Freelancer platforms have changed the way people work and connect. They make it easy for freelancers to find jobs and for businesses to find skilled workers. Whether you are a graphic designer, writer, or developer, these platforms can help you showcase your skills and get paid for your work. Understanding how these platforms operate is key to making the most out of your freelance career. In this post, we will dive into the costs associated with using these platforms, focusing on the various fees involved.

Understanding Different Types of Fees

When you use freelancer platforms, it’s important to know about the different types of fees that may apply. Understanding these fees can help you budget better and make informed decisions. Here are some common types of fees you might encounter:

- Service Fees: These are fees charged by the platform for using their services.

- Payment Processing Fees: Fees related to how money is transferred between you and your client.

- Withdrawal Fees: Charges for withdrawing your earnings from the platform to your bank account.

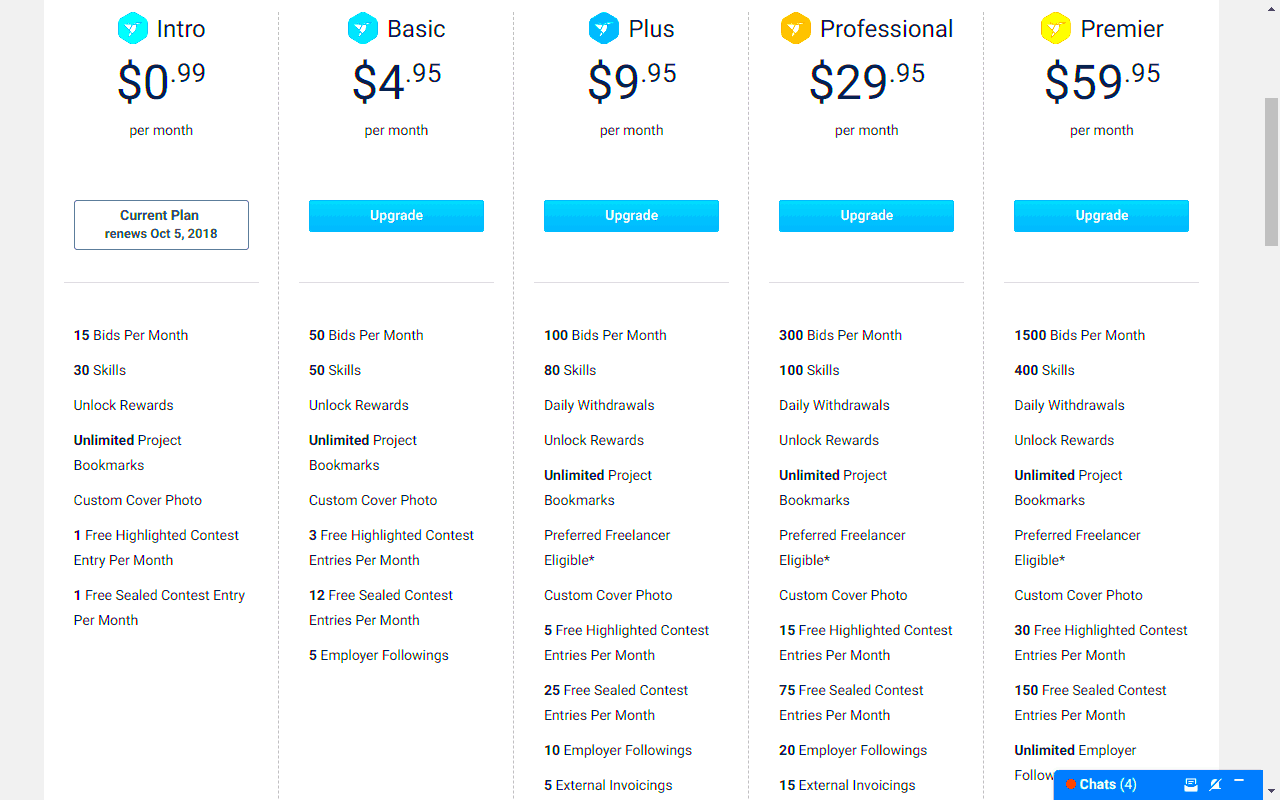

- Membership or Subscription Fees: Some platforms offer premium services for a monthly fee.

Also Read This: How to Become a Web Developer Freelancer

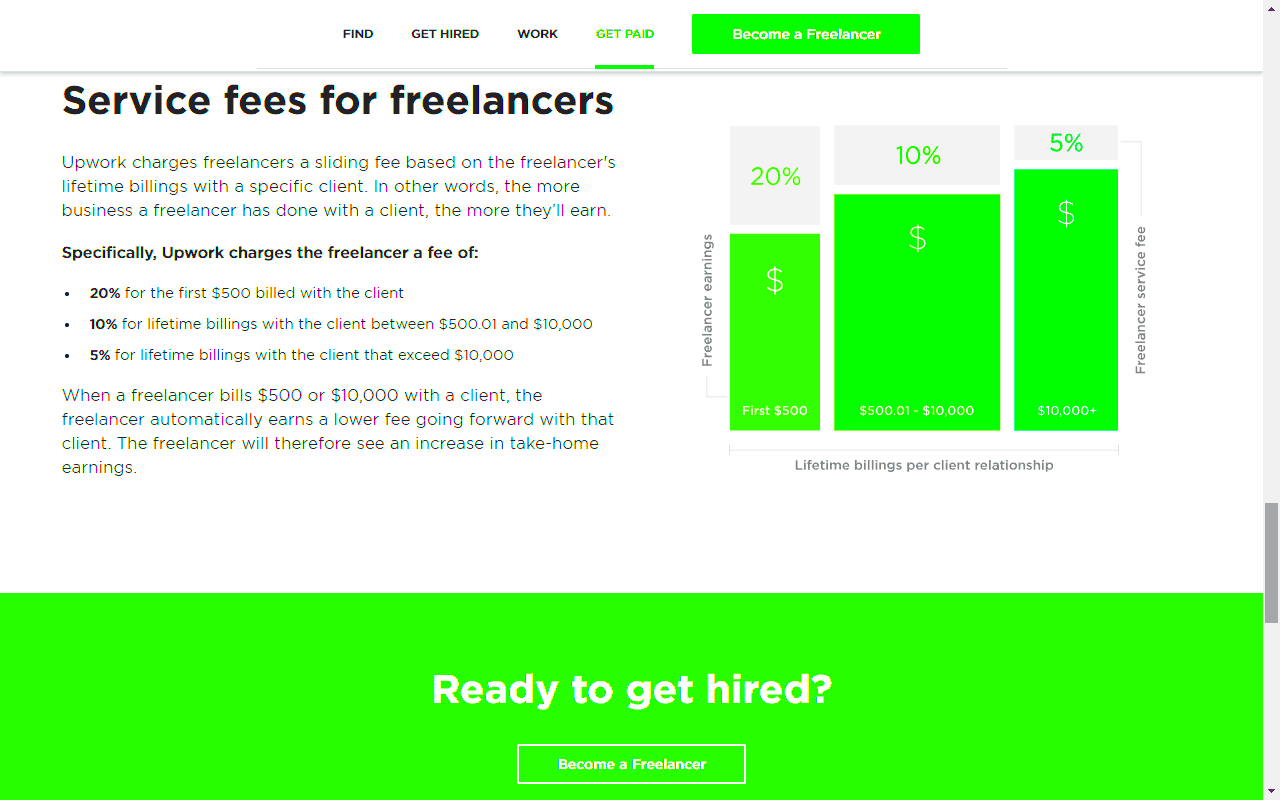

Service Fees Charged by Platforms

Service fees are a major cost to consider when using freelancer platforms. These fees are typically a percentage of the total payment you receive from clients. Here’s how it generally works:

| Platform | Service Fee Percentage |

|---|---|

| Platform A | 20% |

| Platform B | 15% |

| Platform C | 10% |

These fees can vary significantly from one platform to another. For example, if you earn $1,000 from a project on a platform with a 15% service fee, you would pay $150 in fees, leaving you with $850. It’s important to compare these fees when choosing a platform. Always read the fine print, as some platforms might have additional fees for certain services or features.

By understanding service fees, you can choose the best platform for your needs and maximize your earnings.

Also Read This: How to Setup PayPal for Fiverr

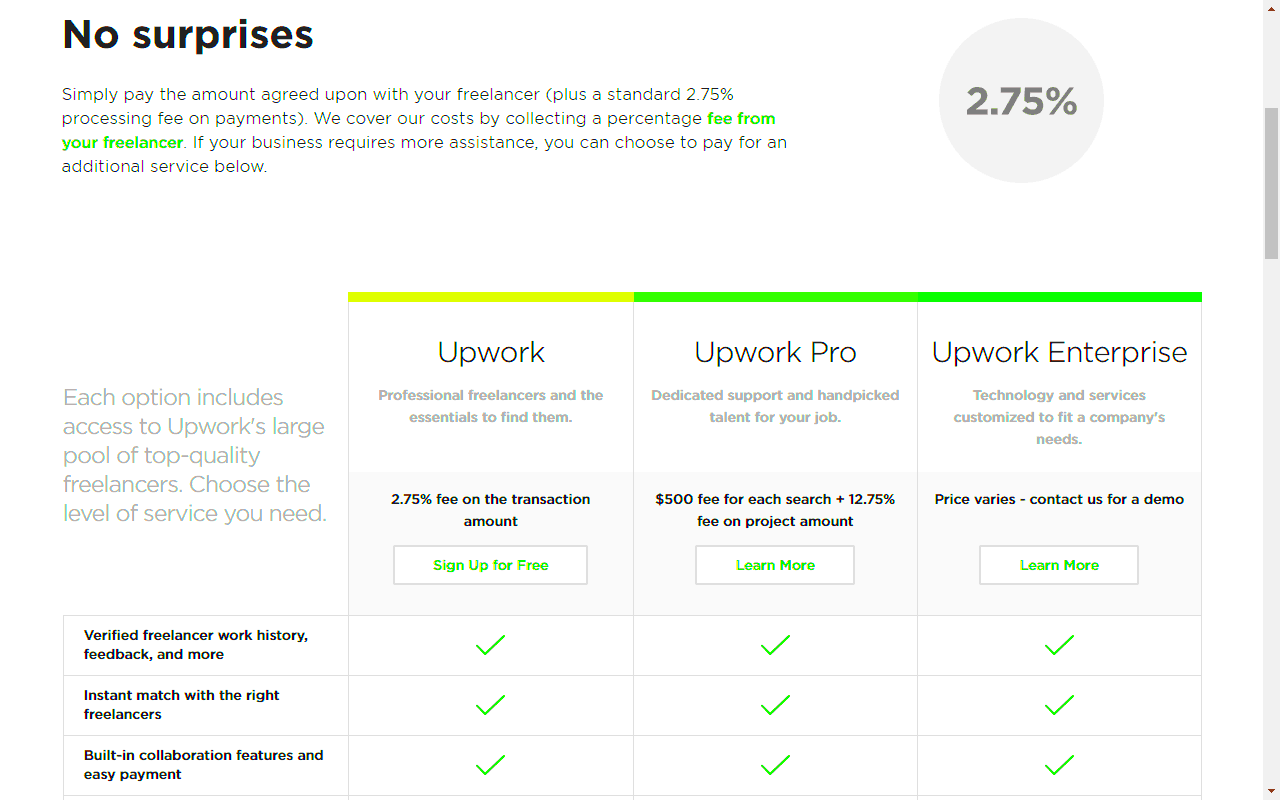

Payment Processing Fees Explained

Payment processing fees are another important cost to be aware of when using freelancer platforms. These fees are charged by payment processors for handling transactions between you and your clients. Understanding how these fees work can help you manage your finances better.

Typically, payment processing fees are a small percentage of the transaction amount, plus a fixed fee per transaction. Here’s a breakdown of how these fees might look:

| Payment Processor | Percentage Fee | Fixed Fee |

|---|---|---|

| Processor A | 3% | $0.30 |

| Processor B | 2.9% | $0.25 |

| Processor C | 2.5% | $0.20 |

For example, if you receive a payment of $1,000 through a processor with a 3% fee and a $0.30 fixed charge, you would pay $30 in percentage fees plus $0.30, totaling $30.30. This means you would receive $969.70 in your account. Keep in mind that these fees can add up, especially if you work with multiple clients and receive many payments.

Also Read This: How to Write Positive Keywords on Fiverr

Additional Costs to Consider

In addition to service and payment processing fees, there are other costs you might encounter when using freelancer platforms. Here are some additional expenses to keep in mind:

- Withdrawal Fees: Some platforms charge a fee when you transfer your earnings to your bank account. This fee can vary widely.

- Currency Conversion Fees: If you work with international clients, you may incur fees for converting currencies.

- Membership Fees: If you choose to join a premium plan for extra features, this will also be an ongoing cost.

- Marketing Costs: To get more clients, you may want to invest in promoting your profile or gig.

By being aware of these additional costs, you can create a more accurate budget and avoid surprises when you get paid. Always review the fee structure of any platform you use, and factor these costs into your overall pricing strategy.

Also Read This: Is Fiverr Worth It for Web Development? Insights from Reddit

Comparing Freelancer Platforms for Cost Efficiency

Not all freelancer platforms are created equal when it comes to costs. To maximize your earnings, it's smart to compare different platforms based on their fees and features. Here are some factors to consider:

- Overall Fee Structure: Look at both service and payment processing fees. Calculate what you would actually take home from your earnings.

- User Experience: A platform that is easy to use can save you time and frustration, which is worth something.

- Client Base: Some platforms attract more clients than others. A platform with a large user base may offer more job opportunities.

- Tools and Features: Check if the platform offers tools that help you manage your projects better, like invoicing or time tracking.

You can create a simple comparison chart to visualize the differences:

| Platform | Service Fee | Payment Processing Fee | Withdrawal Fee |

|---|---|---|---|

| Platform A | 20% | 3% | $1.00 |

| Platform B | 15% | 2.5% | $0.50 |

| Platform C | 10% | 2% | $0.00 |

By carefully comparing these aspects, you can choose the best platform that aligns with your financial goals. This way, you can focus more on your work and less on fees.

Also Read This: Starting as a Data Entry Freelancer

Tips for Reducing Costs on Freelancer Platforms

Using freelancer platforms can be a great way to build your career, but the fees can add up quickly. Fortunately, there are several strategies you can use to reduce these costs. Here are some practical tips:

- Choose the Right Platform: Research various platforms and their fee structures. Some may have lower service fees or better features that suit your needs.

- Negotiate Fees: If you have a strong relationship with your clients, consider discussing fees directly. Sometimes, clients are willing to cover processing fees.

- Use Direct Payment Methods: If allowed by the platform, consider using payment methods that have lower processing fees. Check if your platform permits direct bank transfers or services with lower fees.

- Limit Withdrawals: Instead of withdrawing funds frequently, wait until you have a larger sum to withdraw. This can help you avoid multiple withdrawal fees.

- Maximize Earnings: Focus on higher-paying projects or clients. Higher earnings can offset the fees you pay, ultimately leaving you with more take-home pay.

By implementing these tips, you can minimize costs and maximize your profits on freelancer platforms. Taking a little time to plan can lead to better financial outcomes.

Also Read This: How to Build a Career as a Freelance Translator

Frequently Asked Questions

Many freelancers have questions about costs associated with freelancer platforms. Here are some common questions and their answers:

- What are service fees? Service fees are charges taken by the platform based on your earnings from each project. They vary by platform.

- How can I avoid withdrawal fees? Consider making fewer withdrawals or using platforms that offer free withdrawals.

- Are there fees for currency conversion? Yes, if you work with international clients, some platforms may charge fees for converting currencies.

- Can I negotiate fees with clients? Yes, if you have a good rapport with your clients, you might be able to negotiate who pays the processing fees.

- Is it worth it to pay for a premium membership? It depends on the features offered. If the benefits help you secure more work or save you time, it might be worth the investment.

Conclusion on Overall Costs of Using Freelancer Platforms

Understanding the overall costs of using freelancer platforms is crucial for anyone looking to freelance successfully. By being aware of service fees, payment processing fees, and additional costs, you can make informed decisions that impact your earnings.

It’s important to compare different platforms to find one that suits your financial needs. Remember, while fees are a part of the process, they don’t have to limit your success. By implementing cost-saving strategies, you can keep more of your hard-earned money. Whether you’re just starting out or are an experienced freelancer, taking the time to understand and manage these costs will help you thrive in the freelance world.