Freelancing comes with a lot of flexibility, but it also means you're responsible for managing your own taxes. Unlike traditional employees who have taxes automatically deducted from their paycheck, freelancers need to figure out how much to set aside for taxes on their own. Understanding freelancer taxes can feel complicated, but once you get the hang of it, it's manageable. This post will help you understand the basics of freelancing taxes, how to estimate what you owe, and the common mistakes to avoid. Let’s break it down so you can stay on top of your tax game!

Understanding Freelance Income

As a freelancer, your income comes from various sources, such as clients paying for your services, freelance platforms like Fiverr, and sometimes even royalties or licensing fees. It’s important to understand that all the income you earn as a freelancer is taxable. This includes every dollar you make, whether it’s through a one-time project or ongoing work. Tracking your freelance income is essential to ensure you report everything correctly when it’s time to file your taxes.

Some common ways freelancers earn money include:

- Hourly rates for services offered

- Project-based payments

- Retainers from clients who pay regularly

- Income from selling digital products or assets

It’s a good practice to keep a record of all income received, including invoices and payment confirmations. Accurate record-keeping helps make tax filing easier and ensures you don't miss any income that could affect your tax bill.

Also Read This: How to Contact People on Fiverr: A Step-by-Step Guide

Types of Taxes Freelancers Must Pay

As a freelancer, there are several types of taxes you need to consider. Unlike employees who typically only pay income tax, freelancers are responsible for paying both income tax and self-employment tax. Here’s a breakdown of the key taxes freelancers must pay:

- Income Tax - This is the tax on the total income you earn. The rate depends on your total income and can vary based on where you live.

- Self-Employment Tax - This tax covers Social Security and Medicare contributions. Freelancers must pay both the employer’s and the employee’s share, which totals 15.3% of your net earnings. If your earnings exceed a certain amount, you may also have to pay additional taxes.

- State and Local Taxes - Depending on where you live, you might also need to pay state or local taxes. These can vary greatly depending on your location, so it’s important to check the specific tax laws in your state or city.

- Sales Tax - If you sell products (like digital downloads or merchandise) in addition to services, you may be required to charge and pay sales tax on those items.

In total, freelancers can end up paying a higher tax rate than traditional employees because of the self-employment tax. But don’t worry—there are ways to reduce your taxable income with deductions and credits, which we’ll cover later.

Also Read This: How to Get Your Gig Featured on Fiverr

How to Estimate Your Tax Liability

Estimating your tax liability as a freelancer is a crucial step in managing your finances. You don't want to be surprised at tax time with a large bill that you weren’t prepared for. By setting aside money regularly and estimating what you owe, you can avoid unnecessary stress. The first thing you need to know is that your taxes are calculated based on your total income for the year, minus any deductions you can claim.

Here’s how you can estimate your tax liability:

- Track Your Total Income: Keep records of all the income you earn throughout the year. This can include invoices, payment confirmations, and any earnings through platforms like Fiverr.

- Calculate Self-Employment Tax: As a freelancer, you’ll need to pay both the employee and employer portion of Social Security and Medicare. This is generally 15.3% of your net income. To calculate this, multiply your net earnings by 0.153.

- Apply Income Tax Rates: Once you know your net income, you need to estimate how much you’ll pay in income taxes. The U.S. has a progressive tax system, meaning the more you earn, the higher the tax rate. Use the IRS tax brackets to get an idea of how much you’ll owe.

Once you’ve calculated these figures, you’ll have a better idea of how much you need to set aside. You can adjust this estimate as you go by keeping an eye on your earnings and reviewing your tax situation regularly to make sure you're on track.

Also Read This: Does Fiverr Work in Australia? Exploring Opportunities and Insights

Tax Deductions for Freelancers

One of the perks of being a freelancer is that you can deduct certain business expenses from your taxable income. These deductions can lower your overall tax liability, meaning you pay less. The key to maximizing your deductions is knowing which expenses qualify and keeping track of them throughout the year.

Here are some common tax deductions for freelancers:

- Home Office Deduction: If you work from home, you may be able to deduct a portion of your rent, utilities, and internet costs based on how much of your home is used for business.

- Business Supplies: Any supplies you need for your work—such as computers, software, or office furniture—are deductible.

- Marketing and Advertising: Costs associated with advertising your services, such as website hosting, online ads, and business cards, are deductible.

- Health Insurance: If you're paying for your own health insurance, that cost may be deductible, which can save you a significant amount on your taxes.

- Professional Services: Fees for services like legal, accounting, or consulting that are necessary for your business are also deductible.

To make sure you’re claiming every deduction you’re entitled to, keep thorough records and receipts for all your business-related expenses. The more you can deduct, the less taxable income you’ll have, which means you’ll owe less in taxes.

Also Read This: How to Really Use Fiverr: A Comprehensive Guide

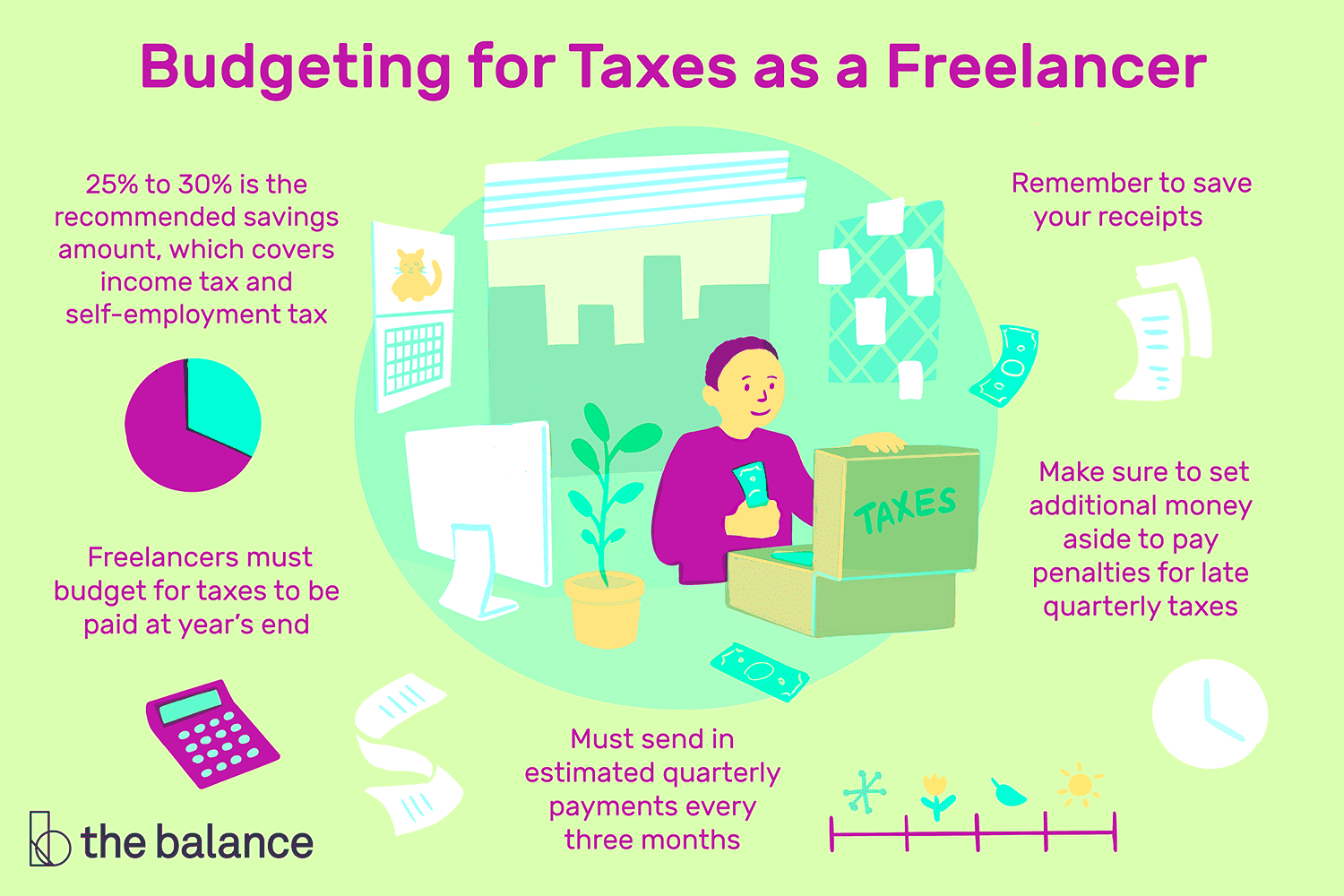

Setting Aside Money for Taxes

As a freelancer, it’s important to set aside money throughout the year to cover your taxes. Since taxes aren’t automatically deducted from your income like they are for employees, it’s your responsibility to manage your own tax payments. Setting aside money regularly can prevent the shock of a large tax bill at the end of the year.

Here’s how you can set money aside effectively:

- Calculate a Percentage to Save: A good rule of thumb is to save at least 25-30% of your income for taxes. This percentage will cover both self-employment tax and income tax. You can adjust this amount depending on your tax bracket.

- Open a Separate Savings Account: Create a separate account just for taxes. This will help you avoid spending the money you need for taxes on other expenses.

- Make Quarterly Payments: Freelancers are typically required to pay taxes quarterly. Use the estimated amount you’ve set aside each quarter to pay your estimated taxes to the IRS. This can help avoid penalties for underpayment.

- Use Tax Tools: Consider using online tools or apps that help you track your income and taxes, making it easier to calculate and set aside the right amount.

By regularly setting aside money for taxes, you’ll ensure that when tax season rolls around, you’re not scrambling to come up with the funds. Planning ahead will also help you stay financially organized and reduce stress.

Also Read This: How to Offer Gigs on Fiverr: A Comprehensive Guide

Common Mistakes to Avoid When Filing Taxes

Filing taxes as a freelancer can be tricky, especially when you’re juggling multiple clients and income sources. It’s easy to make mistakes, but these errors can end up costing you in penalties or missed deductions. To help you avoid common tax mistakes, here are some things to watch out for:

- Not Keeping Good Records: Failing to track your income and expenses is one of the biggest mistakes freelancers can make. Without proper records, you may miss out on valuable deductions and could end up overpaying on your taxes.

- Forgetting to Pay Self-Employment Tax: Many freelancers focus solely on income tax and forget about self-employment tax, which covers Social Security and Medicare. Remember that this tax is separate from income tax and must be paid on your net earnings.

- Overestimating Deductions: While deductions can reduce your tax bill, claiming too many or improper deductions can trigger an audit. Be sure that your deductions are directly related to your business and that you have proper documentation.

- Missing Quarterly Payments: Freelancers are required to make estimated tax payments every quarter. Failing to make these payments can lead to penalties and interest. Set up reminders so you don’t miss these deadlines.

- Ignoring State and Local Taxes: It’s easy to overlook taxes that are specific to your state or city. Depending on where you live, you may be required to pay additional taxes beyond federal income and self-employment taxes.

By staying organized and following the rules, you can avoid these mistakes and ensure you’re not paying more than necessary or facing penalties from the IRS.

Also Read This: How to Make a Good Profile on Fiverr

FAQs About Freelance Taxes

Filing taxes as a freelancer can be confusing, and you might have many questions about how to handle your specific tax situation. Here are answers to some of the most common questions freelancers have:

- Do I need to file taxes if I make less than $400? Yes, if you earn more than $400 in net earnings from self-employment, you are required to file a tax return and pay self-employment taxes.

- Can I deduct expenses for my home office? Yes, you can deduct expenses related to your home office, including a portion of your rent, utilities, and internet. However, the space must be used exclusively for business purposes.

- How do I calculate self-employment tax? Self-employment tax is 15.3% of your net earnings. This includes 12.4% for Social Security and 2.9% for Medicare. You can deduct half of the self-employment tax when calculating your income tax.

- Can I claim deductions for my health insurance premiums? Yes, if you pay for your own health insurance, you may be able to deduct the premiums as part of your business expenses.

- What happens if I don’t make quarterly payments? If you fail to make quarterly estimated tax payments, you may be charged penalties and interest. The IRS expects freelancers to pay taxes throughout the year, not just at the end.

If you have more specific questions, it’s always a good idea to consult a tax professional who specializes in freelance or self-employed taxes to make sure you’re on the right track.

Conclusion: Managing Taxes as a Freelancer

Managing taxes as a freelancer doesn’t have to be overwhelming. By staying organized, tracking your income and expenses, and setting aside money regularly for taxes, you can keep things under control. Remember that freelancers have unique tax obligations, including self-employment tax and income tax, but there are also plenty of deductions available to help reduce your tax bill.

Here are some final tips for managing your taxes effectively:

- Stay Organized: Keep track of every payment you receive and every expense related to your business. The better your record-keeping, the easier your tax filing will be.

- Pay Quarterly: Don’t wait until tax season to pay your taxes. Make estimated payments quarterly to avoid penalties and interest.

- Consult a Professional: If you’re unsure about your taxes, don’t hesitate to ask a tax professional for advice. They can help you navigate the complex rules and ensure you’re paying the correct amount.

By planning ahead and staying informed about your tax responsibilities, you’ll be able to focus on growing your freelance business without worrying about tax season.