Freelancers have a lot of freedom and flexibility, but they must also handle their own taxes. They are self-employed people as opposed to regular employees. This means that they have to report their income and pay their taxes without automatic deductions from their salaries. That is why it is important to know how much tax you should always be prepared for any surprise on tax day.

Freelancers must be conversant with different sorts of taxes, for example, the following:

- Income Tax: Based on your overall earnings.

- Self-Employment Tax: Covers Social Security and Medicare taxes.

- State Taxes: Depending on your state, additional taxes may apply.

The year has all the earnings and expenses you should closely monitor (why?). By doing this, one would not only get an insight into their tax responsibilities but also get the chance to have as many deductions as possible. Tax handling can be simple if done in the right way.

Why Saving for Taxes is Important

The self-employed person must never forget that taxes should be saved for when self-employment is done. The ower penalty of a taxpayer would be imposed by not paying to the government enough in taxes; thus, avoid having problems during tax seasons by allotting money that you won’t touch until the time comes.

Here are a few reasons as to why saving for taxes should be an essential:.

- Avoiding Debt: Not having enough funds can lead to borrowing money or using credit cards to pay your tax bill.

- Reducing Stress: Knowing you have money saved can give you peace of mind.

- Budgeting Better: When you save regularly, you can better manage your cash flow throughout the year.

Put away a part of your earnings every month to be safe from shock. For example, you may set up an ordinary savings account for tax purposes.

Also Read This: Does Fiverr Harm Your Voice Over Career?

How to Determine Your Tax Rate

Establishing how much tax you owe can be quite overwhelming; however, it is not necessarily so as there are many things to consider such as income level, filing status and qualifications for deductions. Below are simple steps on how one can identify their tax rate:

- Estimate Your Income: Calculate your expected earnings for the year.

- Consider Deductions: Know what deductions you can take to reduce your taxable income. Common deductions for freelancers include:

- Home office expenses

- Business travel costs

- Supplies and equipment

- Use a Tax Bracket Chart: Look at the IRS tax brackets to see where your income falls. Here’s a simplified table for reference:

| Income Range | Tax Rate |

|---|---|

| $0 - $10,275 | 10% |

| $10,276 - $41,775 | 12% |

| $41,776 - $89,075 | 22% |

In the end, it’s good to talk to a tax professional for personal advice. They can assist you in finding your way through your precise condition and perfecting your tax arrangements.

Also Read This: How to Change Your Fiverr Review: A Step-by-Step Guide

Setting Up a Savings Plan for Taxes

In order to avoid tax time panic and conflicts in the future, freelancers should consider coming up with a saving plan for their taxes as one of the best financial arrangements. By so doing, ordinary people may not have enough money when they need it during that period. It will definitely save you worries and last minute confusion over finance matters.

Essential steps that will enable you formulate a successful approach to saving some finance include;

- Open a Separate Savings Account: Consider opening a dedicated savings account just for taxes. This keeps your tax money separate from your spending money, making it less tempting to dip into.

- Determine Your Estimated Taxes: Use your previous year’s income and tax information to estimate how much you might owe this year.

- Set a Savings Goal: Based on your estimate, set a goal for how much you need to save each month. For instance, if you estimate you’ll owe $3,000 in taxes, saving $250 a month will help you reach that goal.

- Automate Your Savings: Set up an automatic transfer from your checking to your savings account. This way, you save without even thinking about it!

Stress is often kept in check by having plans for meeting tax obligations. There really is no substitute for organization and foresight.

Also Read This: Do You Need an LLC for Fiverr?

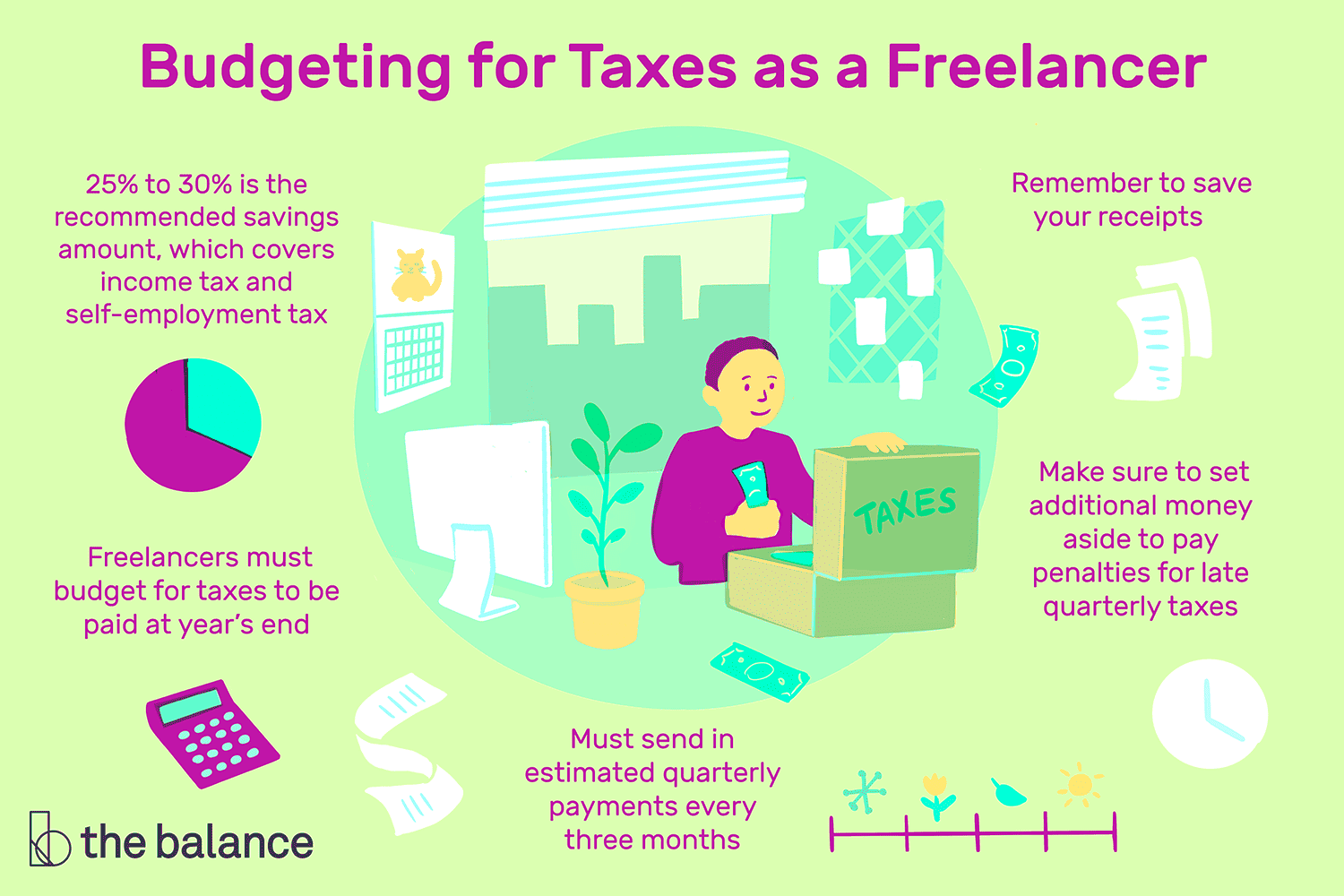

Recommended Percentage to Save for Taxes

When pondering about how much of your income should be kept aside for tax purposes can sometimes turn out to be a complicated task, but there are guidelines that can help make it easier. Many financial professionals advise keeping anything from 20% to 30% of one’s earnings aside for tax-related reasons. Such percentage includes not only federal and state taxes but also self-employment tax.

To aid in your decision making, here’s a breakdown:

- 20% for Lower Income Levels: If you earn under $50,000, saving 20% of your income is usually sufficient.

- 25% for Moderate Income Levels: For freelancers earning between $50,000 and $100,000, a 25% savings rate is often recommended.

- 30% for Higher Income Levels: If you earn over $100,000, consider saving closer to 30% to cover all potential tax liabilities.

Let’s not forget that these figures are merely similarities. However, your tax rate will largely depend on other factors which include your own deductions as well as any eventual credits you might have. Keeping track of how much you earn and how much goes into what expenses can help manage your savings accordingly so you don’t miss out on paying taxes at all.

Also Read This: Does Fiverr Take a Percentage of Tips?

Common Tax Deductions for Freelancers

If you decide to interpret yourself as a freelancer, then you have several tax deductions at your disposal that will help you lower your taxable income. Knowing these deductions could help one save some cash and retain more money.

These are some deductions that will come in handy:

- Home Office Deduction: If you work from home, you can deduct a portion of your rent or mortgage interest, utilities, and internet costs.

- Business Expenses: Expenses related to your freelance work, such as office supplies, software, and equipment, are deductible.

- Travel Expenses: If you travel for work, you can deduct costs like transportation, lodging, and meals.

- Professional Services: Fees paid to accountants, consultants, or other professionals related to your business can be deducted.

- Health Insurance Premiums: If you’re self-employed, you can deduct your health insurance premiums from your taxable income.

Aforementioned, accurate records are essential in having access to these deductions. Therefore, throughout the year, consider tracking your expenses using accounting software or a specific spreadsheet. Deductions of such magnitude can lower taxable income and help retain more money in your business!

Also Read This: How to Offer Gigs on Fiverr: A Comprehensive Guide

How to Stay Organized with Tax Records

Freelancers must maintain order in their tax records. This will assist in tracking income and expenses which will help in getting through tax time positively. The other thing that can be deduced from proper record keeping is that all possible deductions can be enjoyed. So what then do we do to keep things neat?

Here is a list of practical tips for efficient management of tax records:

- Use Accounting Software: Tools like QuickBooks or FreshBooks can simplify your bookkeeping. They help you track income and expenses in real-time.

- Create a Dedicated Folder: Set up a physical or digital folder specifically for tax documents. Include invoices, receipts, and any correspondence related to your business.

- Keep Digital Copies: Scan and save important documents on your computer or a cloud service. This provides a backup in case of loss.

- Organize Monthly: At the end of each month, take a little time to organize your records. This will prevent a last-minute scramble at tax time.

- Label Everything Clearly: Use clear labels for your folders and files so you can easily find what you need when you need it.

Using these suggestions will help you to maintain tidy tax papers that you can easily access whenever the need arises during tax time!

Also Read This: How to Name Your Package on Fiverr: A Complete Guide

Frequently Asked Questions about Freelancers and Taxes

Most freelancers tend to have doubts about tax issues which may result in some insecurity. These are some commonly asked queries that can help easing the confusion:

- Do I need to pay estimated taxes? Yes, if you expect to owe $1,000 or more in taxes, you should make estimated tax payments quarterly.

- What if I don’t make enough money? If your income is below a certain threshold, you may not owe taxes, but it’s still wise to keep records in case your situation changes.

- Can I deduct my home office expenses? Yes, if you use a portion of your home exclusively for work, you can deduct related expenses.

- What records should I keep? Maintain records of all income, expenses, receipts, invoices, and any other documents related to your business for at least three years.

- Do I need an accountant? While not mandatory, hiring a tax professional can help ensure you’re maximizing deductions and staying compliant with tax laws.

In case you have further inquiries, feel free to reach out for expert advice from tax consultant who will assist you with tailor made advice depending on your specific needs.

Conclusion on Saving for Taxes as a Freelancer

Saving for taxes as a freelancer may seem daunting, but it doesn’t have to be. By understanding your tax obligations, setting up a solid savings plan, and keeping organized records, you can navigate tax season with confidence. Remember, being proactive about your tax savings will not only ease your stress but also keep you on the right side of the IRS.

Once more, in a nutshell, these can be summarized as follows:

- Understand Your Tax Responsibilities: Familiarize yourself with what taxes you need to pay as a freelancer.

- Save Regularly: Set aside a percentage of your income for taxes to avoid surprises later.

- Utilize Deductions: Keep track of potential deductions to reduce your taxable income.

- Stay Organized: Keep your tax records in order throughout the year to simplify your tax filing process.

In taking this actions one with effectively manage the taxes thus enabling him or her to focus on their freelancing work which is more efficient.