Freelancing is quite an amazing way to go about; however, it has its own unique set of challenges, particularly when it comes down to paying taxes. It is important for one to understand how tax rates are associated with one’s freelance income. Moreover, there are several aspects that influence the taxes you have to pay such as your place of residence, amount of money earned from freelancing and business expenses incurred. This section will discuss everything that freelancers need to know regarding tax rates and also provide guidance on how they can deal with the cumbersome task of filing their taxes as solo agents.

Types of Taxes Freelancers Need to Consider

As a freelancer you will come across many types of tax. Below is a summary of the leading ones:

- Income Tax: This is the tax you pay on your earnings. The rate can vary based on your total income and the tax bracket you fall into.

- Self-Employment Tax: This tax covers Social Security and Medicare. If you earn over a certain threshold, you’ll need to pay this additional tax, which is typically around 15.3%.

- Sales Tax: If you sell goods or specific services, you may need to collect sales tax from your clients. The rates and regulations can vary widely by state.

- Estimated Taxes: As a freelancer, you might need to pay estimated taxes quarterly to avoid penalties. This helps you manage your tax bill throughout the year.

For remaining in compliance and steering clear of any unforeseen shocks during tax season; it’s crucial to keep tabs on such tax items.

Also Read This: Can I Use My Real Name in My Fiverr Name?

How Tax Rates Vary by Location

Freelancers’ taxation rates, from one place to the other, may vary dramatically. Here are a few essential considerations:

- State Income Taxes: Some states have a flat income tax rate, while others use a progressive system where the rate increases with your income level. For instance:

| State | Income Tax Rate |

|---|---|

| California | 1% - 13.3% |

| Texas | No State Income Tax |

| New York | 4% - 8.82% |

- Local Taxes: Some cities or counties impose their own taxes in addition to state taxes. Make sure to check your local regulations.

- International Tax Rates: If you’re a digital nomad or working with clients overseas, understand how international tax treaties might affect your tax obligations.

Being aware of these alterations can provide you with better budgeting technique and help you steer clear of any confrontations with tax administration in future.

Also Read This: What to Sell on Fiverr: Top Ideas for 2019

Impact of Income Levels on Tax Rates

As a freelancer, your level of income has a significant effect on your tax rates. Generally speaking; earnings tend to determine how much tax one pays. For instance; in most cases people with higher income brackets pay several proportions more of their respective earnings as taxes. The rationale behind this progressive taxation is that those individuals who make large amounts must give up democratic or fair part. Let us explore in detail the interplay between various income levels and consequently their respective tax rate consequences for them along with expectations we should have concerning them.

Things to keep in mind include:

- Tax Brackets: Most countries have tax brackets, which determine how much tax you owe based on your income. For example:

| Income Range | Tax Rate |

|---|---|

| $0 - $10,000 | 10% |

| $10,001 - $40,000 | 12% |

| $40,001 - $85,000 | 22% |

It’s evident from the brackets that your income is subject to tax in stages.

- Effective Tax Rate: Your effective tax rate is the average rate you pay on your total income. Even if you're in a higher bracket, you won't pay that rate on all your income.

- Planning for Taxes: If you expect to earn significantly more, consider consulting a tax professional to understand your tax liabilities better and plan accordingly.

Also Read This: How Do You Get Payments from Fiverr?

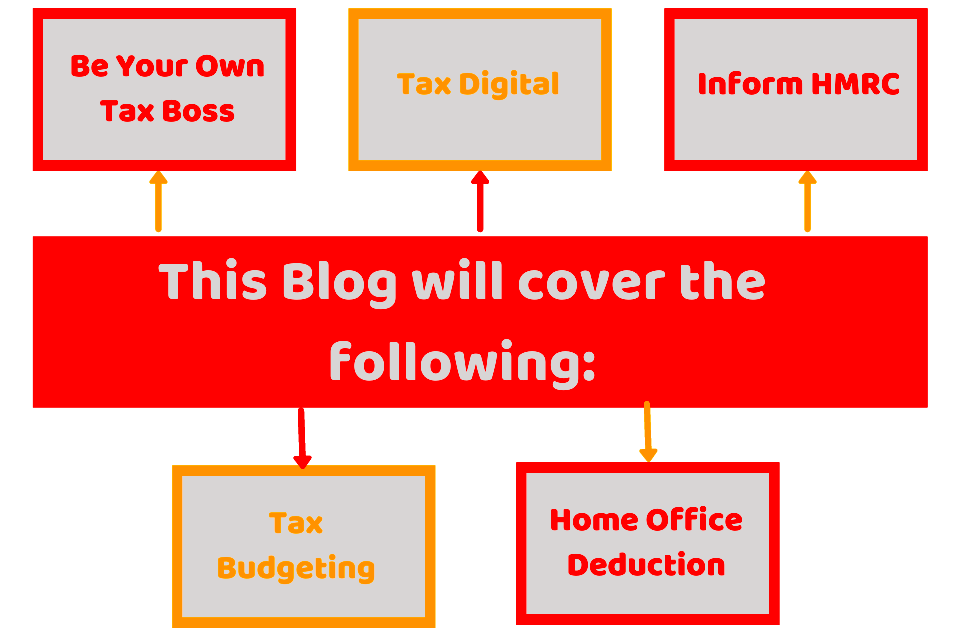

Deductible Expenses for Freelancers

Freelancers have the advantage of being able to deduct certain costs from their taxable income. Knowing about which deductions to take can be advantageous when it comes to tax season, as it will help save you more money. Here are examples of deductions that freelancers often go for:

- Home Office Expenses: If you work from home, you can deduct a portion of your rent or mortgage, utilities, and internet costs. Make sure your home office meets the IRS requirements.

- Supplies and Equipment: Items like computers, software, and office supplies can often be deducted.

- Professional Services: Fees for accountants, tax advisors, or legal services can be claimed as business expenses.

- Travel Expenses: If your work requires travel, you can deduct costs for transportation, lodging, and meals.

In order to make the deduction process easier, it is necessary to keep an accurate record of all expenses incurred and receipts collected. This means that more deductions you take will ultimately translate into lesser amounts of taxable income reported by you!

Also Read This: How to optimize your Fiverr gig for search engines

Filing Taxes as a Freelancer

Though it may appear intimidating, filing taxes as a freelancer is an easily accomplished task through adequate preparation. This article is meant to provide an insight into how one can file their taxes properly:

Initially, you must assemble all important papers comprising:

- Your income records, such as 1099 forms or invoices.

- Receipts for deductible expenses.

- Records of any estimated tax payments you’ve made throughout the year.

Afterwards, select the way in which you want to submit your taxes:

- DIY Software: Many freelancers opt for tax software that guides them through the process and automatically calculates deductions.

- Tax Professional: Hiring a tax advisor can be beneficial, especially if you have complex income sources or significant deductions.

It is critical that after submission, you should maintain duplicates of your tax return and relevant paperwork for no less than three years as a safeguard against audits. One thing you must bear in mind is; if you file on time, then you can escape penalties along with interests on your unsettled taxes.

Also Read This: How to Find Buyers Request on Fiverr

Common Mistakes to Avoid When Paying Taxes

Filing taxes can be tough for the innocent and even the “fools are leading”. Due to this reason, even minor errors can cause major problems later on. When you are self-employed, it is necessary to avoid these common mistakes, which can affect your tax returns or lead to penalties. Some of these traps are as follows:

- Not Keeping Accurate Records: Failing to maintain organized records of income and expenses is a major mistake. Use accounting software or a simple spreadsheet to track your finances throughout the year.

- Overlooking Deductions: Many freelancers miss out on valuable deductions. Review all potential deductions thoroughly, including home office expenses, travel costs, and supplies.

- Forgetting to Pay Estimated Taxes: If you expect to owe more than a certain amount, you need to make estimated tax payments throughout the year. Ignoring this can lead to penalties.

- Not Filing on Time: Procrastination can be costly. Ensure you file your tax return by the deadline to avoid late fees and interest on any unpaid taxes.

You may save a lot of money as well as stress by devoting your lifetime to comprehending your tax obligations. Always bear in mind that it is always reasonable to ask for assistance from a tax expert if in any doubt.

Also Read This: How to Create a Fiverr Account to Sell

Frequently Asked Questions About Freelance Tax Rates

There are numerous freelancers wondering how tax rates pertain to their work. Below are frequently asked questions that are answered as well:

- Do freelancers pay more in taxes? Not necessarily. While freelancers do pay self-employment tax, they can also deduct business expenses, which can lower their taxable income.

- What is the self-employment tax rate? As of now, the self-employment tax rate is 15.3%, which covers Social Security and Medicare taxes.

- How do I calculate my estimated tax payments? You can use the IRS Form 1040-ES to estimate your taxes based on your income. A tax professional can also help you with this.

- Are there any tax credits available for freelancers? Yes! Freelancers may qualify for credits such as the Earned Income Tax Credit or education-related credits, depending on their situation.

In case you have any additional inquiries, please do not hesitate to engage a tax advisor or visit the IRS website for comprehensive information.

Conclusion on Tax Rates for Freelancers

As a freelancer, grasping tax rates is essential for competent financial management. By understanding the types of taxes you will pay and the expenses that can be deducted, for instance, people can easily avoid problems and save money. Always bear in mind that tax rates depend greatly on how much money you make and organizing yourself throughout the year will make filing much easier.

Oral upon personaliable step, out of your own, or pay someone else to do it all the same. Caring about everything is really critical. By observing your tax duties you have more time for freelancing and less time for thinking about taxes. Always remain forward-thinking and knowledgeable in order to sail through the tax waters seamlessly.