Freelancing gives you flexibility, but it also comes with extra responsibilities, especially when it comes to taxes. Unlike traditional employees, freelancers don’t have taxes automatically withheld from their payments. This means you are in charge of calculating, reporting, and paying your taxes. Understanding the tax rates applied to freelance income is essential for keeping your finances in order and avoiding surprises during tax season.

Essentially, it is important to understand the different types of taxes that apply to us and how these affect our income. We shall explore the specifics of this subject matter so as to enable you confidently manage your freelance tax obligations.

Types of Taxes Freelancers Need to Pay

There are various forms of taxes that freelancers ought to pay. These are:

- Income Tax: Just like any other worker, freelancers must pay federal and, in some cases, state income taxes based on their total earnings.

- Self-Employment Tax: This tax covers Social Security and Medicare. As a freelancer, you are considered both the employer and the employee, which means you’re responsible for the full 15.3% self-employment tax rate.

- State and Local Taxes: Depending on where you live, you may need to pay state income tax or local business taxes.

It is likewise essential to be mindful of any existing taxes like sales tax if one is selling products or services to which they may be applied.

Also Read This: How to Become Pro Verified on Fiverr

How to Calculate Your Freelance Income Tax

Calculating income tax for freelancers complex but it becomes easy when simplified in written form; so allow me to take you through the process:

- Estimate Your Annual Income: Add up all the income you've earned throughout the year from freelancing. Don’t forget to include tips, bonuses, and any side gigs.

- Subtract Business Expenses: Deduct expenses related to your freelance work such as office supplies, travel costs, and marketing expenses. These deductions lower your taxable income.

- Calculate Your Tax Rate: Your tax rate depends on your total taxable income. Freelancers fall into different tax brackets depending on their earnings. It's important to know your bracket to determine the correct rate.

- Include Self-Employment Tax: Don’t forget to factor in the 15.3% self-employment tax, which covers your Social Security and Medicare contributions.

- Make Estimated Tax Payments: Freelancers are required to make quarterly estimated tax payments to the IRS if they expect to owe more than $1,000 in taxes for the year.

To evade anxiety during tax season, monitor the money flowing in and out of your pocket during the year so that you are sure you are saving adequately to settle your tax liabilities come due date.

Also Read This: How to Sell on Fiverr Without Skills

Important Tax Deductions for Freelancers

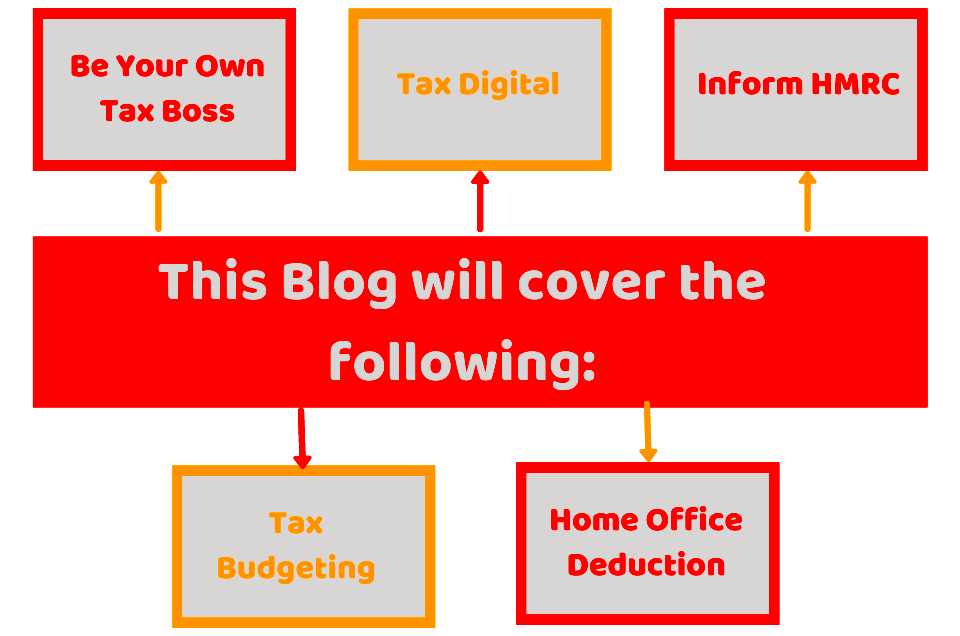

One of the biggest advantages that come with freelancing is that you can easily be allowed to deduct some of your business expenses from your taxable income. This deduction will help reduce your tax liabilities considerably. Therefore, being able to identify those expenses that qualify becomes essential for maximizing savings and staying legally compliant.

In the following are given just a few examples of the tax deductions that can be claimed by freelancers:

- Home Office Deduction: If you work from home, you may be able to deduct expenses related to the portion of your home used exclusively for business, such as rent or mortgage interest, utilities, and maintenance.

- Equipment and Supplies: The cost of purchasing or maintaining equipment (computers, printers, etc.) and supplies needed for your business is fully deductible.

- Travel Expenses: Business travel, including airfare, hotels, and meals, can be deducted if the trip is necessary for your work.

- Internet and Phone Bills: If you use the internet or your phone for your freelance business, you can deduct a portion of these bills based on how much they are used for work.

- Marketing and Advertising: Costs related to promoting your services, such as website hosting fees, social media ads, and business cards, are all deductible.

- Professional Services: Fees for accountants, lawyers, or consultants who assist you with your freelance business can also be deducted.

Throughout the year, record detailed data of these expenses as much as possible and when in doubt regarding any tax deduction, reach out to a tax expert. These may cost you money quickly but help during the season of taxation!

Also Read This: How to Include Freelancing on Your Resume

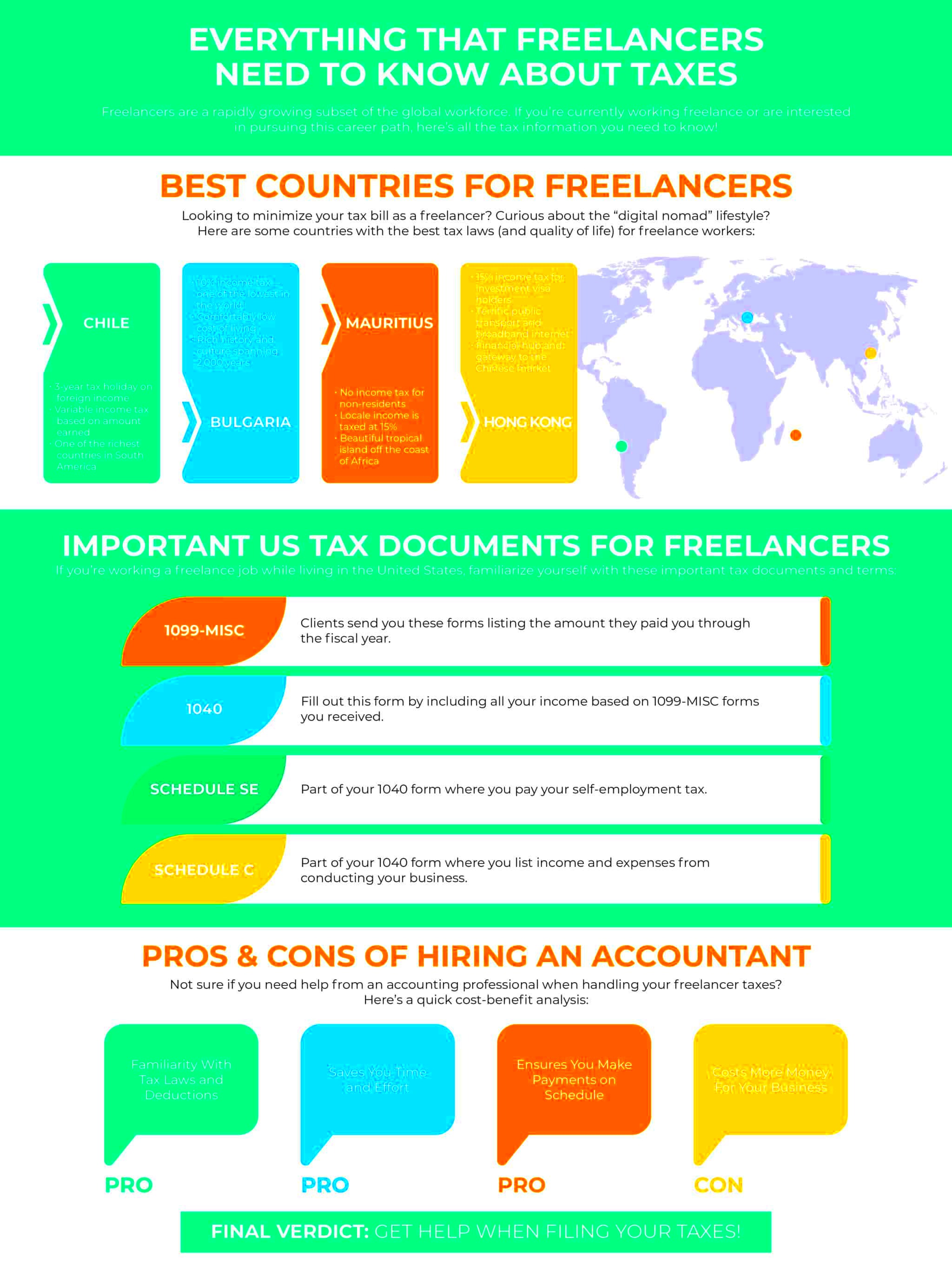

Self-Employment Tax: What You Need to Know

One important tax that every freelancer must be educated about is self-employment tax. The taxes taken from traditional employees due to Social Security and Medicare are not deducted from the payments made to them by the freelancers. Therefore, as an independent worker, it becomes compulsory for you to pay complete amount because there is no one in authority above who can help out with this duty.

A brief overview of what this tax is all about would look like:

- Social Security Tax: This is 12.4% of your net earnings, up to a certain income limit. For freelancers, this portion is quite significant, as they pay both the employer and employee parts of the tax.

- Medicare Tax: This is 2.9% of your net earnings. Unlike Social Security, there is no income cap for Medicare tax, meaning you'll pay this percentage on all your freelance earnings.

In total, the self-employment tax rate is 15.3%. However, the good news is that you can deduct half of your self-employment tax when calculating your taxable income, providing some relief. Make sure you account for this tax when estimating your earnings and expenses to avoid any surprises come tax time.

Also Read This: Annual Earnings of Freelance Graphic Designers

Quarterly Estimated Taxes: How to Stay Compliant

Freelancers are required to pay their taxes throughout the year, not just at the end of it. If you expect to owe $1,000 or more in taxes for the year, you are responsible for making quarterly estimated tax payments to the IRS.

Here’s how to stay on top of your quarterly tax payments:

- Calculate Your Taxable Income: Estimate your total income and expenses for the year. Subtract your business expenses from your income to get a rough idea of your taxable earnings.

- Determine the Amount You Owe: Once you know your taxable income, use the IRS tax brackets and self-employment tax rate (15.3%) to calculate the amount you owe. Don’t forget to consider any applicable state taxes.

- Set Up a Payment Schedule: Quarterly payments are due in April, June, September, and January. Mark these dates on your calendar to ensure you never miss a deadline.

- Pay Electronically: You can easily make your quarterly tax payments online through the IRS's EFTPS (Electronic Federal Tax Payment System), ensuring they are received on time.

These payments can be done rigorously in order to eliminate penalties and massive tax bills during annual return filing. Organization and partitioning some of your earned money as taxes would keep you within the law and relieve worry.

Also Read This: How to Make Money on Fiverr: Step by Step Guide

Keeping Records for Tax Purposes

When it comes to handling freelance taxes, having precise and comprehensive records is crucial. Good record-keeping aids in monitoring your income as well as expenditures and guarantees you are ready in the event of an audit. Good records will make tax time much simpler, allowing you to take all the deductions allowed by law and still remain within the parameters of tax statutes.

Below is a brief overview of what you need to remember:

- Income: Keep a record of every payment you receive from clients, including dates, amounts, and any relevant invoices or contracts.

- Expenses: Track all business-related expenses such as office supplies, software subscriptions, travel costs, and professional services. Make sure to save receipts and bank statements.

- Home Office and Utility Bills: If you claim a home office deduction, keep records of your rent, mortgage interest, utility bills, and other home-related costs.

- Mileage and Travel: If you travel for work, log your miles or keep receipts for flights, hotels, and meals. Apps like MileIQ can help automate mileage tracking.

- Estimated Tax Payments: Document any quarterly tax payments you make, so you can properly report them on your tax return.

This implies that using specific applications such as QuickBooks or FreshBooks enables one to easily follow their comings and goings. When submitting taxes, they also come in handy. It is worth noting that accurate paperwork serves as an assurance against any inquiries by the Internal Revenue Service in future years.

Also Read This: Top Platforms to Promote Your Fiverr Gig for Maximum Visibility

FAQs About Freelance Taxes

A lot of freelancers have inquiries about the way taxations operate on their enterprise. These are some of the frequently asked questions concerning these matters accompanied by answers:

- Do freelancers need to pay taxes on all income? Yes, freelancers must report all income earned from clients, regardless of the amount. Even small payments are taxable.

- How do I know if I need to pay quarterly taxes? If you expect to owe more than $1,000 in taxes for the year, the IRS requires you to make quarterly estimated tax payments.

- Can I deduct personal expenses? No, only business-related expenses are deductible. Personal expenses, even if they benefit your work, cannot be claimed.

- What happens if I don’t pay my quarterly taxes? If you don’t make your estimated payments on time, you may face penalties or interest charges from the IRS when you file your annual tax return.

- How do I file freelance taxes? You’ll need to file IRS Form 1040 along with a Schedule C to report your income and expenses. If you owe self-employment tax, you’ll also need to file Schedule SE.

Despite being initially overwhelming, tax files might turn out to be a walk in the park with proper orientation towards them. In case of any doubts or lack of proper understanding about taxes, it is prudent that one seeks help in terms of guidance from an expert.

Conclusion: Staying Ahead of Your Freelance Taxes

Freelance taxes take a year-round commitment to keep ahead of them. Understanding what taxes to pay, knowing what deductions to take advantage of, and having comprehensive financial records make the whole process easier. Self-employment tax should be budgeted for; this is why one must always remain on time with their quarterly estimated payments so as not to have shocks along the path.

In order not to get stressed out, filing freelance taxes is manageable. A sound plan along with appropriate tools will keep you compliant and help save some money through the legitimate deductions you take. Do not shy away from contacting a tax specialist to assist you if uncertainty arises in any way about tax matters. It is less about who will run your freelance business but rather how best you can be able to do it by being ahead of all tax related issues.