Freelancing offers great flexibility and independence, but it also comes with its own set of responsibilities, especially when it comes to taxes. Unlike traditional employment where income is reported through a W-2 form, freelancers may not always receive a 1099 form from clients. This can make reporting income seem daunting, but it’s crucial to understand how to do it correctly. Knowing how to report your freelance income accurately ensures compliance with tax regulations and can help you avoid potential penalties.

Identifying the Need for Reporting

It’s important to know when you need to report your freelance income. Generally, if you earn more than $600 from a single client during the year, they are required to send you a 1099 form. However, even if you don't receive this form, you are still obligated to report all your income to the IRS. Here are some situations where you should definitely report your income:

- If you earn $400 or more in net earnings from self-employment

- If you have multiple clients and your total earnings exceed $600

- If you work as a freelancer in addition to a regular job

Bear in mind that straightforwardness is crucial. The IRS employs different means to monitor earnings and reporting all figures would always be better to elude future troubles.

Also Read This: Earnings of Freelance Python Programmers

Steps to Report Income Without a 1099

Reporting freelance income without a 1099 form might feel tricky, but it can be straightforward if you follow these steps:

- Keep Detailed Records: Track all your earnings throughout the year. Use spreadsheets or accounting software to log payments as they come in.

- Gather Supporting Documentation: Collect invoices, receipts, and bank statements. These documents will serve as proof of your income and expenses.

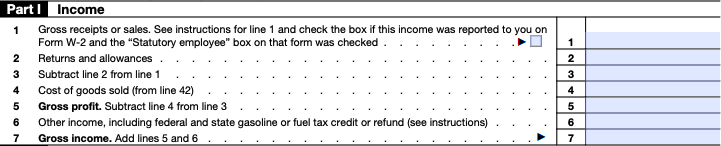

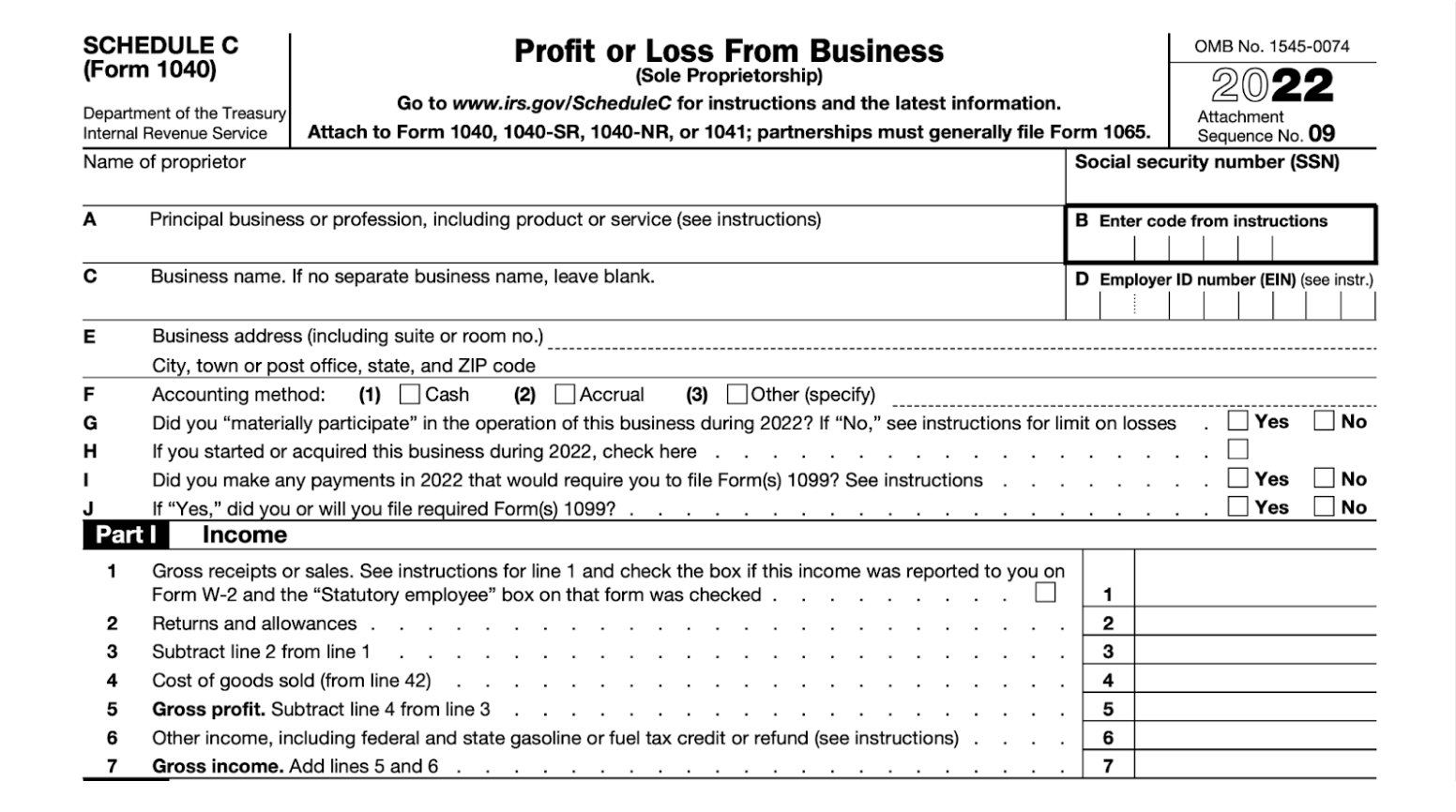

- Use the Correct Tax Form: Depending on your situation, you will typically report your freelance income using Schedule C (Form 1040) for self-employment income.

- Calculate Your Net Earnings: Subtract any business expenses from your total income to determine your net earnings. This figure is what you will report on your tax return.

- File Your Taxes: Complete your tax return and include your Schedule C. Make sure to file by the deadline to avoid penalties.

By following these steps, you can report your freelance income accurately, even without a 1099 form.

Also Read This: How to Extend the Delivery Time on Fiverr

Gathering Necessary Documentation

When it comes to reporting freelance income, having the right documentation is key. Even if you don’t receive a 1099 form, you can still compile your records to ensure you accurately report your earnings. Gathering the necessary documents helps you paint a clear picture of your financial situation. It also provides the evidence you need in case the IRS has any questions. So, let’s explore what you should collect.

These are some important papers that should be collected:

- Invoices: Keep copies of all invoices you send to clients. They should detail the services provided and the amounts charged.

- Bank Statements: These can help verify deposits made into your account, matching them with your earnings.

- Receipts: Save receipts for any business-related expenses, as these can reduce your taxable income.

- Contracts: If you have contracts with clients, hold onto them. They can clarify your working relationship and payment terms.

- Expense Logs: Maintain a record of any business expenses incurred throughout the year.

It is essential to have these documents in order as it alleviates the process of filing taxes and decreases anxiety.

Also Read This: How Does Fiverr Work as a Buyer?

Choosing the Right Tax Form

Choosing the right tax form is essential for correctly reporting your freelance income. The appropriate one not only aids in meeting tax obligations, but it also helps to maximize deductions. Here follows a four-step guideline to show you different forms that you might need:

| Form | Use It For |

|---|---|

| Form 1040 | Your main tax return form. |

| Schedule C | Reporting income and expenses from your freelance work. |

| Schedule SE | Calculating self-employment tax. |

For most freelancers, Form 1040 along with Schedule C will be the primary forms to fill out. If your net earnings exceed $400, you’ll also need Schedule SE to calculate self-employment tax. Make sure to check the IRS guidelines to ensure you’re using the most up-to-date forms.

Also Read This: Understanding the Levels on Fiverr: A Comprehensive Guide

Exploring Other Income Reporting Options

If you’re in a situation where you don't receive a 1099, or if your income comes from various sources, there are alternative ways to report your earnings. Exploring these options can help you stay compliant with tax laws while maximizing your deductions. Here are some additional reporting methods:

- Form 1040 with Additional Income: You can report other income directly on your Form 1040, even if it doesn’t come with a 1099.

- Using Schedule C-EZ: If your expenses are straightforward and you have minimal business costs, you might qualify for Schedule C-EZ, which is simpler.

- Cash Basis Accounting: If you follow this method, report income when you receive it and expenses when you pay them, which can simplify your reporting.

- Self-Employment Tax Options: If you earn less than $400 in net earnings, you generally don’t need to pay self-employment tax, though you should still report your income.

A tax expert may also direct you on what to do depending on your own unique circumstances so that you will be able to make a choice on which is the right reporting alternative for the freelance job you are doing.

Also Read This: How is the California Bullet Train Behind Fiverr?

Common Mistakes to Avoid in Reporting

It is true that even little mistakes in freelance income reporting could cause bigger issues later on. Some common errors made by freelancers may result in

other things such as penalties or audits. To avoid such problems, one must be aware of the following mistakes:

- Failing to Report All Income: It might be tempting to leave out small payments, but all income must be reported to the IRS.

- Not Keeping Accurate Records: Lack of documentation can lead to confusion and inaccuracies in your tax return. Make sure to maintain organized records.

- Ignoring Business Expenses: Many freelancers miss out on valuable deductions by overlooking legitimate business expenses. Keep track of everything!

- Missing Deadlines: Be aware of tax deadlines. Late filings can incur penalties and interest on unpaid taxes.

- Choosing the Wrong Forms: Using the incorrect forms can complicate your filing process. Ensure you're using the right forms for your situation.

These are some of the errors you can avoid to conserve time, money and reduce anxiety hence concentrating on your freelance occupation, rather than tax concerns.

Also Read This: Follow This Simple Way to Determine Fiverr Gig Video Size

Frequently Asked Questions

Freelancing can raise many questions about tax reporting, especially when it comes to income without a 1099 form. Here are some of the most common questions freelancers have:

- Do I need to report income if I don’t receive a 1099? Yes, all income must be reported, regardless of whether you receive a 1099 form.

- What if I earn less than $600 from a client? You still need to report this income, even if a 1099 wasn’t issued.

- Can I deduct expenses if I didn’t receive a 1099? Absolutely! You can deduct any business-related expenses you incurred.

- What forms do I need to file as a freelancer? Typically, you will use Form 1040 along with Schedule C and Schedule SE for self-employment tax.

- How can I avoid an audit? Keep accurate records, report all income, and file your taxes on time to minimize your audit risk.

In case you have queries that are particular to your situation, banks may be able to help you resolve them by having tax experts provide you with expertise depending on what you need.

Conclusion and Final Thoughts

Reporting freelance income without a 1099 can feel challenging, but it doesn’t have to be overwhelming. By understanding the reporting process, gathering the necessary documentation, and avoiding common mistakes, you can navigate your tax responsibilities with confidence. Remember, it’s essential to report all your earnings, keep detailed records, and choose the correct forms to ensure a smooth filing experience.

Freelancing may be best option for persons who want have flexible jobs, pursue their interests and earn money, but it also forces freelancers to take care of their own taxes. If you need help understanding this complicated matter, do not wait any longer to get in touch with a tax expert. A little bit of knowledge and foresight will keep you on the right track as far as taxes are concerned while making your journey as a freelancer enjoyable. Best wishes for happy freelancing!