When you are a freelance financial adviser, you help your clients with their financial decisions. Unlike the traditional financial advisors, freelancers may work at any time during the day or night and also choose to work with different clients. They advise people on how to budget, invest and save money for future goals such as retirement or buying a house.

Freelance financial advising is ideal for individuals who like to mix their fondness for finances with autonomy of being self-employed. It entails comprehending each person’s specific financial requirements, evaluating his or her risk appetite and making tailored recommendations.

- Budget Planning: Assisting clients in creating realistic budgets that align with their income and expenses.

- Investment Advice: Helping clients choose investments that match their risk levels and financial goals.

- Debt Management: Providing strategies for reducing and managing debt.

Essential Skills You Need to Become a Financial Advisor

There are a few essential skills that you have to build upon if you want become successful as an independent financial consultant. The reason behind this is that these aptitude will be helpful in luring customers and subsequently offering them recommendations that suits their situation better.

| Skill | Why It's Important |

|---|---|

| Financial Analysis | Ability to assess financial data and create strategic financial plans for clients. |

| Communication Skills | Helps in explaining complex financial concepts in a way clients can understand. |

| Time Management | Allows you to manage multiple clients and projects effectively. |

Cultivating such abilities distinguishes you from others and enables you to be seen as a reliable consultant within the realm of freelancing.

Also Read This: Are Fiverr Reviews Legit? Unveiling the Truth Behind Freelance Feedback

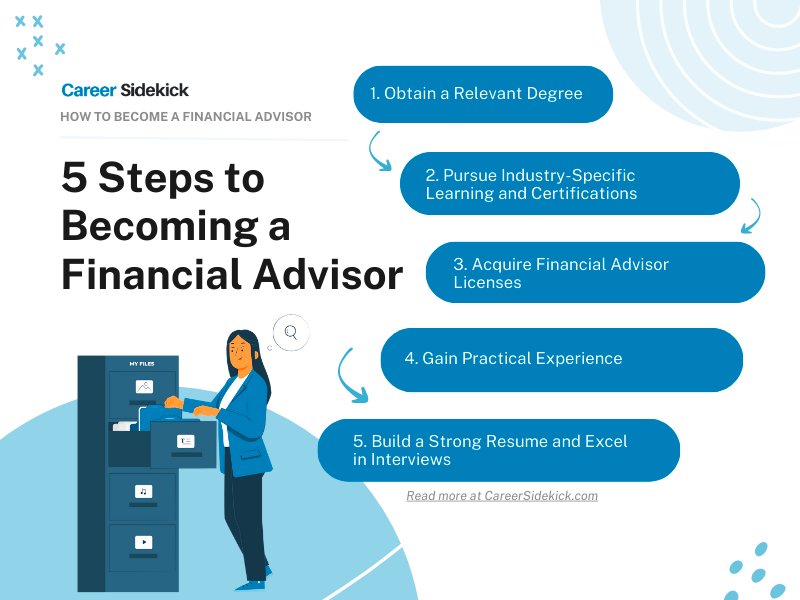

How to Get Started in Freelance Financial Advising

To become a freelance financial advisor, there are specific steps that need to be taken. In contrast to regular employment, freelancing necessitates establishing a framework for acquiring and retaining clients on your own. The following is a procedural manual on how you can start this expedition.

- Gain Relevant Certifications: Most clients prefer advisors with certifications like CFA (Chartered Financial Analyst) or CFP (Certified Financial Planner) for added credibility.

- Define Your Niche: Narrow down your focus to specific financial areas, such as retirement planning, investment management, or debt reduction, which can make you more appealing to targeted clients.

- Set Up Your Online Presence: Establishing a professional website, LinkedIn profile, and other social media platforms can help showcase your expertise and attract potential clients.

- Network with Industry Professionals: Attend industry events, join online forums, and participate in local networking groups to meet potential clients and gain referrals.

- Create a Pricing Structure: Decide how you will charge for your services—whether hourly, per project, or on a retainer basis—based on your level of experience and industry standards.

In this way, you can build a sturdy base for your freelance career and start drawing clients who appreciate your skills.

Also Read This: How to Create a Fiverr Account: Bangla Tutorial

Building a Strong Online Presence as a Financial Advisor

In this day and age when most things happen online, it is essential for independent financial consultants to have an effective web identity that stands out among many others. This not only provides a platform for exhibiting skillfulness but also enables probable customers to reach out with ease. A good internet persona should distinguish you from your contemporaries and make you a reliable source of information concerning your specialization.

Commence with the development of an expert site that puts emphasis on what you offer, your credentials and achievements. Some significant components include:

- About Me Page: Share your background, credentials, and what drives you as a financial advisor.

- Service Offerings: Clearly outline the services you provide, whether it’s financial planning, investment advice, or retirement strategies.

- Client Testimonials: Showcase feedback from satisfied clients to build trust and credibility.

- Blog Section: Share informative articles on financial topics to demonstrate your knowledge and engage visitors.

Remember to harness social media channels such as LinkedIn, Facebook and Instagram so as to connect with a larger audience. This may involve posting interesting information that would attract followers’ interest or joining pertinent groups which would enhance your visibility. An active online persona could result in the acquisition of new customers.

Also Read This: How to Promote Etsy Shops on Fiverr

Finding Clients and Expanding Your Network

It is absolutely crucial for your success as a freelance financial consultant to find clients and improve your network. It is these connections that yield referrals, new clients and significant collaborations. The following are some of the best ways to attract a larger number of clients:

- Leverage Social Media: Use platforms like LinkedIn to connect with potential clients and industry peers. Engage with posts, share insights, and join discussions to enhance your visibility.

- Attend Networking Events: Participate in local meetups, conferences, and seminars to meet people in the finance industry. These events provide great opportunities for building relationships.

- Join Professional Associations: Becoming a member of financial advisor associations can help you access resources and connect with other professionals in your field.

- Offer Free Workshops: Conducting free workshops or webinars can showcase your expertise and attract potential clients who appreciate your knowledge.

Building relationships require time as this is not just something which happens overnight. In order to have great relationship with your clients you must keep on communicating consistently with all your contacts so that they can eventually develop into clients.

Also Read This: Why Do My Gigs on Fiverr Get Denied?

Setting Your Rates and Managing Your Finances

Setting your rates and managing finances are key aspects of running a successful freelance financial advisory practice. It is therefore important to price your services correctly so that you can attract clients but still make a profit out of it.

Here are few ways that can support you in determining your charges:

- Research Industry Standards: Look into what other financial advisors in your area or niche charge to get a sense of the market rate.

- Determine Your Value: Consider your experience, certifications, and the unique services you offer when setting your rates. Don’t undervalue your expertise.

- Choose a Pricing Model: Decide whether you want to charge hourly, by project, or on a retainer basis, based on what suits your business and your clients’ preferences.

After determining your prices, it is time to manage your finances. To do this, one can track their earnings and outgoings with help of accounting applications or MS Excel. Check out these financial management suggestions:

- Create a Budget: Outline your monthly income and expenses to understand your financial position better.

- Save for Taxes: Set aside a portion of your income for taxes to avoid surprises at tax time.

- Monitor Cash Flow: Regularly review your cash flow to ensure you have enough liquidity to cover expenses and invest in your business.

Opting for young iron ore, while championing assertiveness, responsible behavior and being financially responsible are some ways to become successful firm in advising finance.

Also Read This: Can You Tutor on Fiverr? A Comprehensive Guide

Challenges in Freelance Financial Advising and How to Overcome Them

Choosing to freelance as a financial advisor can be very flexible however, there are its own challenges that it has to deal with. To build a successful career, one has to be aware of these challenges and manage them in order to succeed. Some of the common hurdles in this field and ways of overcoming them are here below.

- Inconsistent Income: Unlike a salaried position, your income as a freelancer can fluctuate. To manage this, consider creating a budget that accounts for lean months and aim to save a portion of your earnings during busier times.

- Client Acquisition: Finding clients can be tough, especially when starting out. Utilize networking, social media, and local events to connect with potential clients. Offering free consultations can also entice new clients to try your services.

- Self-Discipline: Working independently requires strong self-discipline. Set a daily schedule and create a dedicated workspace to help maintain focus and productivity.

- Staying Updated: The financial industry is constantly evolving, with new regulations and market trends. Regularly invest time in professional development through courses, webinars, or industry publications to stay informed.

Taking an initiative and tackling these problems directly will facilitate your change towards a successful career as a self-employed financial consultant.

Also Read This: Can You Get Fiverr Credits Back into Your Account?

FAQs on Building a Freelance Financial Advisor Career

When you commence your venture as an independent financial consultant, there might be numerous queries in your mind. Following are some commonly asked questions that can get you cleared along the road:

| Question | Answer |

|---|---|

| What qualifications do I need? | A degree in finance or a related field is helpful, along with relevant certifications like CFP or CFA. |

| How do I find clients? | Networking, social media, referrals, and workshops are effective ways to find clients. |

| Can I work part-time? | Yes, many freelancers start part-time while building their client base. |

| How should I set my rates? | Research industry standards and assess your value and experience to set competitive rates. |

The main aim of these answers is to explain some of the things that you may expect and assist in your new easier process of navigating the career trail.

Conclusion on Growing Your Freelance Financial Advisor Career

To be a successful worker in this career, you have to face certain challenges most people would avoid. Still, it’s a great way of making money, if you are prepared to learn continually and forge good relationships with others. Attracting customers and growing your business can occur by knowing what is expected from you, developing basic skills and having an impressive e-reputation.

A freelance financial advisor needs to overcome a lot of challenges before becoming successful in his or her career. However, he or she has other reasons for making money in this way which will help him or her become one of them rather than conforming with the common people who operate within e-governance settings. You might be able to draw clients and expand your operation by knowing what you are expected to do; learning key skills that are required; and creating a powerful online image for yourself.

Be sure to keep your rates realistic, spend sensibly, and face the obstacles ahead of you with the needful actions. If you are consistent and apply appropriate methods, you can be successful as a freelance financial consultant. You just need to go for it, this is an adventure you must embark on, and that is how your career shall prosper!