As a freelancer, declaring your income comes rather different from regular jobs. From the smallest amount possible to be paid as income, this poses a problem to many who fail to realize that it is their duty to keep track of all the payments received and remit personal deductions, which include federal income tax, state income tax (if any), and self-employment taxes. Learning how freelance income is taxed will save you both time and cash in the future.

The independent contractors have to take care of their earnings like it’s a company income, with rules the same as those laid down for any kind of business. In contrast to standard staff, there are no immediate cuts off from salaries, hence you will have to do some serious tax season preparation.

Types of Freelance Income to Report

Freelance income can be obtained in various ways hence it is significant to give them all correctly. These are few income categories you should consider writing about:

- Client Payments: This includes payments for services provided, whether you’re paid via platforms like Fiverr or directly by your clients.

- Affiliate Marketing Earnings: If you earn money through affiliate links or partnerships, these are taxable too.

- Ad Revenue: Income from ads on websites, blogs, or social media channels is also part of your taxable income.

- Royalties: If you sell digital products, eBooks, or creative content, royalties earned need to be reported.

- Gifts or Tips: Any additional tips or bonuses from clients should be considered income.

With every dollar earned in the course of the year it is very important to keep records so as not to have problems with IRS.

Also Read This: How to Post a Request on the Fiverr Mobile App

How to Track Freelance Earnings

Your freelance earnings must be monitored so that accurate tax returns can be filed at the end of every financial year. The following are simple means to keep track of your income:

- Keep Digital Records: Use accounting software like QuickBooks or FreshBooks to automatically track payments and expenses.

- Save Invoices: Ensure that every invoice sent to clients is saved and properly organized.

- Create a Spreadsheet: If you prefer manual tracking, create a detailed spreadsheet with columns for client name, amount paid, date of payment, and project details.

- Separate Bank Account: Consider using a separate bank account for all freelance income and expenses to keep everything organized.

- Review Payments Regularly: Set aside time each month to review all incoming payments to ensure nothing is missed.

Keeping everything organized all through the calendar year makes filing your taxes much simpler, as well as ensuring that there is no income that goes unreported.

Also Read This: Highest-Rated Sellers on Fiverr in 2024

Filing Taxes as a Freelancer: What You Need

When it comes to filing taxes, this is a challenging process for many freelancers who are new in the business. The good thing is that if you plan well enough, there is no need for stress while doing your taxes. Tax filing as a freelancer is your personal responsibility because you do not have a boss who would withhold taxes for you. This article provides information on how to go about it so as to file taxes as a freelancer.

First, you’ll need to gather all your income records, like 1099 forms (if applicable), invoices, and any other documents showing how much you've earned. The IRS will require detailed information, so being thorough is crucial.

To file, you should do these thngs:

- Income Records: Keep track of all payments received from clients, whether through platforms like Fiverr or directly from clients. This may include both cash and digital payments.

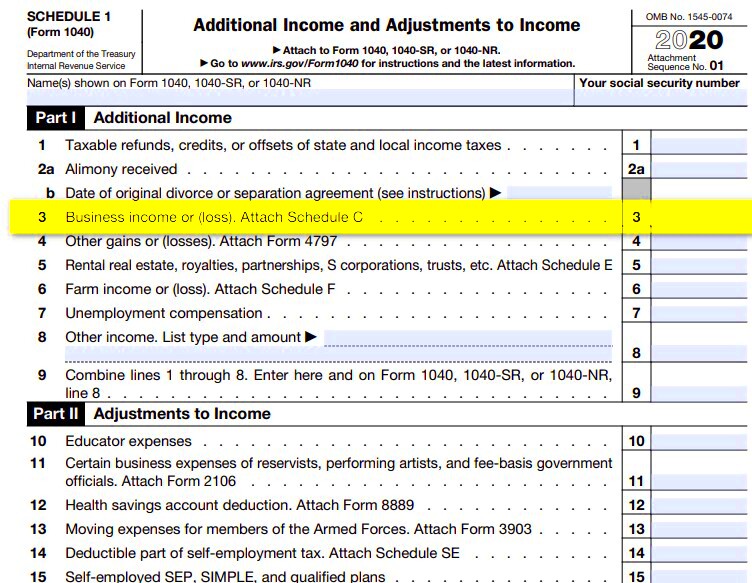

- Form 1040: You’ll file this form along with a Schedule C to report your business income and expenses.

- Self-Employment Tax (SE Tax): Freelancers must also pay self-employment tax, which covers Social Security and Medicare.

- Estimated Quarterly Taxes: Since taxes aren’t automatically withheld, freelancers are required to pay estimated taxes quarterly throughout the year.

Hiring a professional would also be a great idea for people in the freelance community who want to file taxes easily.

Also Read This: What Happens with Late Orders on Fiverr

Common Tax Deductions for Freelancers

One of the bitching perks is that you earn a lot plus save good cash while working from home. So, what can you write off as a freelancer? Here are some deductions every independent contractor ought to learn about:

- Home Office Deduction: If you have a dedicated workspace at home, you can deduct expenses related to that area, such as rent, utilities, and internet bills. The IRS allows you to calculate this either using actual expenses or a simplified method based on the square footage of your office.

- Business Supplies and Equipment: Any equipment or supplies you use for your business, like a computer, phone, software, or even office furniture, can be deducted.

- Marketing and Advertising Costs: Expenses like website hosting, promotional materials, and paid advertising are deductible.

- Professional Services: Fees paid for legal services, accounting, or even subscriptions to professional tools are eligible for deductions.

- Travel and Meals: If you travel for work or have client meetings, you may be able to deduct some of these costs, including meals while on business trips (50% of the cost).

To get the greatest benefit from these deductions, it is necessary to keep all receipts and properly document your expenses. In that case, you will have all the evidence needed in case you ever get audited by the IRS.

Also Read This: Can I Edit or Change Reviews on Fiverr?

How to Avoid Tax Penalties as a Freelancer

Tax penalties are anathema to anyone, especially freelancers who pay their own taxes. The silver lining is that you can steer clear of penalties by being proactive and staying organized all through the year. Here’s what you should know:

- Pay Quarterly Taxes on Time: Freelancers are required to make estimated tax payments four times a year. Missing a payment can result in penalties, so mark these dates on your calendar or set reminders.

- Keep Detailed Records: Keep thorough records of your income and expenses. Whether you use accounting software or spreadsheets, detailed records will help you report your earnings accurately and avoid penalties.

- Set Aside Money for Taxes: Since taxes aren't withheld from freelance income, it's wise to set aside a portion of your earnings for taxes. A good rule of thumb is to save about 25-30% of your income for taxes.

- File on Time: Filing your taxes late can result in penalties. Make sure to file by the tax deadline, or request an extension if you need more time (but remember that any taxes owed are still due by the original deadline).

- Consult a Tax Professional: If you're unsure about any aspect of your tax filing, it’s always a good idea to consult with a tax professional. They can ensure everything is done correctly and help you avoid costly mistakes.

Keeping up with your payments and ensuring accurate documentation can save you from tax fines and alleviate the tension associated with tax period.

Also Read This: Can I Change My Username on Fiverr?

Tips for Organizing Your Tax Documents

It’s essential to have your tax papers in order so you can file them seamlessly. Track your revenue opening family businesses may be they have earned nothing in one year; moreover control expenses – the more money spent on business matters should remain within the company hence increasing profitability through these savings; receipts are also significant. This saves freelancers from getting into trouble when they are required to pay taxes every year because they won’t have any evidence for arguing their case when being fined by the government. Here are some easy ways for you to remain organized and prepare for tax season:

- Create Digital Folders: Set up a folder system on your computer for each tax year. Separate your income records, expense receipts, and other important documents.

- Use Cloud Storage: Consider storing your tax documents in a cloud storage service like Google Drive or Dropbox. This keeps your files safe and accessible from anywhere.

- Keep Receipts for Business Expenses: It’s essential to keep all receipts for deductible expenses. Use apps like Expensify or Shoeboxed to scan and organize receipts digitally.

- Monthly Reviews: Review your income and expenses at least once a month. This will help you catch any missing information before the year ends.

- Use Accounting Software: Tools like QuickBooks or Wave can automatically track your earnings and expenses, making tax time much easier.

When tax season approaches, you will be able to minimize your stress levels if you have been organized throughout the year and had all your essential deductions in mind.

Also Read This: What is Gig Fiverr?

FAQs About Reporting Freelance Income

The world of freelance taxes can be quite confusing, especially for freelancers who often find themselves navigating the murky waters of how to report their income. Here are some FAQs that will help clarify some issues:

-

- Do I need to report all freelance income, even if it's small?

Yes, you must report all income, no matter how small. The IRS requires you to report every dollar earned, even if it's just a few dollars from a side gig.

-

- What forms do I need to file as a freelancer?

You'll need to file a Form 1040 along with a Schedule C to report your business income and expenses. You may also need to file a Schedule SE for self-employment tax.

-

- Do I need to pay estimated taxes?

Yes, freelancers must pay estimated taxes quarterly. This helps you avoid a large tax bill at the end of the year and potential penalties for underpayment.

-

- Can I deduct health insurance as a freelancer?

Yes, if you are self-employed and pay for your own health insurance, you can deduct the premiums as an adjustment to income, which can reduce your taxable income.

It would be wise to seek advice from a tax professional or utilize tax software specialized in freelance taxes if your inquiries are more specific.

Conclusion: Making Tax Filing Easier for Freelancers

Getting prepared and organized can make filing taxes as a freelancer less daunting. It is possible to simplify the process significantly by tracking your earnings, knowing what you can deduct, and ensuring that you pay all your quarterly payments on time.

It doesn't matter if you choose to do your taxes on your own or seek the help of an expert, having a system for organizing documents will save you time and reduce stress. By taking advantage of tax deductions for freelancers, it’s possible to reduce how much one pays in total taxes; thus keeping more income than before.

If you have the appropriate instruments and schemes, filling taxes such as one who works on his/her own will turn out to be just like any other business operations, hence you remain passionate about what you do – your freelancing career!