Just like they do for employees, freelancers need health insurance. However, those who are self-employed may find it difficult to navigate this area. For freelancers like yourself, no employer provides options or covers the costs of insurance. This is why understanding your health insurance needs becomes all the more important.

The freelancers tend to have a multitude of tasks and obligations to undertake, however; it is imperative that they put their health in the first place. The lack of insurance can make an unanticipated medical bill look like an intolerable financial burden. Therefore, it is crucial to investigate available choices and reach sound conclusions.

Factors Influencing Health Insurance Costs

Freelancers health insurance prices may differ due to various reasons. It’s important to understand this while choosing a plan.

- Age: Generally, older individuals pay higher premiums.

- Location: Health insurance costs vary by state and even by city. Research local rates.

- Coverage Level: The more comprehensive the plan, the higher the premium. Balance your needs with your budget.

- Health Status: Pre-existing conditions can lead to increased costs.

- Type of Plan: Whether you choose an HMO, PPO, or another type of plan can impact your costs significantly.

Also Read This: Is Fiverr a Good Stock to Buy in 2021?

Types of Health Insurance Plans Available

Freelancers have a number of healthcare insurance options to select from. Here are some general categories:

| Plan Type | Description | Pros | Cons |

|---|---|---|---|

| Health Maintenance Organization (HMO) | Requires members to use a network of doctors and hospitals. | Lower premiums and out-of-pocket costs. | Less flexibility in choosing providers. |

| Preferred Provider Organization (PPO) | Offers more flexibility in choosing healthcare providers. | Greater choice of providers and less need for referrals. | Higher premiums and out-of-pocket costs. |

| Exclusive Provider Organization (EPO) | Similar to an HMO but does not require referrals. | Lower costs with more provider flexibility. | Out-of-network care is not covered. |

| High Deductible Health Plan (HDHP) | Features lower premiums but higher deductibles. | Allows Health Savings Account (HSA) contributions. | Higher initial out-of-pocket costs. |

Your health needs and financial situation are crucial in selecting the most suitable plan. It’s important to look at all options keenly so that one may obtain proper coverage that favors their situation.

Also Read This: How to Start Work on Fiverr: A Step-by-Step Guide

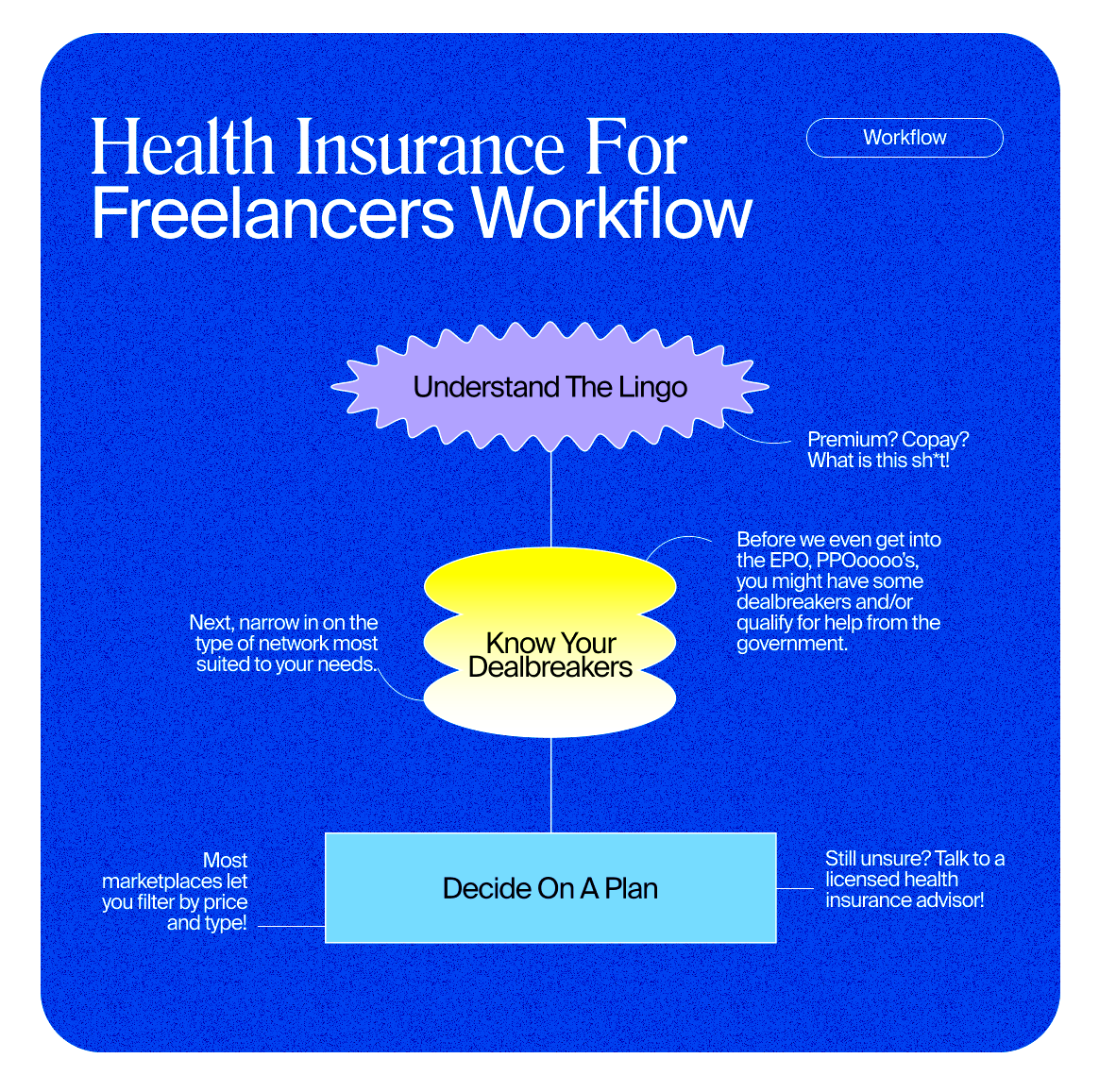

How to Compare Health Insurance Options

Comparing health insurance options is the most difficult of all tasks, this is particularly true for independent contractors who are in for solo struggle. However, this should not discourage you from taking things slowly. The main aim is to choose one that addresses both your body and financial requirements while assuring enough policy protection.

In order to simplify the process of comparing, following steps should be taken:

- Identify Your Needs: Start by assessing your health needs. Consider factors like the frequency of doctor visits, medications, and any ongoing treatments.

- Gather Quotes: Use online comparison tools or contact insurers directly to gather quotes. Make sure you’re looking at similar coverage levels.

- Check Network Coverage: Ensure the plan has a network of doctors and hospitals that are convenient for you. Out-of-network care can be costly.

- Understand Premiums and Deductibles: Look at monthly premiums, deductibles, and out-of-pocket maximums. Balance what you can afford monthly with potential costs when you need care.

- Review Benefits: Examine what services are covered, including preventive care, specialist visits, and prescription drugs. Some plans might offer extras like wellness programs.

Following these measures will enable you to have enough information to select the most suitable option according to your way of life and income status.

Also Read This: How to Cancel an Order on Fiverr as a Buyer

Finding Affordable Health Insurance as a Freelancer

Locating inexpensive medical coverage may be difficult for independent contractors, yet it’s not insurmountable. Here are a few suggestions to enable you save on the expenses:

- Shop Around: Don’t settle for the first plan you see. Compare several options to find the best deal.

- Consider a Health Savings Account (HSA): If you choose a high-deductible plan, an HSA can help you save money tax-free for medical expenses.

- Look for Subsidies: Depending on your income, you might qualify for subsidies through the Health Insurance Marketplace. This can significantly lower your premium.

- Join a Freelancers' Group: Some organizations offer group health insurance plans, which can provide better rates than individual plans.

- Stay Healthy: Maintaining good health can lower your premiums. Regular exercise and a balanced diet can help reduce medical costs in the long run.

To get low-cost health insurance, some research and strategizing is required, but the outcome will be a policy that is affordable to you.

Also Read This: How Much to Charge for Freelance Writing Projects

Tax Implications for Freelancers with Health Insurance

It is fundamental for a freelancer to know the tax ramifications of medical cover since it can influence their monetary status and enhance their savings, too.

Here are a few critical aspects that you should keep in mind:

- Deducting Premiums: You can deduct health insurance premiums from your taxable income. This includes premiums paid for yourself, your spouse, and your dependents.

- Health Savings Account (HSA) Contributions: If you have an HSA, contributions are tax-deductible. This means you can save for medical expenses while lowering your taxable income.

- Self-Employment Tax: Freelancers pay self-employment tax, but deducting health insurance premiums can lower the overall taxable income, thus reducing the tax owed.

- State-Specific Regulations: Be aware that tax laws vary by state. Some states may have additional benefits or deductions for health insurance.

It may be useful to consult with a tax expert for navigating through intricacies and ensuring that you are maximizing your deductions and credits. Being aware of these tax effects can aid freelancers in better handling their financial situations.

Also Read This: How Much Can You Earn on Fiverr?

Common Mistakes to Avoid When Choosing Health Insurance

It is hard to find the best health insurance plan because many freelancers fail; therefore, it’s important that these professionals be warned about the common mistakes they make when purchasing a cover for their health. Here are some of the things you should avoid when buying a health life insurance policy so that you save your time, money and avoid additional tensions.

These are the errors that should be avoided:

- Ignoring the Fine Print: Always read the details of the policy. Many plans come with limitations and exclusions that could affect your coverage.

- Focusing Solely on Premiums: While it’s important to consider costs, low premiums can often mean higher out-of-pocket expenses. Look at the entire cost structure.

- Not Considering Your Health Needs: If you have ongoing medical conditions or need regular prescriptions, ensure your plan covers these adequately. Don’t choose a plan based solely on price.

- Neglecting Preventive Care: Some freelancers overlook the importance of preventive care benefits. Look for plans that cover annual check-ups and screenings without a copay.

- Failing to Reassess Annually: Health needs can change over time. Each year, take a fresh look at your plan to see if it still meets your needs.

A freelancer can choose a plan that genuinely supports his health and financial well-being by avoiding these blunders.

Also Read This: Are There Scammers on Fiverr? Understanding the Risks and How to Protect Yourself

Frequently Asked Questions about Health Insurance Costs

Health insurance costs confuse several freelancers. The following are common queries that can help clarify your understanding:

- What factors affect my health insurance premiums? Premiums are influenced by your age, location, coverage level, and health status.

- Can I change my health insurance plan anytime? Typically, you can only change plans during open enrollment periods unless you have a qualifying event like moving or losing other coverage.

- Are preventive services covered? Yes, most health insurance plans are required to cover preventive services like vaccinations and screenings without a copay.

- What is a deductible? A deductible is the amount you pay out of pocket before your insurance starts covering costs. Plans with lower premiums often have higher deductibles.

- Can I write off health insurance premiums on my taxes? Yes, freelancers can deduct health insurance premiums from their taxable income, which can provide significant savings.

When it comes to understanding these commonly asked questions, it can help you make smart choices about the expenses related to health care coverage.

Conclusion on Managing Health Insurance Costs

When this comes as working on his/her own, to manage expenses on health insurance might be tricky; however if you are well informed, then it is possible to get a plan which looks good for you and does not push you beyond the income. It is important to learn about what is there because without knowledge it will be hard for one to choose the best policies.

I would like to state this.

- Assess your health needs accurately.

- Compare multiple plans carefully.

- Avoid common pitfalls when selecting a plan.

- Stay informed about tax deductions available for health insurance premiums.

Keeping active and constantly reviewing choices can help in controlling health insurance costs thus safeguarding one’s health without draining finances. Do not hesitate contacting an insurance professional or finding online sources with the needed information. The more aware one is, the wiser choices on their health and finances are possible.