Freelancing can be a rewarding way to earn a living, but it also comes with its own set of responsibilities, especially when it comes to taxes. Unlike traditional employees, freelancers are responsible for handling their own taxes. This means you need to understand how taxes work and what your obligations are.

As a freelancer, you will typically be classified as self-employed. This classification affects how you file your taxes and what you need to pay. Here are some key points to remember:

- Self-Employment Tax: This tax covers Social Security and Medicare taxes for freelancers.

- Income Tax: Freelancers pay federal, state, and sometimes local income taxes based on their earnings.

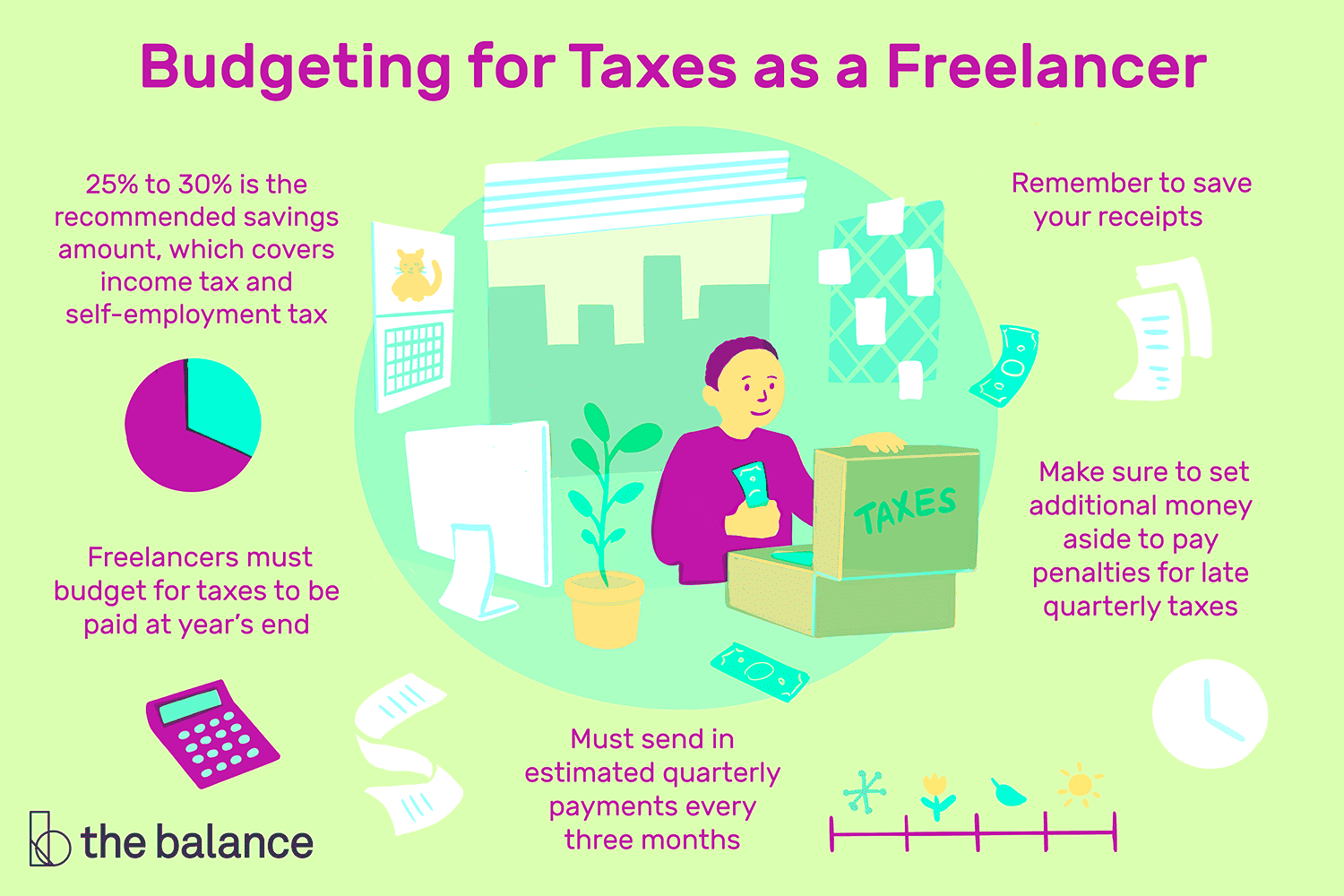

- Quarterly Payments: You may need to make estimated tax payments every quarter to avoid penalties.

Understanding these aspects will help you manage your finances better and ensure you stay compliant with tax laws.

Why Freelancers Need to Save for Taxes

Many freelancers overlook the importance of saving for taxes until it's time to file. This can lead to financial stress and unexpected bills. Saving for taxes is crucial for several reasons:

- Unexpected Costs: Freelancers often face fluctuating income. Saving helps cushion against lean months.

- Avoiding Penalties: Failing to pay taxes can result in hefty penalties. Regular savings can help you meet your obligations.

- Financial Stability: Having a dedicated tax fund promotes overall financial health and peace of mind.

By setting aside money regularly, you ensure that you have the funds available when tax season arrives.

Also Read This: Best Fiverr Sellers for Translation Services in 2024

Calculating Your Tax Obligations

Knowing how to calculate your tax obligations is essential for effective financial planning. Here’s a step-by-step guide to help you understand what to consider:

- Track Your Income: Keep a record of all your earnings. This includes payments from clients, side gigs, and any other sources of income.

- Document Your Expenses: Save receipts for business-related expenses. Common deductible expenses include:

- Office supplies

- Software subscriptions

- Travel costs

- Marketing expenses

Subtract your total expenses from your total income to determine your taxable income. This is the amount you will pay taxes on.

Next, use the following formula to estimate your tax:

| Income Range | Tax Rate |

|---|---|

| $0 - $9,950 | 10% |

| $9,951 - $40,525 | 12% |

| $40,526 - $86,375 | 22% |

| $86,376 - $164,925 | 24% |

This is a simplified approach. Tax rates may vary based on your income level and location. It’s wise to consult with a tax professional to ensure accurate calculations.

Also Read This: What Do I Need to Change My Number on Fiverr?

Setting Aside Money for Taxes

As a freelancer, setting aside money for taxes is crucial for avoiding financial stress when tax season rolls around. It can be easy to forget about taxes when you're focused on getting paid for your work. However, putting a system in place to save regularly can make a huge difference.

Start by estimating how much you need to save. A good rule of thumb is to set aside 25% to 30% of your income for taxes. Here are some practical tips for setting aside money:

- Open a Separate Savings Account: Having a dedicated account for taxes helps you keep track of your savings and prevents you from accidentally spending the money.

- Automate Your Savings: Set up automatic transfers to your tax savings account every time you receive a payment. This way, you won't forget to save.

- Review Your Income Regularly: Keep an eye on your earnings and adjust your savings accordingly. If you have a good month, consider saving a bit more.

By implementing these strategies, you'll feel more prepared when it’s time to pay your taxes, allowing you to focus on what you do best—your freelance work!

Also Read This: How to Promote Your Product on Fiverr

Choosing the Right Savings Method

When it comes to saving for taxes, not all methods are created equal. Finding the right approach for your situation can help you reach your savings goals with ease. Here are some methods to consider:

- High-Interest Savings Accounts: Look for savings accounts that offer higher interest rates. This can help your money grow over time while still being accessible when you need it.

- Money Market Accounts: These accounts often provide higher interest than regular savings accounts and may offer check-writing capabilities, giving you quick access to your funds.

- Certificates of Deposit (CDs): If you can set your money aside for a while, CDs can offer higher returns. Just be aware that your funds will be tied up for the term of the CD.

It's essential to choose a method that fits your financial habits and goals. Take your time to research different options and find what works best for you.

Also Read This: How to Create a Fiverr Gig: Step-by-Step Guide

Common Tax Deductions for Freelancers

One of the perks of freelancing is the ability to deduct certain business expenses from your taxable income. Understanding what you can deduct helps lower your tax bill and maximize your earnings. Here are some common tax deductions available to freelancers:

- Home Office Deduction: If you work from home, you can deduct a portion of your home expenses, such as rent, utilities, and internet costs.

- Equipment and Supplies: Costs for computers, printers, software, and other supplies used for your business are deductible.

- Travel Expenses: If you travel for work, you can deduct expenses like airfare, lodging, and meals, provided they are business-related.

- Marketing and Advertising: Costs associated with promoting your services, like website fees and advertising, can be deducted.

Keeping detailed records of your expenses is vital for taking advantage of these deductions. Consider using accounting software to track your expenses throughout the year. This way, when tax season arrives, you will be well-prepared to file your returns and potentially save a significant amount on your taxes.

Also Read This: What is Selling on Fiverr: A Comprehensive Guide

Keeping Track of Your Earnings and Expenses

As a freelancer, keeping track of your earnings and expenses is essential for managing your finances and preparing for tax season. Good record-keeping not only helps you understand your financial situation but also ensures you claim all possible deductions. Here are some tips to help you stay organized:

- Use Accounting Software: Programs like QuickBooks, FreshBooks, or Wave can make tracking income and expenses easier. These tools allow you to categorize expenses, generate invoices, and produce financial reports.

- Create a Spreadsheet: If you prefer a more hands-on approach, consider setting up a simple spreadsheet. Include columns for date, description, income, expenses, and notes. This method is cost-effective and customizable.

- Keep Receipts: Maintain a system for storing receipts, whether it's a digital app like Expensify or a physical folder. Receipts provide proof of expenses and are crucial during tax filing.

Also, review your earnings and expenses regularly, ideally monthly. This practice will help you stay on top of your financial situation and prepare for estimated tax payments. Consistency is key, so find a routine that works for you and stick to it!

Also Read This: Is Fiverr Still Worth It in 2023?

FAQs About Saving for Taxes as a Freelancer

When it comes to saving for taxes, freelancers often have many questions. Here are some frequently asked questions that can help clarify the process:

- How much should I save for taxes? A general rule is to set aside 25% to 30% of your income for taxes, but this can vary based on your income level and expenses.

- Do I need to make quarterly tax payments? Yes, most freelancers are required to make estimated tax payments quarterly to avoid penalties. Check your local tax laws for specific requirements.

- What if I don't have enough saved for taxes? If you find yourself in this situation, consider setting up a payment plan with the IRS or your local tax authority. It's better to address the issue proactively.

- Can I deduct my home office expenses? Yes, if you use part of your home exclusively for business, you may qualify for a home office deduction. Keep track of relevant expenses to claim this deduction.

Understanding these aspects can help you manage your finances better and avoid surprises when tax time comes around.

Conclusion

Saving for taxes as a freelancer may seem daunting at first, but with a solid plan and consistent effort, you can make it manageable. By understanding your tax obligations, setting aside money regularly, and keeping accurate records of your earnings and expenses, you'll position yourself for success. Remember to take advantage of the deductions available to you and choose a savings method that aligns with your financial goals.

With these strategies in place, you can focus more on your work and less on tax-related stress. Stay organized, be proactive, and you'll find that managing your taxes can be a smooth process. Happy freelancing!