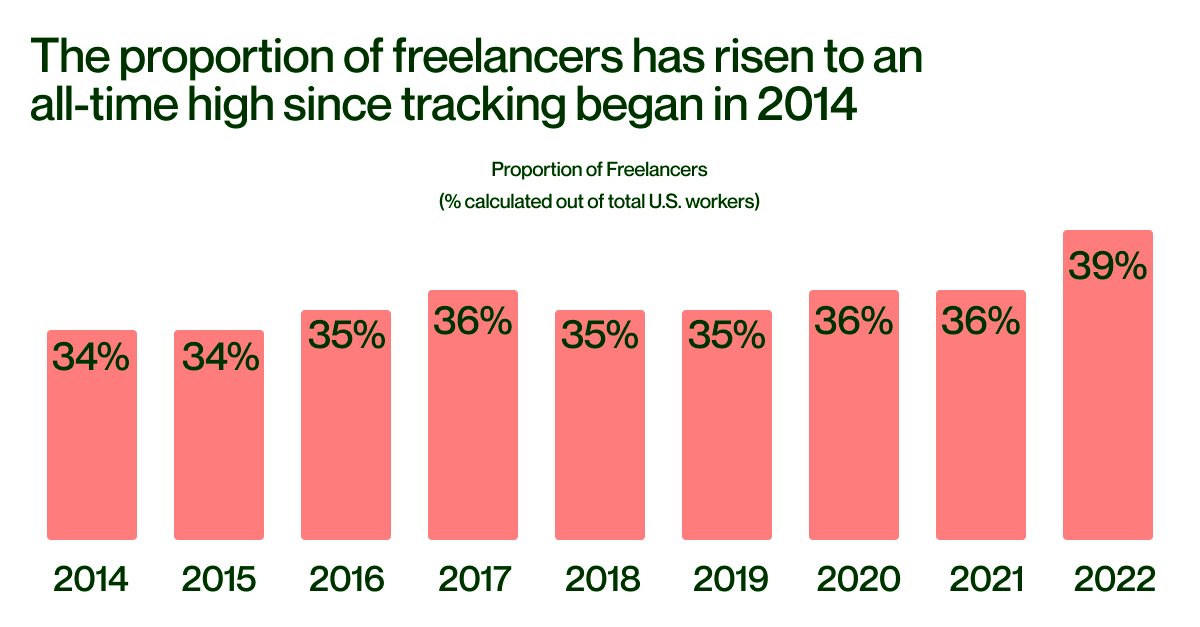

There’s been explosion of freelanders embracing it as their vocation because they want more flexibility and autonomy in their lives. Compared to conventional employment with set pay checks, freelancers earn different amounts from one month to the next depending on what work they have done and the number of clients who want work done at that time. Being aware of how this money flows can lead to improved financial management for freelancers.

Various freelancers face the variation in their monthly incomes. The nature of services offered, client base, and price charged can greatly affect the earnings of any individual in this profession. This realization enables freelancers to have attainable financial goals and budget accordingly.

Factors Influencing Freelancers' Monthly Earnings

The amount of money freelancers earn in a month is greatly influenced by numerous factors. Some of the main aspects to note include:

- Experience and Skill Level: More experienced freelancers can often charge higher rates.

- Market Demand: The need for certain skills can vary. High demand usually means better pay.

- Client Relationships: Strong relationships can lead to repeat business and referrals.

- Time Management: Effective time management allows freelancers to take on more work.

- Platform Fees: Some freelancing platforms charge fees, impacting take-home pay.

Also Read This: How to Cancel an Order on Fiverr: A Step-by-Step Guide

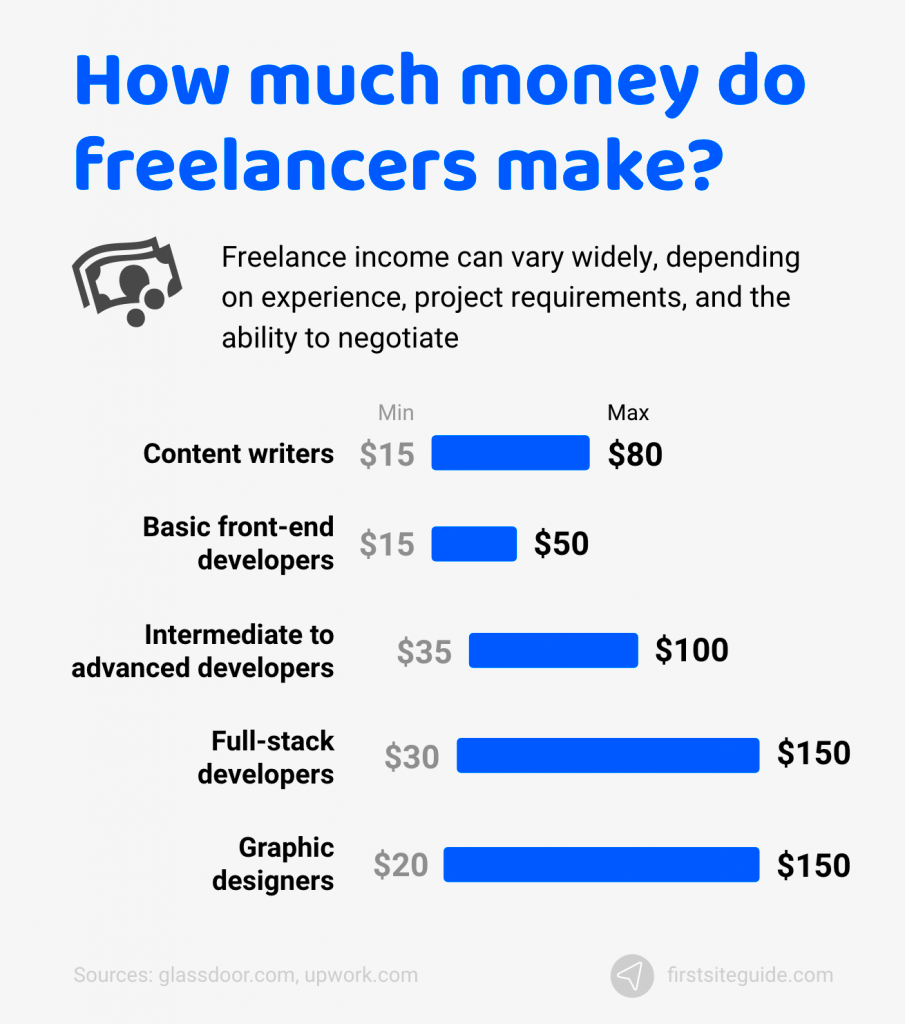

Popular Freelancing Gigs and Their Earnings

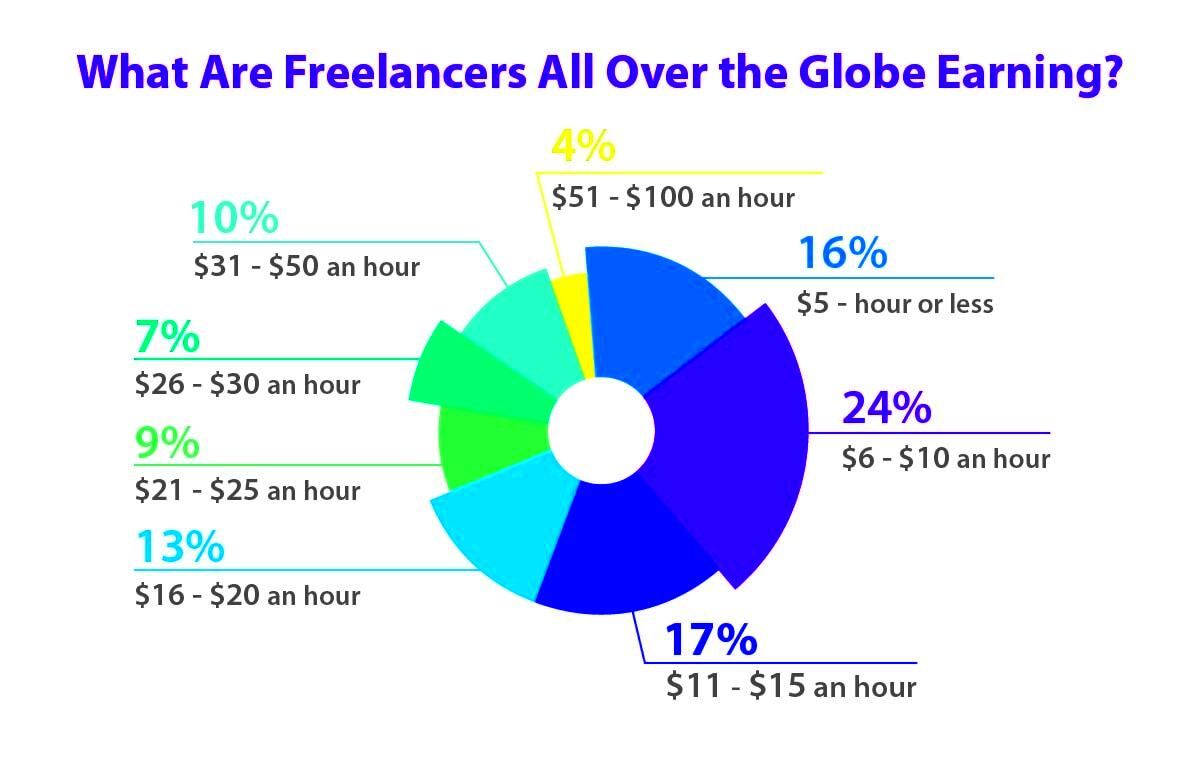

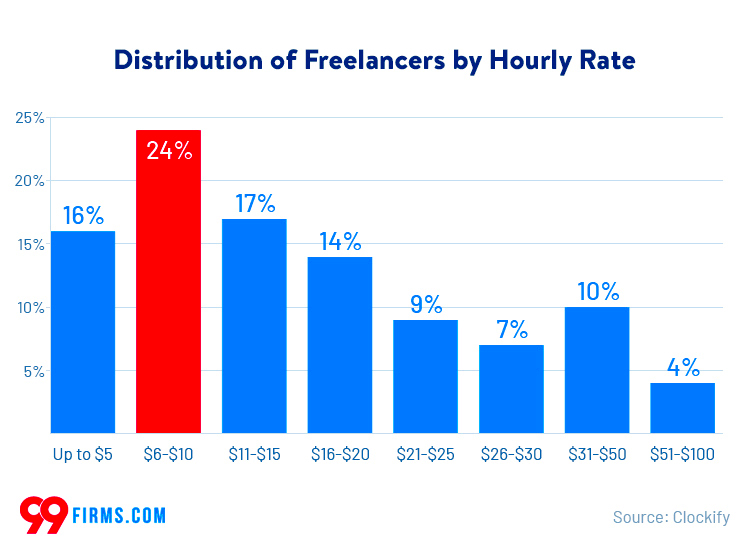

There are numerous gigs available for freelancers that have differing amounts of money they pay. The probably most common freelancing roles include the following together with the relevant figures on what one is likely to earn monthly:

| Freelancing Gig | Average Monthly Earnings |

|---|---|

| Graphic Designer | $2,500 - $5,000 |

| Content Writer | $1,500 - $4,000 |

| Web Developer | $3,000 - $6,000 |

| Social Media Manager | $2,000 - $5,000 |

| Virtual Assistant | $1,000 - $3,000 |

Depending on expertise, place or net clientele, such statistics may widely differ. By enhancing their skill set or specializing in certain services, numerous freelancers can raise their income potential. Freelancers must appreciate these dynamics for them to make rational career choices.

Also Read This: How to Inactivate Your Fiverr Gig: A Step-by-Step Guide

How to Set Your Rates as a Freelancer

As a freelancer, one of the hardest tasks you will ever encounter is determining your pricing structure. In as much as you want to have favorable prices, you should also be cautious not to set them so low that your earnings might become inadequate. This means that one state should engage in a study and analyze ones own self for purposes of making this equilibrium possible.

Before putting together your list of prices, first thing you should think about is what exactly do you bring to the table? If you are new in this niche, scrap everything expensive; attract them with low figures instead. But as you progress in time and develop an appealing portfolio which gives customers confidence about their investment, hike up the payment. Here are some guidelines to follow when establishing charges:

- Research Industry Standards: Look at what others in your field charge. Websites like Upwork and Fiverr can provide insights.

- Calculate Your Costs: Make a list of your monthly expenses, including tools, software, and living costs. This will give you a baseline for what you need to earn.

- Consider Your Experience: Factor in your skills and years of experience. More expertise usually means higher rates.

- Test Your Rates: Start with a rate and see how clients respond. You can always adjust based on demand and feedback.

Keep in mind that requesting a fair compensation for your worth is acceptable. The core of freelancing revolves around proper evaluation of your time and skills.

Also Read This: What is Beta Reading on Fiverr?

Strategies to Increase Your Monthly Income

As a freelancer, it is all just about intelligent tactics and regular diligence that enhances your monthly income.There are implementable approaches for increasing profits when you want to broaden your client range or revise upward your charges.

The followings are some strategies that you should give a thought to:

- Upsell Your Services: Offer add-ons or premium services to existing clients. This can significantly increase your earnings without needing new clients.

- Diversify Your Skills: Learning new skills can open doors to additional gigs. Consider taking online courses to expand your expertise.

- Network Actively: Attend industry events and join online communities. Building relationships can lead to referrals and new opportunities.

- Improve Your Online Presence: Invest time in showcasing your work on social media and freelancing platforms. A strong portfolio can attract more clients.

- Set Clear Goals: Define how much you want to earn each month and develop a plan to reach that goal. Track your progress regularly.

Applying these methods may assist you in increasing your monthly earnings and securing economic stability.

Also Read This: What Happens If They Don’t Complete the Order on Fiverr?

Managing Finances as a Freelancer

Managing your finances as a freelancer is essential for long-term success. Therefore, you must budget, save and plan for unexpected income. Unlike traditional jobs where taxes and benefits are often handled for you, freelancers must take charge of their finances.

There are some tricks on how to manage your money well:

- Keep Accurate Records: Use accounting software or spreadsheets to track income and expenses. Keeping good records makes tax season easier.

- Set Aside Money for Taxes: Freelancers need to pay taxes quarterly. Set aside a percentage of your earnings to avoid surprises.

- Create a Budget: Outline your monthly expenses and stick to it. This helps you understand your financial situation and make informed decisions.

- Build an Emergency Fund: Aim to save at least three to six months’ worth of expenses. This cushion can help you during slow months.

- Invest in Your Business: Consider spending some of your earnings on tools and resources that can help you improve your services or skills.

For freelancers, managing money properly is key. If you want to remain flexible while working as a freelancer, then here are some tips that will help you maintain stability in your finances.

Also Read This: How to Contact Fiverr by Phone

Common Challenges Freelancers Face with Earnings

Freedom is a tantalizing bait to the freelancing community; however, it has its own set of challenges especially when we consider finances. It is worth noting that income stability remains an issue for many freelancers, thus warranting an understanding of these hurdles for better management. The following are some challenges that commonly affect freelancers in terms of their incomes.

- Irregular Income: Unlike a regular paycheck, freelancers often experience fluctuating income. Some months may be lucrative, while others might leave them scrambling.

- Client Payment Delays: Waiting for clients to pay can disrupt cash flow. Sometimes, invoices take longer than expected to process.

- Underpricing Services: Many freelancers undervalue their work, which can lead to burnout and financial strain.

- Market Competition: With the rise of freelancing, competition has increased. Standing out while maintaining competitive rates can be tricky.

- Financial Management: Freelancers must handle their own taxes and expenses, which can be overwhelming without proper financial knowledge.

The first step towards finding solutions is to recognize these challenges. In addressing these problems proactively, freelancers can create a more stable financial situation.

Also Read This: How to Offer Services on Fiverr

Tips for Sustaining a Steady Income

To maintain a stable income as a freelancer you need certain disciplines, plans and sometimes creativity. Though freelancing has its ups and downs; there are ways to make your earnings more stable.

- Diversify Your Client Base: Having multiple clients reduces the risk of losing income if one client stops providing work.

- Create Recurring Revenue: Offer subscription services or ongoing contracts for consistent monthly income.

- Establish a Solid Workflow: Streamlining your work processes can help you take on more projects without sacrificing quality.

- Build a Personal Brand: Invest time in developing your online presence. A recognizable brand can attract clients more easily.

- Regularly Review Your Rates: Don’t hesitate to adjust your rates based on your experience and the value you provide. Regular reviews keep you competitive.

Therefore applying these tips can give freelancers a steady income and take pleasure in their labor.

Also Read This: Pricing for Freelance Photography Services

FAQs About Monthly Earnings of Freelancers

Indeed, there are a lot of things that anyone can ask a professional. Here are some of the common queries from beginners which can help cast light on wider issues.

- What is the average monthly income for freelancers? It varies greatly by field and experience but can range from $1,000 to over $10,000.

- How can I ensure timely payments from clients? Establish clear payment terms upfront and consider using contracts to protect yourself.

- Is it necessary to have an emergency fund? Yes, having an emergency fund can help cover expenses during lean months.

- How do I calculate my freelance rates? Consider your expenses, experience, and what others in your industry charge to set your rates.

- Can I have multiple income streams as a freelancer? Absolutely! Many freelancers diversify their income by offering different services or products.

Thus, responding to these frequently asked questions can assist freelancers in dealing with the intricacies of income generation in the gig economy. Proper information provided will allow freelancers to make sensible choices regarding their professions.

Conclusion on Freelancers' Earnings and Strategies

There are things that are special for freelance earnings and what they bring along with. Earnings may be high but irregular cash flow and competition characterize life of a freelancer. Nevertheless, freelancers can create a stable financial future by understanding how to fix the right rates, managing money wisely, and putting in place different strategies for sustaining their income. To be successful in freelancing world it is thus important to diversify clients, enhance skills and maintain an active online presence. In the end, freelancers have financial freedom as well as rewards if they plan their work well enough and put much effort in it.