Reporting income as a freelancer can be overwhelming, especially if you’re just starting out. It goes beyond completing tax forms; it involves grasping your financial situation and making sure you follow the rules. Having gone through this myself I can assure you that the process gets easier once you break it down into steps. Whether you freelance full time or part time knowing how to accurately report your income is essential for staying organized and minimizing stress during tax season.

Understanding Your Income Sources

As a freelancer you may have income streams so its crucial to classify and grasp the origins of your earnings. Here’s a breakdown of how to do it.

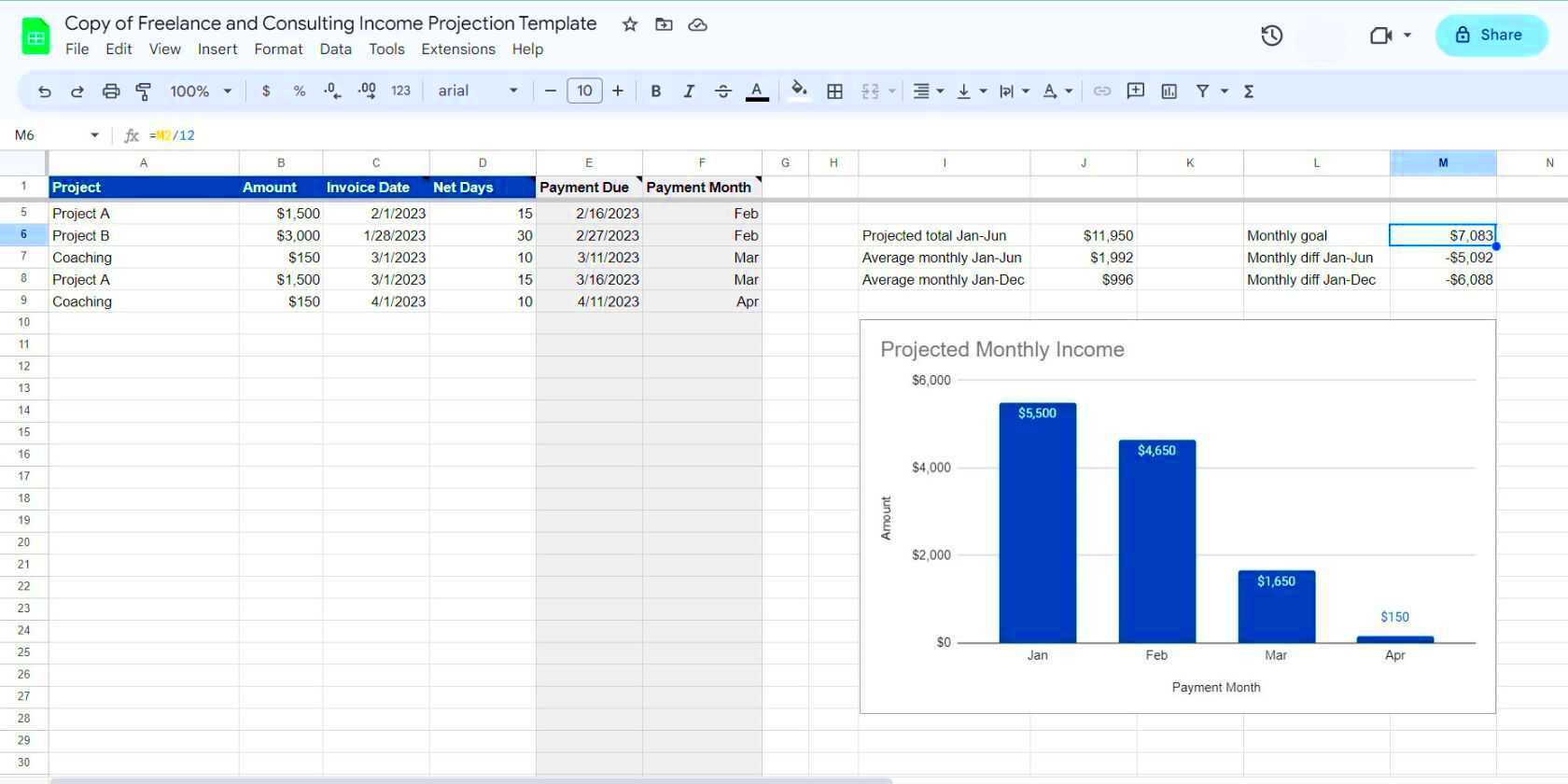

- Client Payments: This is the primary source of income for most freelancers. Each client might have different payment terms and methods, so tracking these payments accurately is crucial.

- Freelance Platforms: If you use platforms like Fiverr or Upwork, ensure you keep records of all transactions. These platforms often provide monthly statements which can be useful.

- Project Milestones: For projects with milestone payments, document each payment received as you hit specific project goals.

- Additional Income: This can include anything from royalties to affiliate marketing earnings. Keep track of these separately to avoid confusion.

By grasping these origins you can improve your financial management skills and produce precise reports. I recall facing challenges in classifying my earnings when I was just starting off. However now I rely on a straightforward spreadsheet to monitor my finances and it has brought about a significant positive change.

Also Read This: How Do You Pay on Fiverr?

Keeping Accurate Records of Your Earnings

Keeping track of your finances is crucial for freelancers. If you dont maintain accurate records it becomes challenging to report your earnings accurately. Here are a few suggestions that have proven effective for me.

- Maintain a Dedicated File: Use a dedicated folder or digital file for all your income-related documents. This includes invoices, payment receipts, and bank statements.

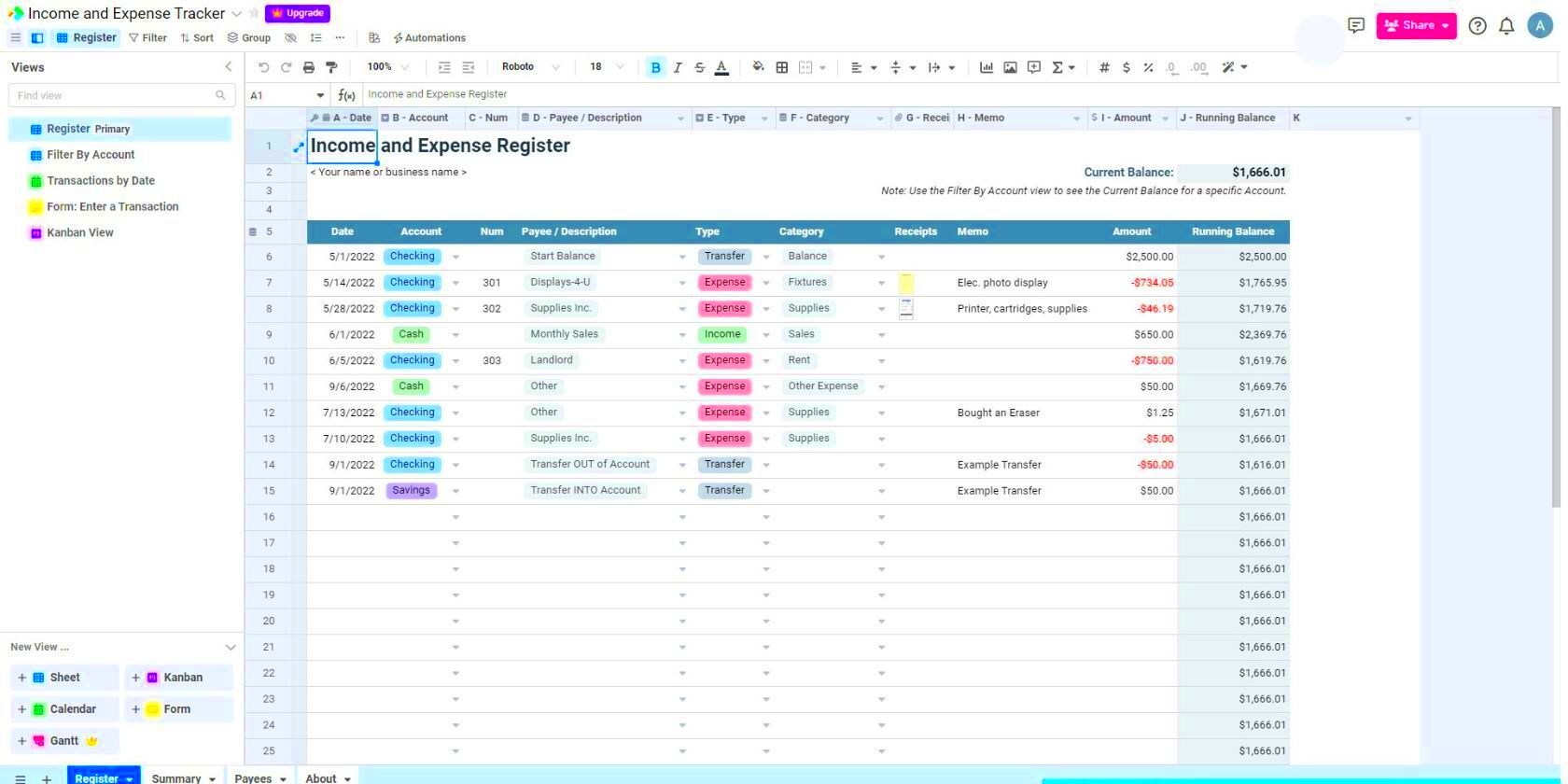

- Use Accounting Software: Tools like QuickBooks or FreshBooks can help you automate record-keeping. They allow you to track expenses, income, and generate reports effortlessly.

- Regular Updates: Update your records regularly rather than waiting until tax season. This practice will save you time and reduce errors.

- Organize by Date: Keep your records organized by date to make it easier to review and reference them when needed.

There was a time when I found myself drowning in a sea of receipts and bills because I fell behind on my record keeping. It was a real challenge to sort things out at the eleventh hour. These days I make it a point to jot down every transaction as it occurs and it has spared me from a lot of stress.

Also Read This: How to Get Paid Invoice Through Fiverr as a Client

Choosing the Right Reporting Method

Selecting the way to report your freelance earnings can significantly impact how you handle your money matters and submit your tax returns. When I first started freelancing I attempted to manage everything by hand which resulted in quite a bit of chaos. With time I discovered that choosing a method that suits your working preferences and financial circumstances is crucial. Here are a few alternatives to think about.

- Cash Basis Accounting: This method records income and expenses when they are actually received or paid. It’s straightforward and often preferred by freelancers because it aligns with the real flow of money. It’s what I use to keep track of my earnings and expenses as they come in.

- Accrual Basis Accounting: This method records income and expenses when they are incurred, regardless of when the money is actually exchanged. This can be useful if you have a lot of receivables and payables but might be more complex to manage.

- Using Accounting Software: Many freelancers, including myself, find it helpful to use accounting software that offers integrated reporting methods. Tools like Zoho Books or Xero can simplify the process by automatically tracking income and expenses.

Select a method that feels easy and feasible for you. It’s beneficial to invest some time in exploring various alternatives to discover what suits you best. Personally I’ve discovered that the cash basis approach aligns well with my freelancing requirements although your circumstances may vary. Make sure to assess your choices thoughtfully.

Also Read This: Is Fiverr Business Account Free? A Comprehensive Guide

Filing Your Taxes as a Freelancer

As a freelancer tackling your taxes might feel daunting but if you break it down into manageable steps the process becomes a lot easier. Here’s a simple guide to assist you in navigating through it.

- Gather Your Documents: Collect all income statements, invoices, receipts, and any other relevant documents. Having everything in one place makes the filing process much easier.

- Choose Your Filing Method: You can file taxes yourself using online platforms like TurboTax or seek help from a tax professional. I used to file my taxes myself but now prefer a tax consultant for added peace of mind.

- Fill Out the Right Forms: As a freelancer, you’ll likely need to fill out forms such as Schedule C (for reporting profit or loss) and Schedule SE (for self-employment tax). Make sure you complete these forms accurately.

- Claim Deductions: Don’t forget to claim all eligible deductions. Expenses related to your freelance work, such as software subscriptions, office supplies, and even part of your home utility bills, might be deductible.

- Submit and Pay: After completing the forms, submit them to the IRS by the due date. Ensure you pay any taxes owed to avoid penalties.

When I began my freelance journey navigating the tax filing process seemed daunting. However with time and the right resources it turned into a more manageable endeavor. Just keep in mind to stay organized and kick things off to prevent any last minute rush.

Also Read This: Is Fiverr SEO a Scam? Unveiling the Truth Behind Fiverr’s SEO Services

What to Do if You Make Mistakes on Your Tax Return

Dealing with errors on your tax return can be stressful, but it’s crucial to tackle them quickly to prevent any issues down the line. Based on my personal journey here’s a guide to help you navigate the process:

- Identify the Mistake: Review your return carefully to pinpoint where the error occurred. Whether it’s a miscalculation or incorrect information, knowing what went wrong is the first step to fixing it.

- File an Amended Return: If you realize a mistake after submitting your tax return, file an amended return using Form 1040-X. This form allows you to correct errors and update your information.

- Contact the IRS: If you’re unsure how to proceed or need clarification, don’t hesitate to contact the IRS directly. They can provide guidance on correcting your return.

- Pay Any Additional Taxes Owed: If the mistake results in additional taxes owed, pay them as soon as possible to avoid interest and penalties.

- Keep Records: Maintain detailed records of the mistake and the correction process. This will be useful if any questions arise in the future.

During my initial freelance journey I made a mistake in my tax return submission. It was quite stressful but I managed to resolve it promptly and gained valuable lessons from the situation that made me more careful in my future filings. Errors are a part of life but with some effort and attention to detail they can be rectified.

Also Read This: How Much Does the Average Seller Make on Fiverr?

Common Mistakes to Avoid When Reporting Income

Reporting income can be a task and errors can bring about stress or even penalties. Having experienced this personally I’ve picked up a few lessons through my own challenges. Here are some common traps to be cautious of.

- Mixing Personal and Business Finances: It’s tempting to use one account for everything, but this can lead to confusion. I used to mix my freelance earnings with personal expenses until I realized the importance of separating them. Use different accounts to keep things clear.

- Ignoring Small Income: Every bit of income matters, even the small payments. I once overlooked a few small payments, thinking they weren’t significant, but they added up. Always record every income source, no matter how small.

- Forgetting About Deductions: Many freelancers miss out on deductible expenses. I used to overlook things like internet bills or software subscriptions. Keep track of all potential deductions to maximize your tax benefits.

- Not Keeping Receipts: Without receipts, proving your expenses can be challenging. I learned this the hard way when I had to scramble to find proof for a few transactions. Store all receipts and invoices securely.

- Filing Late: Procrastination can lead to penalties. I used to file my taxes at the last minute, which was stressful and error-prone. Start early to avoid the rush and ensure everything is accurate.

With a little bit of planning and carefulness, you can steer clear of these blunders. Based on what I've seen keeping tabs on these things can spare you a heap of hassle down the line.

Also Read This: What Does “Gig” Mean on Fiverr?

Tips for Staying Organized Throughout the Year

Keeping things in order all year round is key for hassle free tax filing and running your freelance venture smoothly. I’ve learned some tricks along the way that make a big difference like these.

- Create a Routine: Establish a regular schedule for managing your finances. I set aside time every week to update my records and review my income and expenses. This routine helps me stay on top of things and prevents last-minute chaos.

- Use Digital Tools: Leverage technology to streamline your processes. I use accounting software like QuickBooks to track expenses and generate reports. It’s a lifesaver and significantly reduces the manual work involved.

- Set Up Reminders: Don’t rely solely on your memory. Set up reminders for important tasks like invoicing clients or reviewing monthly expenses. This small step has helped me keep everything on track.

- Maintain a Financial Calendar: Keep a calendar for tax deadlines, payment due dates, and other important financial events. I use a digital calendar to make sure I never miss a deadline or payment.

- Review Regularly: Make it a habit to review your financial status regularly. Monthly reviews help you spot any discrepancies early and make adjustments as needed. This practice has saved me from many potential issues.

Keeping things in order isn’t only about preventing stress; it’s also about making your freelancing journey easier and more efficient. These suggestions have had an impact on my work and I trust they will benefit you too.

Also Read This: How to Hide Your Country on Fiverr

Frequently Asked Questions

Here are a few inquiries that freelancers frequently make regarding income reporting.

- How often should I update my financial records? Aim to update your records at least once a week. Regular updates prevent errors and make tax season much less stressful.

- What should I do if I receive payment in a foreign currency? Convert the payment into your local currency using the exchange rate on the date of the transaction. Keep a record of the exchange rate used for accurate reporting.

- Are freelance expenses deductible? Yes, many freelance expenses are deductible, including office supplies, software, and travel expenses related to your work. Keep detailed records of these expenses to maximize your deductions.

- Do I need to report income from side gigs? Yes, all income, including from side gigs, should be reported. It’s important to be transparent and accurate to avoid any issues with tax authorities.

- What if I miss a tax deadline? If you miss a deadline, file your return as soon as possible to minimize penalties and interest. Contact the IRS if you need additional time or have specific concerns.

These frequently asked questions address issues but it's important to seek personalized advice from a tax professional. Dealing with taxes can be tricky and having expert support can really help.

Conclusion

Reporting income as a freelancer doesn't have to be an overwhelming task. With some planning and the approach it can seamlessly fit into your freelancing journey. Drawing from my experiences I've found that the secret lies in maintaining consistency with your record keeping selecting the reporting method and promptly addressing any errors. By steering clear of pitfalls and staying proactive with your finances throughout the year managing your income and taxes becomes significantly smoother. Keep in mind that every freelancer encounters these challenges but armed with the right tools and mindset you can navigate them with confidence and ease. Stay organized continue learning and don't hesitate to seek assistance when necessary. Your future self will appreciate the effort you invest, today.