for important tasks.

- Prioritize Tasks: Not all tasks are equally important. Use the Eisenhower Matrix to categorize tasks based on urgency and importance:

| Urgent | Not Urgent |

|---|---|

| Important Tasks | Plan for these tasks |

| Tasks to Delegate | Tasks to Ignore |

- Break Projects into Smaller Tasks: Large projects can be daunting. Divide them into manageable tasks and tackle them one at a time.

- Limit Distractions: Identify what distracts you and create a work environment that minimizes these distractions. Consider tools like website blockers if necessary.

Because utilizing your time wisely is important in ensuring that you meet all your timelines, manage stress levels are lessened, and enhance the general quality of work.

Also Read This: Can I Make Multiple Fiverr Accounts?

Continuing Education and Professional Development

As a freelance financial analyst, you need to be on top of everything happening in the industry and be upgrading yourself always if you want to make it in the long run. A good way to achieve this is through continuous education and other forms of skill enhancement. This will help improve your knowledge as well as making you more marketable to potential clients. The following are some of the ways through which one can invest in themselves:

You should begin with such techniques:

- Take Online Courses: Platforms like Coursera, Udemy, and LinkedIn Learning offer various finance-related courses. These can help you learn new tools or refresh your existing knowledge.

- Attend Workshops and Seminars: Look for local or online workshops that focus on financial analysis. Networking with other professionals can also be a bonus.

- Join Professional Organizations: Organizations such as the CFA Institute offer valuable resources, networking opportunities, and certifications that can enhance your credibility.

- Read Industry Publications: Staying informed about financial news and trends is crucial. Subscribe to financial journals, blogs, or podcasts to keep your knowledge up to date.

- Engage with Online Communities: Join forums or social media groups related to financial analysis. Engaging with peers can provide insights and opportunities for collaboration.

By investing in your professional growth, potential customers perceive commitment to your career as well as a pool of current and pertinent information that could be used in the negotiation process.

Also Read This: Why Can’t I Change Seller’s Rating on Fiverr?

FAQs

When starting off in your career as a freelance financial analyst, you might be having some queries. The following Frequently Asked Questions (FAQs) will solve for your dilemma.

- What qualifications do I need to become a freelance financial analyst? While a degree in finance or a related field is helpful, experience and skills can also pave the way. Certifications like CFA or CPA can enhance your credibility.

- How do I find clients as a freelance financial analyst? Utilize networking, attend industry events, and leverage online platforms to connect with potential clients.

- How should I set my rates? Research market rates, assess your experience, and consider different pricing models like hourly rates, project-based fees, or retainer agreements.

- How can I manage multiple projects effectively? Use calendars, set clear goals, prioritize tasks, and limit distractions to stay organized and meet deadlines.

- Is continuing education necessary for freelancers? Yes, ongoing learning is crucial in finance to stay updated on trends and enhance your skills, making you more attractive to clients.

In case of any more inquiries, do not hesitate to contact fellow professionals or ask for help from people with more experience in the field. The ability to acquire information equals the ability to have influence!

Conclusion

Success as an independent financial analyst requires a combination of abilities, proper time administration, and lifelong learning. Always bear in mind that setting the right prices and acquiring customers are critical steps towards creating a viable enterprise. Furthermore, pursuing professional development opportunities is an effective way to remain pertinent in the fast-evolving profession. These strategies, together with a proactive mindset will enable you to develop a flourishing freelance career that satisfies both your monetary aspirations while at the same time enjoying freedom and flexibility of working according to personal preference.