Working as a freelancer can be liberating you get to pick your projects decide when to work and have the flexibility to set up shop wherever you please. However with that freedom comes a responsibility, particularly regarding taxes. Unlike regular employees there are no automatic tax deductions from your paychecks. You play both roles, the boss and the employee. For many individuals this can feel quite daunting. I recall my year as a freelancer when it hit me during tax season that I hadn't saved enough for taxes. Believe me rushing to come up with money is not an enjoyable experience.

Freelancers should proactively budget and reserve a part of their earnings for tax obligations. It's something that often goes unmentioned when you embark on your journey but once you encounter it you realize its significance. The experience of being caught off guard can lead to stress particularly as tax deadlines approach. The key to feeling less anxious is staying organized. Preparing for taxes is vital, in ensuring financial security and tranquility.

Understanding Freelancer Tax Obligations

As independent workers our tax obligations vary significantly from those who receive a paycheck. Unlike employees we dont have a company handling income tax deductions on our behalf. Its crucial for us to stay informed about what we owe and when. A part of this is grasping the distinction between income tax and self employment tax. The latter often catches new freelancers off guard. When I began my journey I assumed that taxes were solely determined by my earnings. However the self employment tax, which encompasses Social Security and Medicare was an additional expense that took me by surprise.

Freelancers need to keep track of all their earnings, including payments from clients, regardless of whether they're sporadic or come from abroad. The tax system requires you to make estimated tax payments every three months. And when it comes to deductions you can claim expenses like office supplies, internet bills and even a portion of your rent if you work remotely. However navigating deductions can be complex so it's crucial to maintain thorough records. Learning the ins and outs of what you owe and how to minimize it within the boundaries is a skill that takes time to perfect.

Also Read This: How to Start a Fiverr as a Fake Girlfriend

How Much Should You Set Aside for Taxes?

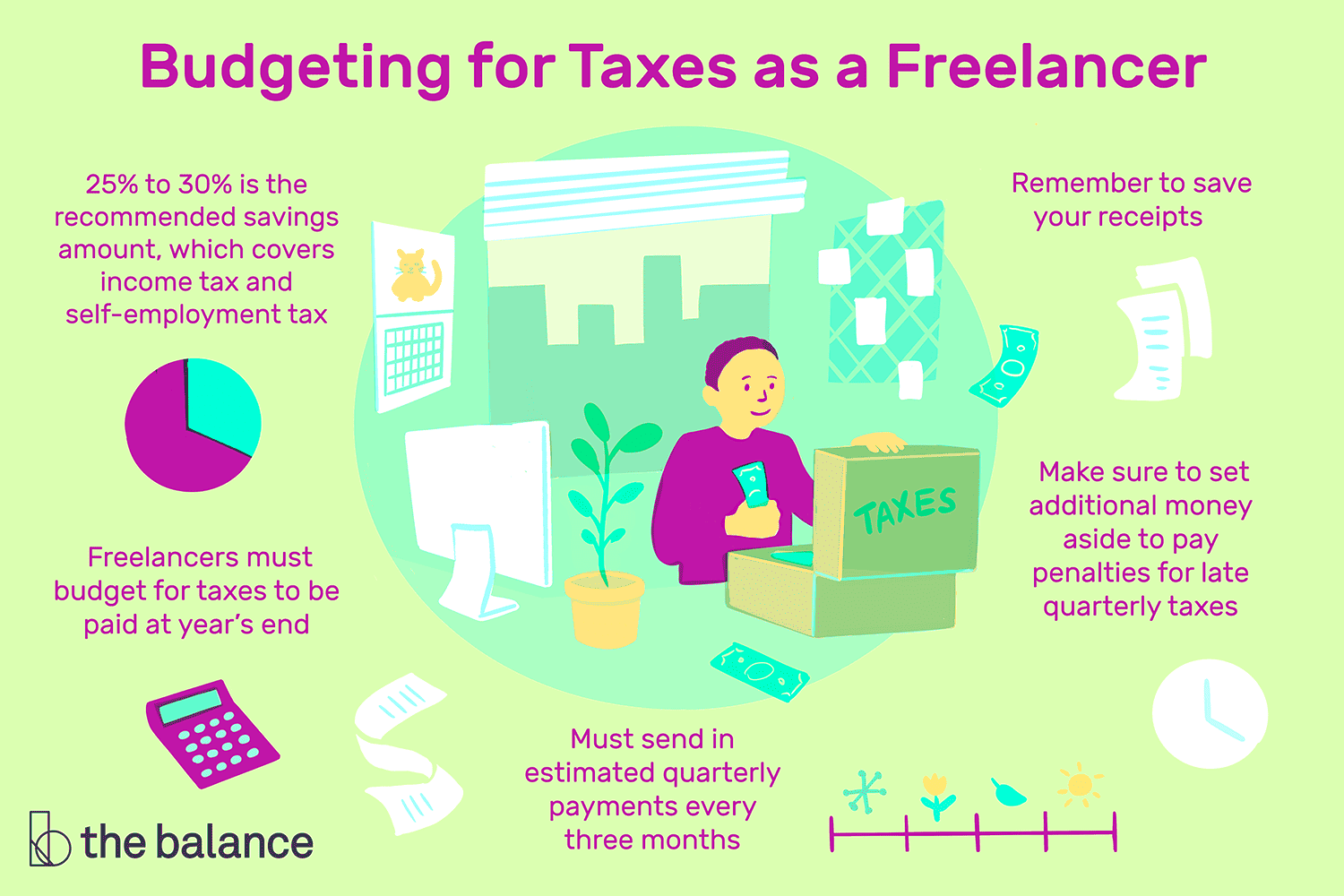

This is a question that freelancers ponder at some stage. Finding the right balance can be challenging. If you save too little you’ll end up with a tax bill. On the hand if you save too much it might feel like it’s impacting your current living expenses. Personally I prefer to err on the side. When I first started I used to set aside 25% of every payment I received. It felt like a lot but I was grateful for it come tax season. Now I adjust that percentage based on my income bracket although 25% to 30% is a solid guideline for most freelancers.

Here’s a quick look at how you can estimate:

- Federal income tax: This will depend on your tax bracket, which ranges from 10% to 37%.

- Self-employment tax: This is a flat rate of 15.3%, covering both Social Security and Medicare.

- State and local taxes: These vary widely depending on where you live.

When you bring these together, you’ll notice how fast it accumulates. A cautious strategy is to figure out your projected tax rate and save that portion every time you receive your payment. If you’re uncertain about where to begin seeking advice from a tax expert, even for a session can guide you in the direction.

Also Read This: How to Report a Buyer on Fiverr

Best Practices for Managing Your Tax Savings

When you begin your freelancing journey it’s tempting to be swept away by the thrill of being your own boss. However as someone who has experienced the ups and downs I can assure you that tax season can be quite an eye opener if you’re not ready for it. Throughout the years I’ve discovered some strategies to make saving for taxes a lot smoother. I really wish someone had shared these tips with me earlier!

A smart move is to set up a savings account solely for tax purposes. While it may appear redundant initially, believe me, it really has a significant impact. Whenever you receive your paycheck, promptly deposit a portion (let's say 25 30%) into this account. Out of sight, out of mind, you know? This way, when the time comes to pay your quarterly taxes, you won't feel the strain. Plus having that money tucked away gives you a sense of security.

Here are some additional tips:

- Set reminders: Quarterly tax payments sneak up on you. I use my phone’s calendar to remind me a week in advance.

- Automate savings: Some banks let you automate transfers to your tax account. This is a great way to stay consistent without thinking about it every time you get paid.

- Keep detailed records: Every receipt, invoice, or business-related purchase should be documented. You’ll thank yourself later.

It’s not solely about self control, but also about simplifying things for yourself. As freelancers we juggle numerous responsibilities, so why not lighten the load when it comes to taxes?

Also Read This: How to Get People to See Your Fiverr Gig

Common Mistakes Freelancers Make with Taxes

When I embarked on my freelancing journey I stumbled through tax matters quite a bit. I guess it’s all part of the process of getting the hang of things. However if I can spare you some trouble let me share with you a few tax missteps that freelancers especially those just starting out often make.

1. Not setting aside enough money: This is the biggest one. Freelancers often underestimate how much they need to save. When I received my first tax bill, I was shocked—it was much higher than I’d anticipated. Setting aside at least 25-30% of your income is a good practice to avoid this.

2. Forgetting about quarterly taxes: Unlike salaried employees, we freelancers must pay estimated taxes every quarter. I once skipped a payment and ended up with a hefty penalty. Now, I make sure to mark those deadlines on my calendar.

3. Not keeping track of expenses: Many freelancers don’t realize how important tracking expenses is. Every little thing adds up—whether it’s your internet bill, software subscriptions, or even a portion of your rent if you’re working from home. But if you don’t keep a record, you’ll miss out on deductions, which can significantly reduce your taxable income.

4. Mixing personal and business finances: Early on, I didn’t see the need for a separate business account. Big mistake. Keeping personal and business finances mixed can complicate things when tax season rolls around. Having a clear separation makes tracking income and expenses much simpler.

These may seem like things, but they can have a significant impact in the long run. By learning from these errors I've managed to save both time and money. Therefore do your best to steer clear of these pitfalls and you'll appreciate it in the future!

Also Read This: How to Describe Your Offer on Fiverr: A Comprehensive Guide

Helpful Tools for Tracking Your Income and Expenses

Handling money matters as a freelancer can be quite a challenge. However with the right resources it becomes a lot smoother. I didn't always rely on tools and I must say sticking to the method with spreadsheets can get really tricky. Fortunately there are quite a few tools available that are easy to use and can assist you in keeping track of your earnings, spending and tax obligations.

Here are a few tools that have really simplified things for me.

- QuickBooks Self-Employed: This is one of my favorites. It automatically tracks mileage, expenses, and even your estimated quarterly taxes. It’s a lifesaver when tax season comes around.

- Zoho Books: If you’re looking for something that’s a bit more affordable, Zoho is a great alternative. It offers similar features to QuickBooks but with a more budget-friendly price tag.

- Wave: For those just starting out, Wave is a free tool that does a pretty good job. It handles invoicing, expense tracking, and basic accounting needs, which is perfect for new freelancers.

- Google Sheets: If you want a simple, customizable way to track things, Google Sheets works wonders. I used it for years before moving on to more advanced tools, and it’s a great way to start.

Using these tools really helps eliminate the uncertainty. They also assist in keeping things orderly and making sure you don't overlook any potential deductions. Believe me once you give them a try you won't feel inclined to revert to the old way of managing your finances!

Also Read This: What is Fiverr Service Fee?

How Often Should You Pay Estimated Taxes?

If you’re just starting out in freelancing you might not realize that taxes aren’t just paid once a year. Freelancers are required to make tax payments every three months. I still remember the moment I discovered this it felt like I was always crunching numbers! However it’s not as overwhelming as it seems once you establish the routine of setting aside money for it. Consider it as making smaller payments instead of dealing with a hefty bill, at the end of the year.

Estimated tax payments are required quarterly throughout the year.

- 1st Quarter: Due April 15 (covers January 1 - March 31)

- 2nd Quarter: Due June 15 (covers April 1 - May 31)

- 3rd Quarter: Due September 15 (covers June 1 - August 31)

- 4th Quarter: Due January 15 of the following year (covers September 1 - December 31)

I recall a time when I missed one of these deadlines and let me tell you, the penalties are not something you want to deal with. The trick is to stay organized in advance. A simple reminder on your calendar can do the trick. If you've had a quarter with significant income make sure to tweak your estimated payments accordingly or you might receive an unexpected bill down the line. It's wiser to slightly overpay than find yourself facing a penalty.

Also Read This: How to Make Your Fiverr Profile Stand Out

FAQ

Do I need to pay estimated taxes even if I don't make much money?

Certainly, if you anticipate owing a minimum of $1,000 in taxes it's advisable to make payments on a quarterly basis. It doesn't make a difference whether your income is modest—if taxes are due they need to be settled.

What happens if I miss a quarterly payment?

Failing to make a payment can lead to fees and added interest. That said you can sidestep penalties by settling at least 90% of your tax liability before the year wraps up. Nonetheless it's wise to keep track of your obligations to steer clear of any extra expenses.

How do I calculate how much to pay?

The IRS offers forms to assist in estimating your tax payments. However a general guideline is to reserve 25 30% of your income for taxes. Additionally you can utilize resources such as QuickBooks or consult with a tax expert to obtain a more precise amount.

Can I deduct expenses from my taxes?

Absolutely freelancers can write off expenses that are tied to their work like office supplies travel costs internet bills and even a part of your rent if you have a home office. Its important to save all your receipts and keep an eye on them over the course of the year.

Conclusion: Stay Prepared to Avoid Tax Surprises

Through my experiences I’ve realized that being ready for tax season can really help you avoid a lot of unnecessary stress. Freelancing brings its challenges and dealing with taxes is definitely one of the toughest. However once you establish a routine of setting aside funds keeping track of your expenses and making quarterly estimated tax payments it becomes way easier to handle. Trust me I know what it’s like to panic at the moment wondering if I’ve saved enough. It’s simply not worth all that anxiety.

Treating taxes like a regular part of your business is the way to go. Create a system that suits you best, whether it’s saving automatically setting up reminders or using a dependable tool to keep everything in check. Being well prepared and organized means you won't encounter any unpleasant surprises when tax season rolls around. Remember freelancing is all about relishing the flexibility it brings and having peace of mind plays a significant role in that.