It is difficult to manage your finances as a freelancer; tax-related issues are even more serious. The unique tax obligations that freelancers encounter set them apart from other employees. A sound understanding of why you should save towards taxes is important for your financial stability. You will not have to worry about large amounts in tax when they fall due every year, if you plan and save regularly.

Lots of independent professions forget about tax benefits anticipating that they can manage it after.The thought of leaving it till later can actually make people face more challenges financially and incur costs that were not in their budgets.Here are some reasons why it is important to save on taxes.

- Financial Stability: Saving for taxes ensures that you have the funds available when needed, reducing financial stress.

- Avoiding Penalties: Setting aside money helps you avoid penalties for underpayment or late payments.

- Better Budgeting: Knowing how much to save each month allows for more accurate budgeting of your overall finances.

Identifying Your Tax Obligations as a Freelancer

Knowing about taxes that you may owe is the first thing we need do in order to control the money coming from freelancing profession. Freelancers have to pay themselves personally both income tax and self-employment tax. These are essential parts of what a freelancer has to pay:

- Income Tax: This is based on your net earnings, and you will pay this based on the tax bracket that applies to your income level.

- Self-Employment Tax: This covers Social Security and Medicare taxes for self-employed individuals, which is approximately 15.3% of your net earnings.

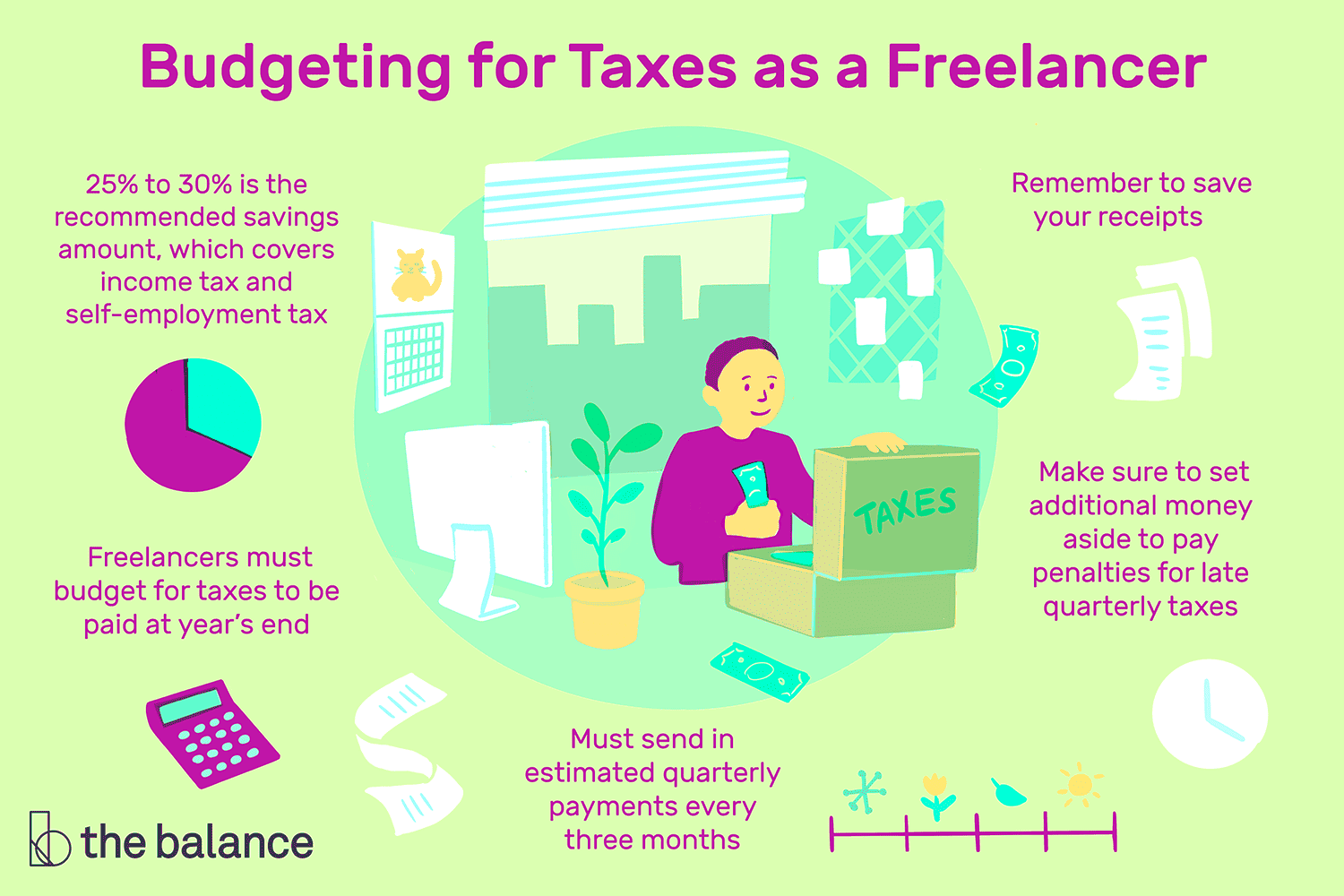

- Estimated Tax Payments: Freelancers must make estimated tax payments quarterly, which requires careful planning to ensure you have sufficient funds.

Maintaining precise records of both income and expenditures is essential for deciding the taxable income as well as the amount that should be reserved for taxes. In case you need personalized advice, it would be better to seek a tax professional’s consultation, particularly if you are uncertain about your obligations exactly.

Also Read This: How Much Can I Withdraw from Fiverr?

Creating a Budget for Tax Savings

Once you comprehend your tax responsibilities, the following move is to come up with a budget that will save for such taxes. A well organized budget is essential in order to set aside a certain percentage of one’s earnings for tax savings. Here’s how to begin:

- Track Your Income: Keep detailed records of your income sources to know how much you're earning each month.

- Estimate Your Taxes: Use your previous year's income and tax rates to estimate how much you will owe. Online tax calculators can help with this.

- Set Aside a Percentage: A common rule of thumb is to set aside 25-30% of your income for taxes. This percentage may vary based on your specific circumstances.

- Create a Separate Savings Account: Consider opening a separate account solely for tax savings. This makes it easier to track your progress and keep the funds out of your daily spending.

- Review and Adjust: Regularly review your budget and adjust as needed. If your income fluctuates, so should your savings plan.

A tax savings budget can not just prepare you for taxed season but promotes overall financial discipline and makes sure you keep hold of your freelance finances.

Also Read This: How Much Freelance Interpreters Charge and Make

Choosing the Right Savings Account for Tax Money

The selection of an appropriate savings account is a vital step in tax saving. In this regard, a separate account facilitates keeping your savings on taxes distinct from your normal expenditures. Thus, you will not mistakenly use these funds for non-tax-related expenses. Therefore, it becomes essential to look into some of the options and factors to help you decide on the best option.

Consider looking at some of the following savings account options:

- High-Yield Savings Account: These accounts typically offer higher interest rates compared to traditional savings accounts. This means your tax savings can grow a bit while you wait to pay your taxes.

- Money Market Account: Money market accounts often come with check-writing privileges and debit card access, providing flexibility while still earning interest.

- Certificates of Deposit (CDs): If you can set aside your tax savings for a specific period, CDs often offer higher interest rates than standard savings accounts, though your money will be less accessible.

Before considering an account, these factors must be kept in mind:

- Interest Rates: Look for accounts with competitive interest rates to maximize your savings.

- Fees: Check for monthly maintenance fees or minimum balance requirements that could eat into your savings.

- Accessibility: Ensure you can easily access your funds when tax time arrives without any hassle.

In the end, the best savings account will enhance your tax savings while protecting them until you need to access them. This forward-thinking method can ease your worries during tax season.

Also Read This: Do You Have to Accept Custom Order Requests on Fiverr?

Setting Up a Regular Savings Plan

The establishment of a steady savings strategy is critical to effectively managing your tax responsibilities. The implementation of a regular saving habit is important in ensuring that you have sufficient money set aside to cater for your tax obligations without so much stress. So let’s see some tips on how one can come up with a good saving plan.

For establishing a systematic savings plan all you need to do is follow these easy steps:

- Determine Your Savings Goal: Calculate how much you need to save based on your estimated tax obligations. Aim to have enough saved before your quarterly payments are due.

- Set a Monthly Savings Amount: Decide on a fixed amount to set aside each month. This could be a percentage of your income or a set dollar amount. Many freelancers find it helpful to set aside 25-30% of their monthly earnings.

- Automate Your Savings: To make saving easier, consider setting up an automatic transfer from your checking account to your savings account. This way, you won’t have to think about it, and your savings will grow without extra effort.

- Review and Adjust: Regularly review your savings plan to ensure it aligns with your income fluctuations. Adjust your monthly savings amount as needed to keep up with your tax obligations.

With a regular savings plan, one will find out that saving taxes becomes a simple part of their financial schedule thus avoiding taxes that come as last minute rush when it is tax season.

Also Read This: How to Make a Fiverr Description That Stands Out

Utilizing Tax Deductions to Lower Your Tax Bill

You can decrease your taxable income with a perfect deduction and this could help you save a lot of money during tax returns. We will look at some common deductions that are applicable to freelancers and how one can use them effectively.

The following are several tax deductions that you ought to take into consideration:

- Home Office Deduction: If you use a part of your home exclusively for your business, you may be eligible for a home office deduction. This can include a portion of your rent or mortgage, utilities, and maintenance costs.

- Business Expenses: Any expenses necessary for running your freelance business can typically be deducted. This includes costs like office supplies, software subscriptions, and marketing expenses.

- Self-Employment Taxes: You can deduct half of your self-employment tax from your taxable income, which helps offset the cost of Social Security and Medicare taxes.

- Health Insurance Premiums: If you pay for your health insurance, those premiums can often be deducted from your taxable income.

To get most from your deductions it is important to keep detailed records of all business-related expenses and this can be made easier by using accounting software or hiring a tax professional. Consulting a tax advisor may also prove beneficial so that one can benefit from various deductions depending on their specific circumstances.

The proper utilization of tax deductions leads to a reduction in one’s tax bill and therefore allows for more money to be invested back into the business or saved for future expenses.

Also Read This: Steps to Starting a Career as a Python Freelancer

Keeping Accurate Financial Records

Keeping precise financial records as a freelancer is critical in managing your business’ finances effectively. This means that you can stay on top of the income, expenses and tax obligations; when it comes to filing taxes, you will have less work to do since everything is organized. Additionally, it helps you in seeing how well your business is doing and hence make good decisions concerning it. The following are some strategies that can help maintain record keeping precision.

Your financial records should be organized to the T! Here’s how you can do it:

- Use Accounting Software: Investing in accounting software like QuickBooks, FreshBooks, or Wave can streamline your financial record-keeping. These platforms can automate invoicing, expense tracking, and even tax calculations.

- Maintain Separate Accounts: Open a dedicated bank account for your freelance income and expenses. This separation makes it easier to track your business finances and simplifies tax reporting.

- Keep Receipts: Always save receipts for business-related purchases. Consider using a scanning app to digitize and categorize receipts for easy access later.

- Regularly Update Records: Set aside time weekly or monthly to update your financial records. Consistency is key to preventing last-minute scrambles when tax time arrives.

- Backup Your Data: Regularly back up your financial data to prevent loss due to system failures. Cloud storage solutions can offer secure and accessible backups.

Accurate financial records help you alleviate the stress of tax season as well as obtain great understanding of your business' financial condition. Properly organized systems enable better decisions and efficient financial management.

Also Read This: Getting Started as a Freelance Botanist in Sims 4

Frequently Asked Questions

Tax and finances raise similar questions in the minds of many freelancers . Knowing answers to these frequently asked questions is helpful as far as clarifying your financial responsibilities and optimizing tax strategies are concerned. Now let us look at some common queries.

- What can I deduct as a freelancer? You can deduct a variety of expenses related to your business, including office supplies, software, and even part of your home expenses if you have a dedicated home office.

- How do I estimate my quarterly tax payments? You can estimate your quarterly tax payments based on your expected income for the year. It’s generally advisable to set aside 25-30% of your income for tax purposes.

- What records do I need to keep for tax purposes? You should keep records of all income received, receipts for deductible expenses, and any relevant invoices. It’s a good idea to retain these for at least three years.

- Can I claim my home office as a deduction? Yes, if you use part of your home exclusively for business, you can claim the home office deduction. Be sure to understand the specific requirements to qualify.

- Is it necessary to hire a tax professional? While it’s not mandatory, hiring a tax professional can help you navigate complex tax laws and ensure you’re maximizing your deductions.

Coming up to grips with these issues will debunk the financial and taxation nightmare that freelancers grapple with thus enabling better concentration on their jobs as they won’t have fears of unanticipated tax liabilities.

Conclusion and Key Takeaways

There are moments when one may feel overloaded by self-employed finance management; however, in case appropriate strategies are implemented one can easily go about this matter and make sure that they have a healthy pocket. The main objective is to come up with an approach that is sustainable when taking into account tax saving and usage of income skills.

Bear in mind some of these major points:

- Prioritize Tax Savings: Make it a habit to set aside money for taxes each month, so you’re not caught off guard during tax season.

- Choose the Right Accounts: Select a savings account that works for you, ensuring it helps you grow your tax savings while keeping them accessible.

- Keep Accurate Records: Maintaining organized and accurate financial records will save you time and stress when it’s time to file your taxes.

- Utilize Deductions: Familiarize yourself with the deductions available to freelancers to minimize your taxable income and lower your tax bill.

- Seek Professional Guidance: Don’t hesitate to consult with a tax professional if you have questions or need assistance navigating your tax responsibilities.

Freelancing comes with a lot of freedoms but the key is to monitor our expenditure as we know it too well.