It is significant that you comprehend the charges linked with the procedure of card recognition when working as a freelancer. This helps to uphold the safety of your payments and protection of your identity. Therefore, freelancers have to know about these expenses in order to plan their budgets properly due to the growing use of online transactions. This part discusses what exactly card authentication is and how vital it is for your freelancing firm.

Factors Influencing Card Authentication Costs

Freelancers may be affected by some elements which could change their card authentication expenses. Below are some notable factors:

- Transaction Volume: The more transactions you process, the lower the per-transaction cost might be. High-volume freelancers often benefit from lower rates.

- Payment Method: Different payment methods (credit cards, debit cards, etc.) may have varying costs associated with them. Some methods come with higher fees.

- Service Provider: The fees charged by your payment gateway or processor can vary significantly. It's crucial to compare different providers to find the best rates.

- Geographic Location: Depending on where you are located, the costs associated with card authentication may vary due to local regulations and market conditions.

Those factors can be understood such that they will assist in planning well for the costs of card authentication in your freelance undertaking.

Also Read This: Does Fiverr Allow Zoom? Exploring Communication Options on the Platform

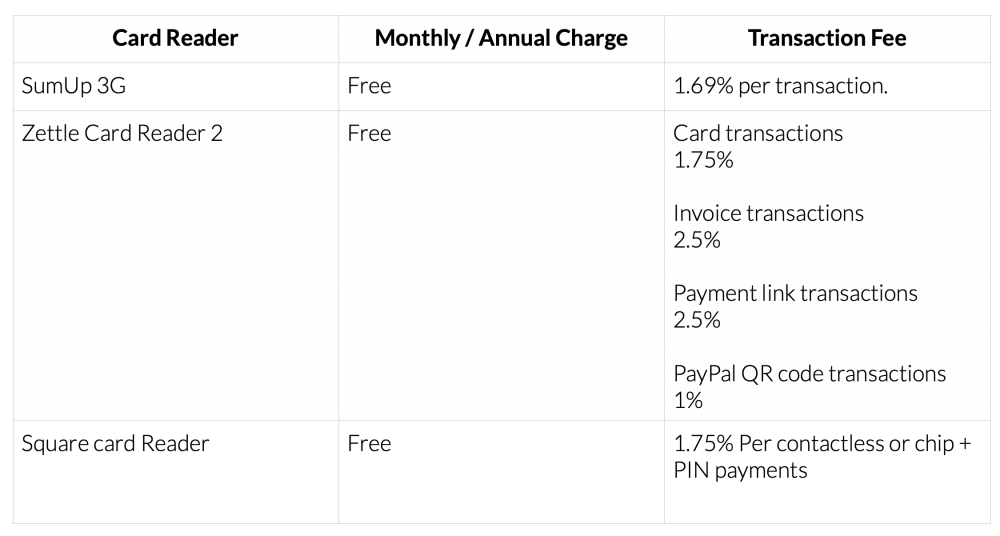

Comparing Card Authentication Costs Across Platforms

Freelancing platforms have such a wide gap in their card authentication costs. Here is a brief comparative analysis of some of the popular platforms:

| Platform | Card Authentication Fee | Additional Charges |

|---|---|---|

| Fiverr | 2.9% + $0.30 per transaction | Withdrawal fees may apply |

| Upwork | 3% for all payments | Currency conversion fees may apply |

| Freelancer.com | 2.9% + $0.30 per transaction | Withdrawal fees vary by method |

Picking the platform that best meets your financial goals may also require that you look closely at its associated fees. This allows you to keep your costs low and earn more as a self-employed individual.

Also Read This: Earnings of Freelance Web Designers

Budgeting for Card Authentication as a Freelancer

Freelancers need to have a budget so that they can manage their financial stability. This budgeting process must include the costs related to card verification procedures. This writing intends to help readers understand the importance of predicting and preparing for these costs in order to warn against anything that may cause liquidity complications. In this section, we’ll outline several ways on how to budget for card authentication expenses.

Therefore, the steps include making a plan concerning the budget for card authentication.

- Track Your Transactions: Start by keeping a record of all transactions that involve card authentication. This includes payments received and any associated fees.

- Estimate Monthly Costs: Based on your transaction history, estimate your monthly card authentication costs. This will give you a clearer picture of what to expect.

- Allocate Funds: Set aside a specific amount in your monthly budget for card authentication costs. Treat this like any other expense to ensure you’re prepared.

- Review Regularly: Periodically review your budget and transaction records to see if your estimates are accurate. Adjust your budget as needed.

Through effective card authentication budgeting, one can have efficient financial management leading to concentration on best tasks such as excellent service delivery to the clients.

Also Read This: How to Switch to Seller on Fiverr App for Android

Tips for Reducing Card Authentication Costs

As a freelance worker, you can make big savings on your profit margin by reducing card authentication expenses. Follow these useful tips to cut costs:

- Shop Around: Don’t settle for the first payment processor you find. Compare fees and services from different providers to ensure you’re getting the best deal.

- Negotiate Rates: If you have a high transaction volume, consider negotiating your rates with your payment processor. They may be willing to lower fees to keep your business.

- Minimize Chargebacks: Chargebacks can lead to additional fees. To avoid them, ensure clear communication with clients and provide excellent service.

- Use Alternative Payment Methods: Explore other payment options, like direct bank transfers or payment apps, which may offer lower fees.

So in as much as they might sound basic, these ideas will ultimately help you lower the amounts you spend on verifying cards thus saving more for yourself.

Also Read This: How to Become Fiverr Pro Verified

Choosing the Right Payment Method for Your Needs

In this section, we will look at vital aspects to consider in order for freelancers to choose the right payment method. This is important because it can determine cash flow, charges and satisfaction of clients.

Following are certain parameters that need to be kept in mind while choosing a payment method:

- Transaction Fees: Look for payment methods with competitive fees. Consider how these fees will affect your overall earnings.

- Speed of Payments: Some methods offer faster access to funds than others. If you need quick access to your earnings, prioritize speed.

- Security Features: Ensure the payment method you choose has robust security measures in place. Protecting your information is vital.

- Client Preferences: Consider what payment methods your clients are comfortable using. Offering their preferred options can enhance the client experience.

Through a thorough assessment of these factors, one is able to identify a payment method that is appropriate for their freelancing business and promotes a smooth cash flow.

Also Read This: How Much Does Fiverr Take from Sellers?

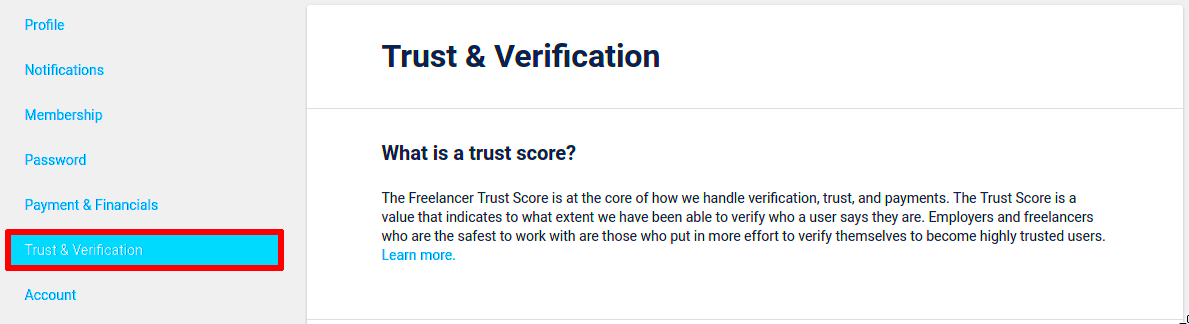

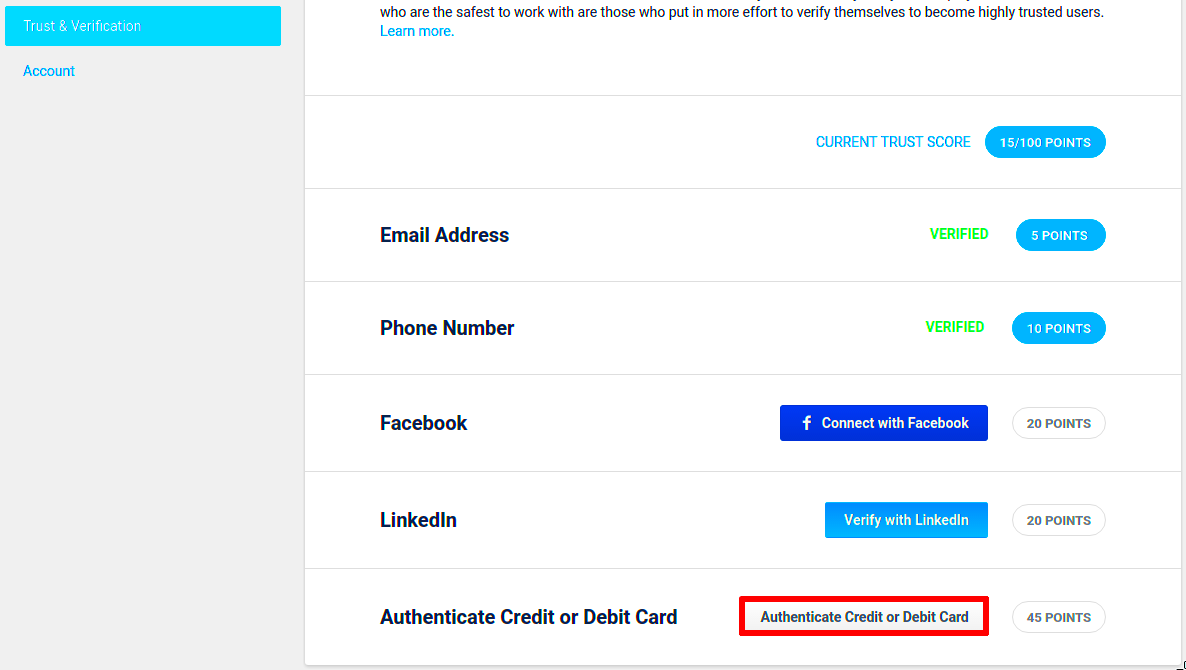

Frequently Asked Questions about Card Authentication Costs

As a freelancer attempting to find his way in the field of card testing, you may have inquiries regarding the expenses and good procedures. These are some frequently asked questions that can help elucidate your understanding:

What is card authentication?

Illuminating the strategy to determine whether or not particular patterns reflect possible identity of a customer based on card type card authentications concerns identification of a legitimate cardholder who is paying for offered services (Veverka et al., 2006). This system functions primarily by comparing details entered by an individual during online payment with those preserved in the firm’s password holder. Additionally, this service can serve as an alert for potential frauds.

Are card authentication fees always the same?

Indeed, card authentication payments are not fixed and differ significantly depending on a number of different determinants such as the query site selected for use, order size and others. Therefore it is very important to compare offers in order to get the most reasonable prices for your company.

Can I negotiate card authentication fees?

Of course, large volumes of transactions could prompt many payment processors into fee negotiation. So, go ahead and contact them and talk about what you need.

What can I do to reduce chargeback fees?

To help minimize the number of chargeback fees, you should keep in touch with your clients transparently, ensure you’re delivering quality work and have descriptions of your services that are detailed enough. It’s easy this way to avoid chargebacks arising out of miscommunication.

How do I choose the best payment processor?

In making an informed decision, it is important to consider the transaction costs, security protocols, speed of payment and client preferences. This could be achieved by reviewing several processors in this regard.

Conclusion on Card Authentication Costs for Freelancers

For freelancers it is of utmost importance to comprehend and handle card authentication costs. In order to manage the finances well, make smart use of all available means of payment, and take measures to reduce expenses, thereby optimizing your revenue and keeping yourself solvent. Make a note that a better informed choice will lead to a good result hence keep on looking for more information and adjust yourself accordingly if you want to succeed in freelancing.