If you're a freelancer, you may have realized that not all clients will send you a 1099 form at the end of the year. While the 1099 form is a common way to report freelance income, there are situations where you may not receive one. In this case, it's still important to report your earnings accurately to avoid issues with the IRS. This guide will walk you through the steps of reporting freelance income even without a 1099, ensuring you stay on track with your taxes.

Why You Might Not Receive a 1099 Form

There are several reasons why a client may not provide you with a 1099 form. Here are some of the most common situations:

- Your earnings are below $600: The IRS requires businesses to send 1099 forms to freelancers who earn $600 or more in a calendar year. If you make less than $600, they are not obligated to issue a 1099.

- You were paid through a platform: If you received payment via an online platform like PayPal or Fiverr, these platforms may not issue a 1099 for individual transactions unless your total income exceeds the threshold.

- Incorrect classification of your work: Some clients may classify you as an independent contractor and may not issue a 1099 form if they consider you a vendor for tax purposes.

- Client's failure to comply: Sometimes, the client may simply forget or fail to send you the 1099 form even if they should.

Even without the form, you’re still required to report all your earnings to the IRS. It's your responsibility to keep track of all your freelance income.

Also Read This: Fast and Easy Remote US Internships: Quick Access to Valuable Experience from Anywhere

Steps to Report Freelance Income Without a 1099

When you don't receive a 1099 form, it’s crucial to report your freelance income correctly on your tax return. Here's a step-by-step guide on how to do it:

- Step 1: Gather Your Income Records

Start by collecting all the details of your freelance work, including invoices, payment receipts, or bank statements showing the income you've earned. This information will serve as your proof of income for the year.

- Step 2: Calculate Your Total Freelance Income

Once you have all your records, total up your earnings. Include payments from all clients, regardless of whether you received a 1099 form or not.

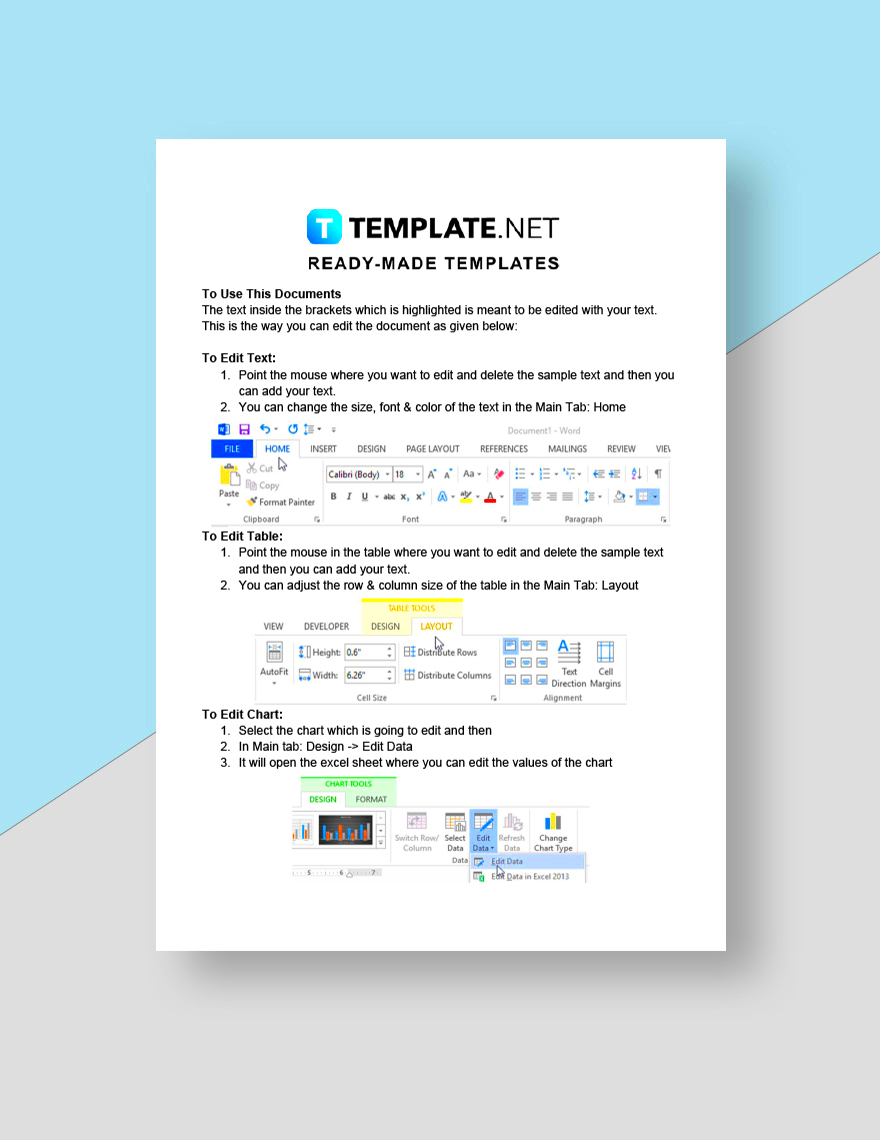

- Step 3: Report Income on Schedule C

As a freelancer, you’ll use IRS Schedule C (Form 1040) to report your business income and expenses. Even without a 1099, you still need to report the total amount of money you earned. Schedule C allows you to track both your income and any business-related expenses.

- Step 4: Fill Out Schedule SE for Self-Employment Taxes

In addition to reporting your income on Schedule C, you’ll need to fill out Schedule SE to calculate self-employment taxes. As a freelancer, you are responsible for paying both Social Security and Medicare taxes on your earnings.

- Step 5: Keep Detailed Records

Even though you’re reporting your income without a 1099 form, it’s essential to maintain thorough records of all your freelance work. This will help you if you get audited or need to prove your income in the future.

By following these steps, you can accurately report your freelance income, even if a 1099 form was not provided.

Also Read This: Explore the Steps to Craft the Perfect Fiverr Gig Title for Graphic Design

Gathering and Organizing Your Income Records

When you’re working as a freelancer, keeping track of your income is essential for reporting your earnings accurately. Even without a 1099 form, you’ll need to provide documentation of what you’ve earned throughout the year. This means organizing all the details of your freelance work, from payments received to invoices sent. Here’s how you can do it:

- Track All Payments: Collect information about all payments made to you, including dates, amounts, and client details. This can be found through PayPal statements, bank transactions, or through the platform you work on, like Fiverr.

- Maintain Invoices and Contracts: Keep copies of invoices or contracts you’ve issued. These documents can serve as proof of the work you performed and the amount owed or paid.

- Organize Your Income Records: Use spreadsheets, accounting software, or even a simple ledger to record your income. Break it down by client, date, and payment type to make it easy to reference when needed.

- Keep Personal and Business Finances Separate: If possible, use a separate bank account for your freelance work. This makes it easier to track business-related income and expenses separately from personal spending.

Good organization is key when it comes time to file your taxes. Having a clear record of all your earnings will help you avoid errors and ensure you report your income accurately.

Also Read This: Can You Bring a Price Down on Fiverr?

How to Report Freelance Income on Your Tax Return

Once you’ve gathered and organized your freelance income records, it’s time to report everything on your tax return. Here's how to do it correctly, even if you didn’t receive a 1099 form:

- Step 1: Complete IRS Schedule C (Form 1040)

Freelancers must report their income and expenses on Schedule C. This form is attached to your regular tax return (Form 1040). On Schedule C, you’ll list the total amount of income you earned from your freelance work.

- Step 2: Report Your Income

On the Schedule C form, report the total freelance income you earned. Include all payments received from clients and make sure to add up all your earnings, regardless of whether you got a 1099.

- Step 3: Deduct Your Business Expenses

If you had any expenses related to your freelance work, such as office supplies, equipment, or software subscriptions, you can deduct those from your income on Schedule C. This can lower your taxable income and reduce the amount of taxes you owe.

- Step 4: Complete Schedule SE for Self-Employment Tax

Freelancers must also pay self-employment tax, which covers Social Security and Medicare. To calculate this, you’ll need to complete Schedule SE. This form helps you determine the additional taxes you need to pay on your freelance income.

- Step 5: File Your Tax Return

Once you’ve completed Schedule C and Schedule SE, attach them to your main Form 1040 tax return and submit it to the IRS. Remember to file your taxes by the deadline to avoid penalties and interest.

Reporting your freelance income accurately on your tax return is crucial for staying compliant with the IRS and avoiding potential issues down the road.

Also Read This: How to Get Famous on Fiverr

Common Mistakes to Avoid When Reporting Freelance Income

Reporting your freelance income might seem straightforward, but there are a few common mistakes that freelancers often make when filing taxes. Avoiding these errors can save you time, money, and stress:

- Forgetting to Report All Income: It’s easy to miss some small payments or income from clients who didn’t send you a 1099. Be sure to report every dollar earned from freelance work, even if you didn’t receive a 1099 form for it.

- Not Keeping Track of Expenses: Many freelancers forget to deduct their business expenses, which can result in higher taxes. Keep detailed records of all your expenses related to your freelance work, such as office supplies, software, and travel costs.

- Mixing Personal and Business Finances: Combining your personal and business finances can make it harder to track income and expenses accurately. It’s a good idea to use a separate bank account for your freelance earnings to simplify the process.

- Not Paying Self-Employment Tax: Freelancers are responsible for paying both income tax and self-employment tax (which covers Social Security and Medicare). Be sure to fill out Schedule SE to calculate and pay your self-employment tax.

- Missing Deadlines: Missing the tax filing deadline can result in penalties and interest charges. Be sure to file your tax return on time and pay any owed taxes to avoid extra costs.

- Underreporting Deductions: While claiming deductions for business expenses is important, be cautious. Only claim deductions that are directly related to your freelance work and maintain proper documentation for each expense.

By being aware of these common mistakes and taking steps to avoid them, you’ll have a smoother tax filing experience and ensure that you comply with all IRS requirements.

Also Read This: How Much Can You Charge on Fiverr?

Tips for Managing Freelance Income Without a 1099

Managing your freelance income effectively is crucial, especially if you don’t receive a 1099 form. Without a formal report from clients, it’s easy to lose track of your earnings. Here are some tips to help you stay organized and make tax season much easier:

- Keep Detailed Records: Make a habit of documenting every payment you receive, whether through a bank statement, PayPal, or another platform. Use a spreadsheet or accounting software to track all transactions with the date, client, and amount.

- Separate Business and Personal Finances: Use a separate bank account for your freelance income and expenses. This makes it easier to track your earnings and deductions without mixing them up with your personal finances.

- Use Accounting Tools: Consider using accounting software or apps designed for freelancers. Programs like QuickBooks Self-Employed or FreshBooks can automatically track your income and expenses, making tax filing simpler.

- Set Aside Money for Taxes: Freelancers don’t have taxes automatically deducted from their payments. To avoid surprises come tax season, set aside a portion of your earnings for taxes. A common rule is to save about 25-30% of your income for tax purposes.

- Save Receipts for Deductions: Keep receipts for any business expenses, such as office supplies, software, or even home office costs. These can be deducted from your taxable income to lower your overall tax burden.

By following these tips, you’ll ensure that your freelance finances are well-managed and that you’re prepared when it comes time to file your taxes.

Also Read This: Suggested Rates for Freelance Animation Services

Frequently Asked Questions About Reporting Freelance Income

Many freelancers have questions when it comes to reporting income, especially when they don't receive a 1099 form. Here are answers to some of the most common questions:

- Do I still need to report income if I didn’t receive a 1099?

Yes, you must report all your freelance income to the IRS, even if you didn’t receive a 1099 form. It’s your responsibility to keep track of all earnings and report them accurately.

- What if my client didn’t send me a 1099 on time?

If you don’t receive your 1099 by the deadline (usually January 31st), contact your client and ask for it. If they still don’t send it, you’re still required to report the income. You can use your own records to report it.

- Can I deduct business expenses if I don’t receive a 1099?

Yes! Whether or not you get a 1099, you can still deduct eligible business expenses on Schedule C. Keep receipts and records for any purchases related to your freelance work.

- How do I calculate self-employment tax?

You calculate self-employment tax using Schedule SE. This tax covers Social Security and Medicare, and is calculated based on your net income (income after expenses).

- What happens if I don’t report all my freelance income?

Failing to report your income can result in penalties, fines, and interest charges. It’s always better to be accurate and upfront about your earnings to avoid problems with the IRS.

If you have more specific questions, it's always a good idea to consult a tax professional to make sure you're on the right track.

Conclusion

Reporting freelance income without a 1099 form might seem challenging, but with the right steps, you can ensure you're staying compliant with the IRS. By organizing your income records, reporting everything accurately, and avoiding common mistakes, you’ll be able to manage your freelance taxes with confidence. Remember, even without a 1099, you’re still responsible for reporting all your earnings. Following the tips and strategies outlined here will not only help you avoid tax issues, but it will also set you up for financial success in the long run.