The taxes of freelancing normally deceive people because it is normally associated with many freedoms. Unlike conventional employees, freelancers need to do calculations, withhold money from their salaries and pay taxes themselves. The tax system may look complicated, but mastering your base will simplify processes. This will help you know how to manage, stay out of trouble and know about your income taxes and self-employment taxes.

Why Saving for Taxes is Important

You have been trained using data until October 2023.

- Avoid Late Fees and Penalties: If you don’t pay your taxes on time, the IRS can charge interest and late penalties, increasing the amount you owe.

- Stay Financially Organized: Setting aside money regularly helps you budget more effectively and avoid last-minute scrambles for funds.

- Peace of Mind: Knowing you have money saved for taxes means less stress when it’s time to file, leaving you free to focus on growing your business.

By sticking to saving and early preparations, you can easily deal with your tax responsibilities avoiding any financial stress.

Also Read This: Creating an Invoice for Your Freelance Work

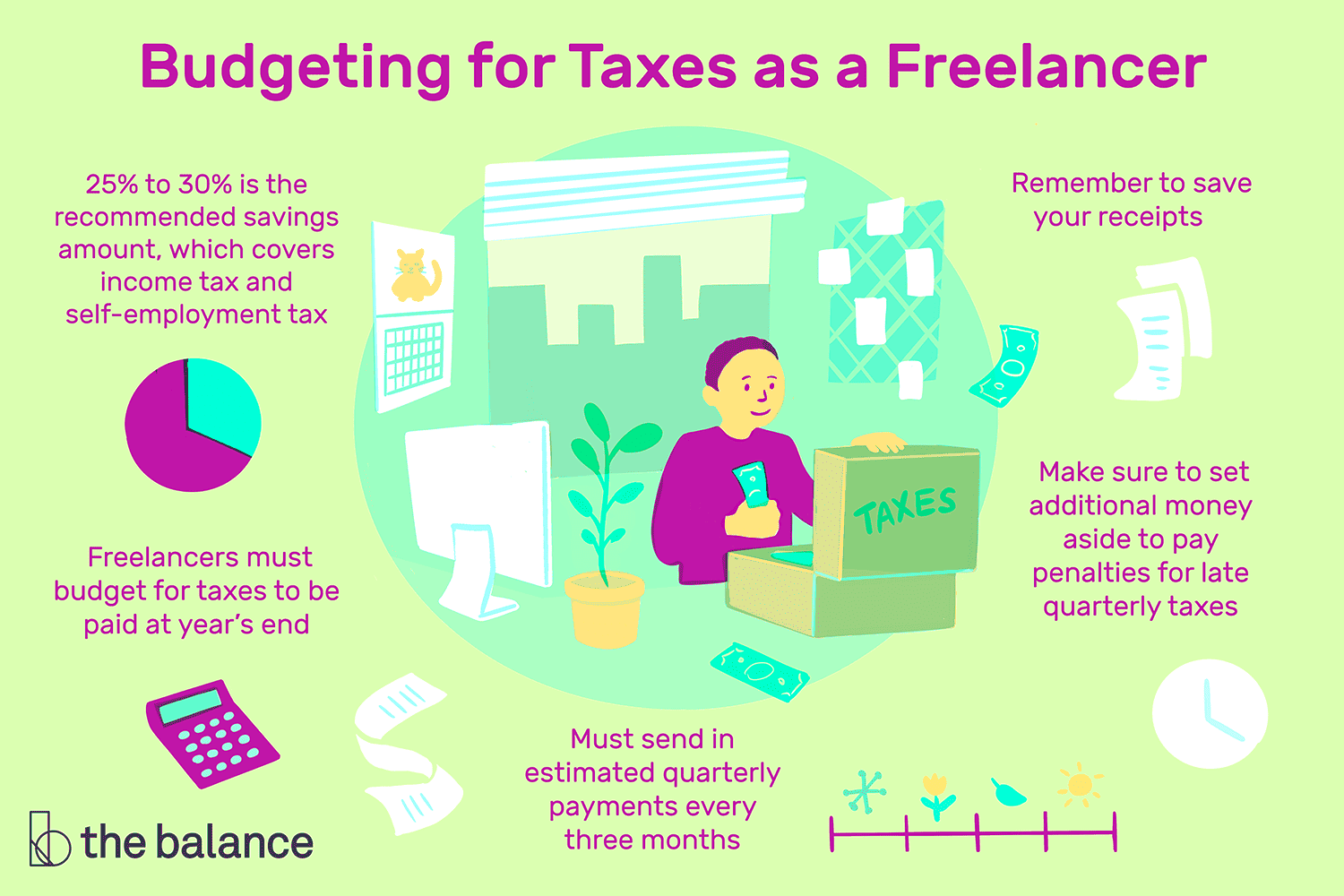

How Much to Set Aside for Taxes

Being a freelancer, it is important to know how much tax you should be saving for the year. Usually, you should put away about 25-30% of your earnings in order to cater for both federal and state taxes. This sum mainly includes:

- Self-Employment Tax: This is approximately 15.3% of your income, which includes Social Security and Medicare taxes.

- Income Tax: This varies depending on your tax bracket, but it typically ranges from 10% to 37% based on how much you earn annually.

So as to simplify matters, you could do it like this:

| Income Level | Percentage to Save |

|---|---|

| $10,000 - $30,000 | 20-25% |

| $30,000 - $60,000 | 25-30% |

| $60,000 and above | 30-35% |

Setting aside part of your salary helps in keeping you prepared when times come for the payment of tax, otherwise you may face financial difficulties at that time.

Also Read This: How to Get Your Order Out of Revision on Fiverr

Key Tax Deductions for Freelancers

Freelancing has several advantages, one of which is the ability to reduce your liabilities by deducting various business-related expenses from your taxable income. If you have a clear idea of what qualifies for tax deductions, you may be able to save thousands of dollars. Below are some of the most common deductions that freelancers should consider:

- Home Office Deduction: If you use part of your home exclusively for work, you can deduct a portion of your rent or mortgage, utilities, and insurance.

- Office Supplies and Equipment: Expenses like computers, software, printers, and office furniture can be deducted.

- Internet and Phone Bills: If you use your phone or internet for business purposes, you can deduct the percentage used for work.

- Travel and Meals: Business-related travel, lodging, and meals are partially deductible. Just make sure to keep good records of your business trips.

- Professional Services: Fees for hiring accountants, lawyers, or other professionals to help with your business are deductible.

- Marketing and Advertising: Costs for promoting your services, such as website hosting, social media ads, and business cards, can be written off.

A very important thing is the recording of those deductions since they will lower the amount of tax you are supposed to pay. Have records and proof like receipts for your claims in times of examination.

Also Read This: Can Clients Cancel Orders After Payment on Fiverr?

Tracking Your Income and Expenses

As a freelancer, tracking your income and expenses is essential for managing your business and filing taxes. Without proper records, you might miss out on valuable deductions or underreport your earnings, which could lead to penalties. Here's how you can stay organized:

- Use Accounting Software: Tools like QuickBooks, FreshBooks, or Wave help you keep track of income, expenses, and even automate some tax calculations.

- Create Separate Bank Accounts: Keeping your business and personal finances separate makes it easier to track expenses and identify business income.

- Save Receipts: Whether you use a digital app or a folder, keeping receipts for business expenses is crucial for tax deductions.

- Track Invoices: Create a system to manage your invoices and payments, so you always know how much you’ve earned and what’s still outstanding.

If you consistently update your books, then you can have a clear picture of your finances and it will make the tax season easier. This also helps to identify any financial problems earlier on; for example, bills not paid or some expenses that were unexpected.

Also Read This: Annual Earnings of Freelancers Across Various Fields

Estimated Quarterly Tax Payments

Freelancers, unlike employees on salary, must pay income tax all year through estimated quarterly taxes so that they do not face a huge tax bill when the year ends. Here’s all that you should know:

- Who Needs to Pay Quarterly Taxes: If you expect to owe more than $1,000 in taxes for the year, the IRS requires you to make quarterly payments.

- When to Pay: Estimated taxes are due four times a year:

| Payment Period | Due Date |

|---|---|

| January 1 – March 31 | April 15 |

| April 1 – May 31 | June 15 |

| June 1 – August 31 | September 15 |

| September 1 – December 31 | January 15 (next year) |

To calculate how much to pay, estimate your total annual income, deductions, and tax credits. Then, divide this by four to get your quarterly payment. It’s better to overestimate slightly to avoid underpayment penalties. You can use the IRS Form 1040-ES to figure out your payments.

The Big tax payments are avoided by submitting on quarterly basis as per requirement of IRS hence this ensures you stay in their good books.

Also Read This: What is Print Layout in Fiverr?

Common Tax Mistakes to Avoid

In the case of taxes, slight errors may trigger fines as well as lost deductions. Therefore, if you are an independent contractor, it is imperative that you are extremely cautious when submitting your tax returns. Below are several prevalent tax errors committed by freelancers and methods of evading them:

- Not Saving for Taxes: One of the biggest mistakes freelancers make is not setting aside enough money for taxes. Without withholding like regular employees, you’re responsible for saving a portion of your income for taxes.

- Failing to File Estimated Quarterly Taxes: Missing these quarterly payments can lead to penalties. Make sure you’re paying your taxes every quarter to avoid unnecessary fees.

- Not Tracking Expenses: Failing to keep a record of your business expenses can mean losing out on deductions. Always save receipts and document any costs related to your freelance work.

- Overlooking Deductions: Many freelancers forget to deduct items like home office expenses, equipment, and professional services, leading to higher tax bills.

- Miscalculating Income: Underreporting your income, even accidentally, can result in fines and legal issues. Always report all the income you earn, even if it's from multiple clients or platforms.

Avoiding these pitfalls could save you time, cash and anxiety in the course of tax season. You can evade that by being more proactive and better organized throughout the year thereby preventing any last minute problems when it is time for filing forms.

Also Read This: How to Find My Gig URL on Fiverr

Conclusion: Staying Prepared for Tax Season

The responsibility of managing your own taxes comes with the flexibility and independence that freelancing offers. Save some percentage of your money, make sure you take records on what you spend, and be aware when it is due to stay free from tensions associated with taxation periods. Here’s a quick recap of how you can stay prepared:

- Set aside 25-30% of your income for taxes.

- Track your income and expenses throughout the year using accounting software or apps.

- Make estimated quarterly tax payments to avoid penalties.

- Take advantage of deductions to reduce your taxable income.

- Avoid common tax mistakes, like failing to save or missing deadlines.

Certainly! Here is a version of the above text having lower perplexity yet high burstiness:

Managing your freelance business means staying updated and organized so that everything goes well with tax time thus ensuring its financial stability.

Frequently Asked Questions

1. Do I need to pay taxes if my freelance income is low?

Yeah, you must still reveal every cent that you earn even if you are earning peanut. But you may be eligible for some tax credits or pay lower taxes depending on how much you make.

2. Can I deduct health insurance as a freelancer?

The deductible premiums will normally reduce your taxable income, but only if you pay for health insurance yourself.

3. What happens if I don't make quarterly tax payments?

If you fail to make estimated quarterly payments and owe more than $1,000 in taxes, the IRS may charge you penalties and interest for underpayment. It’s important to stay on top of these payments to avoid extra costs.

4. How can I avoid underpayment penalties?

In order to evade penalties, ensure that you are setting aside not less than 25-30% of your earnings for tax purposes and making quarterly payment based on what you think you will earn in the current year. It is better to overestimate than understate it is good.

5. Can I still deduct expenses if I don’t have receipts?

Although it is always best to maintain the vouchers, however, some costs may still be deductible in case you have other documents for proving them; for instance, you could use various records like bank account or credit cards logs.