Your financial well-being as a freelancer depends on knowing your tax obligations. Unlike regular employees, freelancers operate as independent contractors and possess different tax duties. Paying taxes falls on you alone and may seem overwhelming for beginners. Nevertheless, having some information will help you go through this process confidently.

As a freelancer, one has to pay income tax as well as self-employment tax, which covers both Social Security and Medicare. Here are some important things to note:

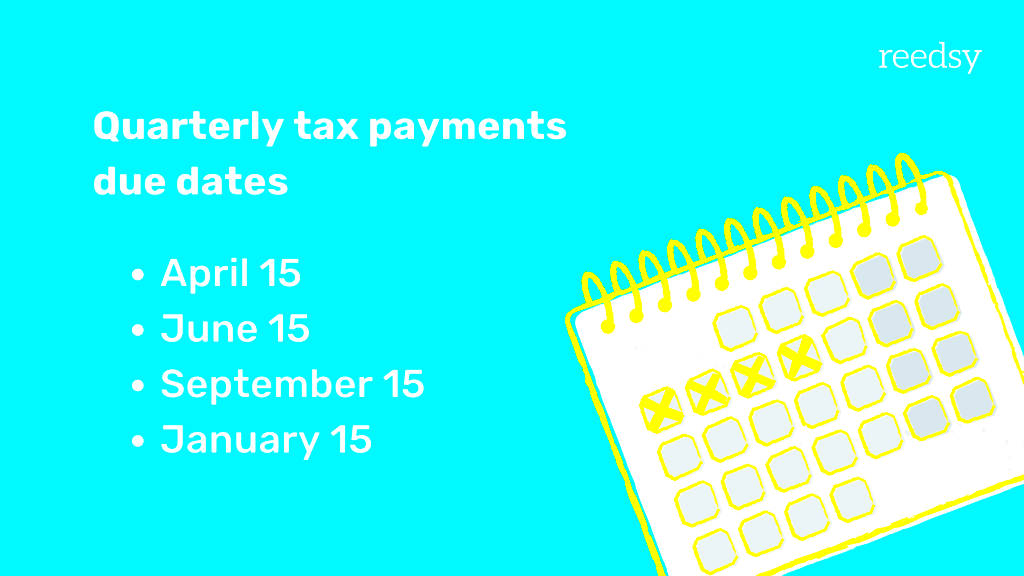

- Quarterly Payments: Freelancers often need to make estimated tax payments quarterly. This helps avoid a large tax bill at the end of the year.

- Deductible Expenses: Keep track of your business expenses, as these can lower your taxable income. This includes costs like software subscriptions, office supplies, and even home office expenses.

- Record Keeping: Maintaining accurate records of your income and expenses is essential. Use accounting software or apps to simplify this process.

Common Tax Challenges Faced by Freelancers

The tax issues that freelancing brings are different from each other. To handle them in proper way and to prevent from falling into traps, it is essential that you understand them.

- Income Variability: Freelancers often experience fluctuating income, making it hard to predict tax liabilities.

- Underestimating Tax Payments: Many freelancers underestimate their tax obligations, leading to potential penalties and interest.

- Lack of Benefits: Unlike traditional employees, freelancers miss out on employer-sponsored benefits that can affect tax liabilities.

It can be difficult to navigate through all the obstacles that come with tax season. But identifying and anticipating them can help reduce the weight.

Also Read This: How to Work as a Freelance Researcher

How to Organize Your Finances for Tax Season

Get proper money arrangements for taxation duration hence its able to be simple now. The procedures may be simplified with an organized method thereby relieving yourself of any tension.

Here are few steps you may want to take into account:

- Create a Separate Business Account: Having a dedicated business bank account makes tracking income and expenses much easier.

- Utilize Accounting Software: Tools like QuickBooks or FreshBooks can help you manage your finances and generate reports effortlessly.

- Keep Track of Receipts: Store all receipts in one place, whether digitally or physically. This practice is crucial for deducting expenses.

- Set Aside Money for Taxes: Consider setting aside a percentage of your income regularly to cover your tax payments.

- Schedule Regular Financial Reviews: Monthly check-ins can help you stay on top of your finances and make adjustments as needed.

By organizing your finances early, the tax season can be smoother with less worry about it and more time to freelance work.

Also Read This: Is It Safe to Provide Your Name on Fiverr?

Tax Deductions Available for Freelancers

As a freelance worker the best way to pay less taxes is by utilizing all possible tax deductions. This will help you save money in the end since they will lower your taxable salary. In order to maximize your earnings, it is important that you understand what you can deduct.

Here’s a few regular tax deductions that independent contractors are able to submit claims:

- Home Office Deduction: If you work from home, you can deduct a portion of your rent or mortgage, utilities, and internet expenses. To qualify, your workspace must be exclusively used for business.

- Business Expenses: This includes costs related to running your business, such as software subscriptions, office supplies, and professional services.

- Travel Expenses: If you travel for work, you can deduct transportation costs, lodging, and meals. Just make sure to keep your receipts and a detailed log of your trips.

- Health Insurance Premiums: Freelancers can deduct their health insurance premiums from their taxable income, which can provide significant savings.

- Retirement Contributions: Contributing to a retirement account, like a SEP IRA, can lower your taxable income while helping you save for the future.

You can retain a greater portion of your income, which you earned through toil, by utilizing such deductions. However, it is recommended to contact a tax specialist and guarantee that you have availed all the possible deductions as well as conforming to the taxation guidelines.

Also Read This: How to Make a Video for Your Fiverr Gig

Steps to Filing Your Taxes as a Freelancer

Filing your taxes as a freelancer can appear intimidating but by focusing on baby steps, it will be made easier. This is a simple guide on how to handle tax season:

- Gather Your Documents: Collect all necessary documents, including 1099 forms from clients, bank statements, and receipts for deductible expenses.

- Choose Your Filing Method: Decide whether you want to file your taxes manually, use tax software, or hire a tax professional. Each option has its pros and cons.

- Calculate Your Income: Sum up your total income from freelancing, including any additional income sources.

- Deduct Your Expenses: Subtract your business expenses from your total income to determine your taxable income.

- Complete Your Tax Forms: Fill out the necessary tax forms, typically a 1040 with Schedule C for self-employed individuals.

- Review and Submit: Double-check your forms for accuracy and submit them either electronically or by mail.

You can make your tax filings simpler and file them with less stress using these means to meet your financial responsibilities.

Also Read This: How can you add superscript in Canva like a pro?

Importance of Keeping Accurate Records

Accurate record keeping is crucial not just for tax purposes but also for the overall health of your freelance business. It helps you keep track of how much money you have earned, how much you have spent and prepares you adequately when it comes to filing tax returns come April.

Here is why keeping precise records is important:

- Simplifies Tax Preparation: When your records are organized, preparing your tax return becomes a much simpler task.

- Helps Identify Deductions: Accurate records make it easier to spot deductible expenses that you might otherwise overlook.

- Supports Business Decisions: Keeping track of your income and expenses helps you make informed decisions about your business, such as identifying profitable services or areas for improvement.

- Provides Legal Protection: In case of an audit, having detailed records can support your claims and protect you from penalties.

For the sake of being organized you may want to use accounting software, spread sheets or just a filing system. To make certain that nothing drops, update your records at regular intervals. In addition to saving time during tax season it also helps in achieving overall success for your business.

Also Read This: Is Fiverr Safe for Sellers?

Resources for Freelancers Seeking Tax Help

Tax season is something that can overwhelm many people, and this is especially true for self-employed individuals who usually have to deal with various difficulties which are not common place. Luckily, there are numerous resources at your disposal to help you understand everything better. No matter what you want, whether it is expert opinion or free tools, at the end of the day you will have access to a lot of information.

Some treasure resources are available for self-employment:

- IRS Website: The IRS website provides essential information on tax obligations, forms, and deadlines. Make sure to check out their resources specifically for self-employed individuals.

- Online Tax Software: Programs like TurboTax and H&R Block offer user-friendly interfaces that guide you through the filing process. They often include specific sections for freelancers and can help you identify deductions.

- Freelancer Forums and Communities: Joining online forums like Reddit or freelance groups on social media can connect you with others who share their experiences and advice about tax-related issues.

- Professional Tax Advisors: If your situation is complex, consulting a tax professional can provide tailored advice. They can help you understand your obligations and maximize deductions.

- Webinars and Workshops: Many organizations offer free or low-cost webinars focused on taxes for freelancers. These can be a great way to gain insights from experts in the field.

Using these tools, you can maneuver through taxes with assurance and make sure that you have done what you ought to do in tax so as not to go through bad stress.

Also Read This: What Happened to Fiverr 5?

Frequently Asked Questions

Many free agents ponder on tax duty and function queries. The following are few instances in respect to which answers have been provided thereby helping you understand better;

- Do I need to pay taxes if I make under a certain amount? Yes, all income is taxable, even if it's below a certain threshold. It's crucial to report all your earnings.

- Can I deduct my home office expenses? Absolutely! If you have a dedicated space for your business, you can deduct related expenses, like a portion of your rent or utilities.

- What happens if I miss the tax deadline? Missing the deadline can result in penalties and interest. If you need more time, file for an extension, but remember that you still need to pay any taxes owed.

- Should I hire a tax professional? If your tax situation is complex or you want to ensure you maximize your deductions, hiring a tax professional can be beneficial.

- How can I estimate my tax payments? You can estimate your tax payments based on your previous year's income or use the IRS's Form 1040-ES for guidance.

When approaching tax season, it is best to have knowledge about often asked questions which will prepare and make you feel informed.

Conclusion

Navigating the world of taxes as a freelancer can be difficult, but it doesn’t need to be intimidating. By understanding your tax obligations, using available resources and keeping proper records, you can make tax time easier.

Don’t forget to make use of deductions of which pertain specifically to you, and don’t hesitate in seeking help if necessary. Nowadays there are numerous ways to reduce tax related worries such as online tools, expert consultation or community support. A systematic approach and up-to-date information will keep your freelance career satisfying with good financial management.