One of the key areas that every freelancer needs to keep an eye on is tax management. Unlike salaried employees, freelancers should set aside their own taxes which may appear daunting at times; this is because they are not accustomed to doing so. However, if freelancers know how to save for taxes, it will greatly influence their financial status.

To avoid getting surprises when it comes to your finances saving for taxes is the way out. Client based professionals frequently earn variable incomes; hence they might receive tax penalties unless they properly plan their taxes. This not only ensures compliance with the law but also provides an opportunity for building stable independent careers.

How to Estimate Your Freelance Income for Tax Purposes

The first step you should take to know how much tax to save is to estimate your freelance income. As freelancers do not have a salary, it is important to take account of all earnings. The following are effective ways of estimating your income:

- Track all income streams: Record every payment from clients, including one-time projects, retainer fees, and any side jobs.

- Review your financial history: If you've been freelancing for a while, use past income as a guide to estimate future earnings.

- Consider seasonal fluctuations: Some months may be busier than others, so try to predict slow and peak periods.

- Include all sources: Don't forget to include income from royalties, affiliate marketing, or other passive streams.

The tax savings can be adjusted accordingly by having a regular review of your incomes. It is better to estimate high and keep much rather than facing shortage when paying for taxes.

Also Read This: How to Find Orders on Fiverr

Setting Aside Money for Taxes: A Practical Guide

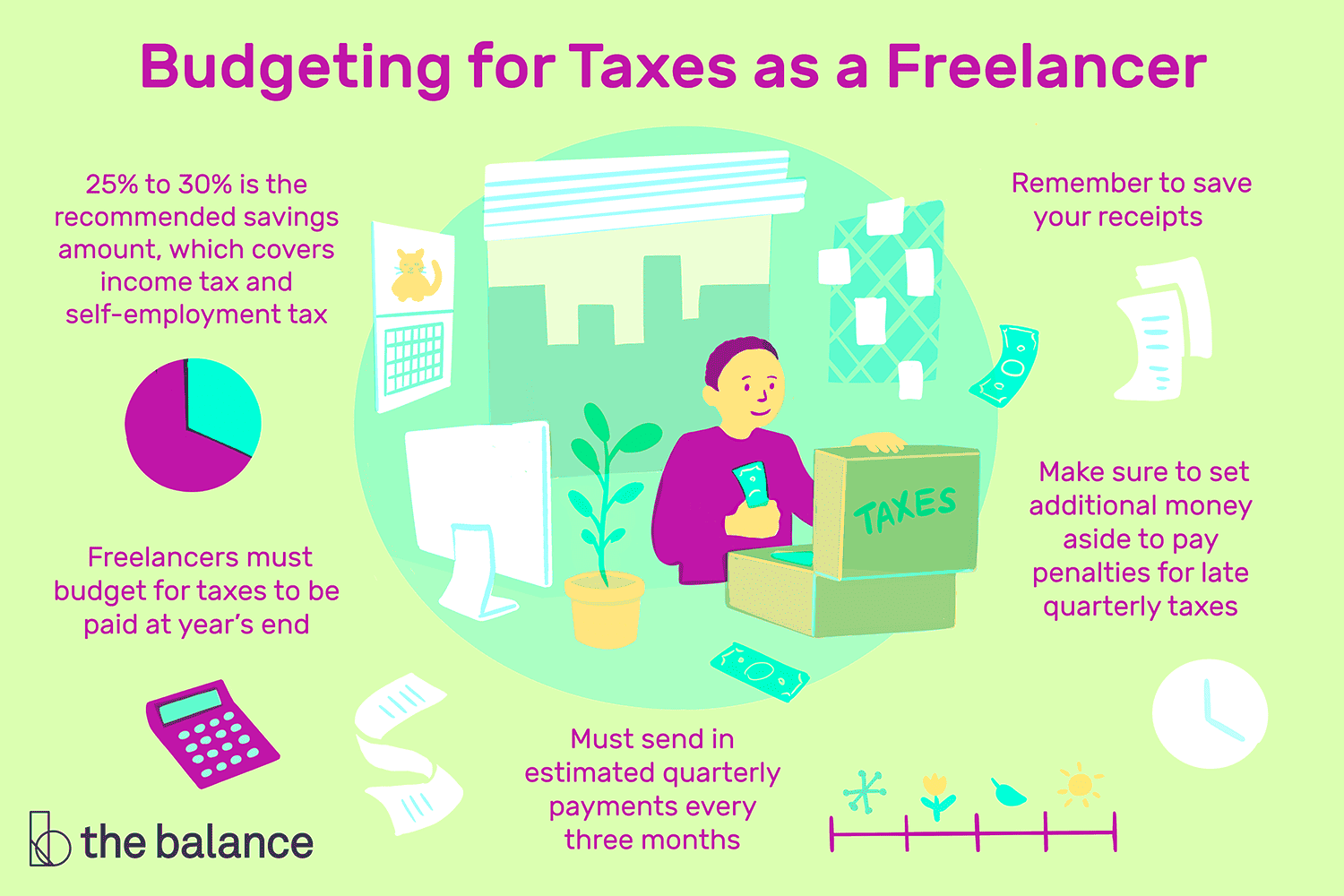

Putting aside money for taxes can be daunting but having a clear plan makes it simpler. Self-employment taxes, or taxes paid by freelance workers on their own income, include both Social Security and Medicare components. Here’s how you do it:

- Open a separate bank account: Set up an account exclusively for tax savings. This helps you avoid spending the money you’ll need for tax payments.

- Set aside a percentage of your income: A general rule of thumb is to save 25-30% of your freelance income for taxes. This covers federal income taxes, state taxes (if applicable), and self-employment taxes.

- Make quarterly tax payments: The IRS requires freelancers to make estimated tax payments quarterly. Missing these deadlines can result in penalties.

- Use tax software or hire a professional: If calculating taxes seems daunting, tax software can simplify the process, or you may hire an accountant to help.

Don’t you know; just a little money set out every month will keep you away from the troubles resulting from lack of money when taxes are due? By doing this, you will have an easy time running your freelance business without disruptions.

Also Read This: Top Platforms to Promote Your Fiverr Gig for Maximum Visibility

Tracking Business Expenses to Reduce Your Tax Liability

One of the efficient strategies for reducing your freelance tax is by accurately following your business costs. The lesser your taxable income, the more expenses you can justify deductible meaning you will spend less on taxes. Nevertheless, it is imperative to maintain detailed records so that you abide by tax regulations.

Should you wish to track your business expenditure with maximum efficiency, here are some of the ways that you can employ:

- Use accounting software: Programs like QuickBooks or FreshBooks make it easy to categorize and track your expenses in real-time.

- Keep all receipts: Whether it’s for a client lunch or a new software subscription, make sure you save your receipts either digitally or physically. This is crucial if you're ever audited.

- Separate personal and business expenses: Open a separate bank account and credit card for your business to avoid mixing personal and business purchases.

- Track mileage: If you drive for business purposes, you can deduct your mileage. Keep a log of your trips or use apps that automatically track mileage for tax purposes.

- Understand deductible expenses: Office supplies, marketing costs, professional services, and even a portion of your home office (if you work from home) can be deducted.

Organizing and consistently keeping tabs on your expenses helps in a great deal to lower tax income hence saving more money from your sweat.

Also Read This: What to Expect in Earnings as a Freelance Writer

What You Need to Know About Tax Deductions for Freelancers

By virtue of their status, freelancers can access numerous tax reductions that could lessen their global tax responsibilities. It is this deduction that enables you to deduct certain business expenses from your income thus reducing it to an extent that makes it less taxable. If you know what are the deductions applicable in your case, you will be able to save a lot of money.

Common Tax Deductions for Freelancers: Below are a few examples of typical tax deductions available for independents.

- Home office deduction: If you have a dedicated space in your home used exclusively for work, you may qualify for the home office deduction.

- Health insurance premiums: Freelancers can deduct their health insurance premiums if they are not eligible for an employer-sponsored plan.

- Business-related travel: Any trips taken for business purposes, including flights, accommodation, and meals, are deductible.

- Equipment and supplies: From computers to office supplies, any tools you use to run your freelance business can be deducted.

- Marketing and advertising costs: Whether it’s website hosting fees or paid ads, you can deduct these expenses as business costs.

- Software and subscriptions: Any software that is necessary for your business, such as design tools or accounting software, is also deductible.

In order to optimize your deductions, it is essential to maintain precise documentation regarding such expenses. Each and every minor deduction contributes towards reducing the amount of tax you owe in the year’s conclusion.

Also Read This: What is a Buyer Brief on Fiverr?

Filing Quarterly Taxes: When and How to Pay

Self-employed individuals pay their taxes, as no taxes are automatically deducted from their income. Freelancers are required by the IRS to pay estimated taxes quarterly, four times each year. These are termed quarterly taxes and if they are not paid on time, there may be penalties which are imposed.

This guide will indicates how and when to pay quarterly taxes:

| Quarter | Payment Due Date |

|---|---|

| January - March | April 15 |

| April - May | June 15 |

| June - August | September 15 |

| September - December | January 15 (of the following year) |

To determine how much you owe, estimate your annual income and calculate your expected tax liability. You can use Form 1040-ES to calculate these payments, which covers both federal income taxes and self-employment taxes (Social Security and Medicare).

After determining the sum, you could either pay through an online platform such as IRS’s Direct Pay system, send a check or utilize a payment processor. It is important to pay on time so as not to incur penalties and remain in good books with them IRS.

Also Read This: How to Pass the Fiverr Test: Your Ultimate Guide

Common Tax Mistakes Freelancers Should Avoid

Possessing a rare hardship is anything but strange to freelancers in consideration of tax issues yet allotment of taxes by the untrained individuals is stranglingly tedious. In fact, wrong declarations may attract hefty fines, penalty fees or cause you pay more than what you should have paid for. Thus, we need to know much about these mistakes in order to avoid them and enable ourselves save money from taxes.

Avoid these common tax mistakes made by freelancers

- Not setting aside money for taxes: One of the biggest mistakes is not saving enough for taxes throughout the year. Since freelancers don't have taxes automatically withheld, it's crucial to save a portion of your income to cover your tax bill.

- Missing quarterly tax deadlines: The IRS expects freelancers to make estimated tax payments quarterly. Missing these deadlines can result in penalties. Be sure to mark your calendar and make payments on time.

- Failing to track expenses: Many freelancers miss out on tax deductions because they don’t keep detailed records of their business expenses. Without proper documentation, you may lose valuable deductions.

- Confusing personal and business expenses: It’s important to keep personal and business finances separate. Mixing them up can complicate your tax filings and may raise red flags during an audit.

- Not hiring a tax professional when needed: Taxes for freelancers can be complicated, especially if you have multiple income streams or work internationally. Hiring an accountant or tax professional can help you avoid costly mistakes.

Completely different errors are being avoided therefore the chances of incurring financial penalties are reduced hence increasing the amount saved.

Also Read This: How to Build Your Career as a Freelance Marketer

FAQ: Answers to Common Questions About Freelance Taxes

Freelancers tend to have a good deal of queries concerning taxation and rightly so, since it can be really tricky. Here’s the answer to some common inquiries:

1. Do freelancers need to pay taxes?

Undoubtedly, freelancers are required to remit federal income taxes as well as self-employment taxes. Depending on the situation, taxes imposed by state and local governments may be involved.

2. How do I calculate my quarterly tax payments?

To estimate your quarterly payments, calculate your expected income for the year, then use IRS Form 1040-ES to determine how much you owe. Divide that by four and pay it by the quarterly deadlines.

3. What can freelancers deduct on their taxes?

Freelancers may deduct business-related costs such as office supplies, travel, health insurance premiums, software subscriptions and home-office expenses. Therefore, it is important for freelancers to maintain precise records in order to be able to claim such tax deductions.

4. What happens if I don’t pay quarterly taxes?

More than penalties, tax evaders might find themselves in situations where they mistakenly reported their earnings or mismanaged them altogether. Self-employed individuals should therefore take note of the fact that quarterly taxes are like salaries paid in installments by those who have jobs. Since freelancers are usually paid in bits and pieces as they work, it’s important to keep up with these payments.

5. Should I hire a tax professional?

Hiring a tax professional may be a good investment if you find freelance taxes challenging or complicated. They can assist in lessening your tax responsibility and guarantee the accuracy of your filings.

Conclusion: Building a Tax-Smart Freelance Business

Establishing a successful freelance business is not just about getting customers and executing high-quality work; it also entails keeping abreast of your taxation obligations. To escape expensive blunders and minimize monetary unease, you need to know ways to predict your earnings, monitor your expenditures, as well as settle tax dues promptly.

It’s important to regularly save some cash for your taxes, maintain an accurate record of your business expenditure and make use of the available deductions. Although freelancers have specific financial obligations towards the government, these can be efficiently handled if done right. You may want to involve a tax expert as your enterprise expands in order to optimize on how you manage your taxes and ensure compliance with all applicable regulations.

Organizing yourself and taking action can help you to become successful in finances for a long time and also create a tax-friendly freelance company.