As a freelancer, you may find that managing your health insurance costs is quite different from those of a traditional employee. Without an employer to contribute to your premiums, you're responsible for paying the full cost on your own. This can lead to higher premiums and the challenge of finding a plan that fits both your budget and your healthcare needs. In this section, we’ll explore why freelancers face these challenges and how to navigate them effectively.

Why Freelancers Face Higher Health Insurance Costs

Freelancers often pay more for health insurance than employees, and this is due to several factors. Here are a few key reasons:

- No Employer Contribution: Employees often enjoy health insurance benefits paid partially or entirely by their employers. As a freelancer, you bear the full cost of your premiums.

- Limited Group Discounts: Employees typically have access to group insurance plans, which offer lower rates due to pooling risk. Freelancers, however, usually need to buy individual plans, which can be more expensive.

- Pre-existing Conditions: Freelancers with pre-existing health conditions may face higher premiums or be excluded from certain plans, adding to their overall costs.

- Income Variability: The fluctuating income of a freelancer may also impact their eligibility for government subsidies or discounts, making it harder to find affordable options.

Understanding these challenges can help you make more informed decisions when shopping for insurance. In the next section, we'll discuss some of the most common health insurance options available to freelancers.

Also Read This: Earning Potential of a Freelance Video Editor

Different Health Insurance Options for Freelancers

Freelancers have several options when it comes to health insurance, each with its own benefits and drawbacks. Here’s a breakdown of the most popular choices:

- Marketplace Insurance Plans: The Health Insurance Marketplace offers various plans through the Affordable Care Act (ACA). These plans allow you to compare coverage options based on your budget. You may also be eligible for subsidies depending on your income.

- Private Insurance Plans: Freelancers can purchase insurance directly from private companies. While these plans can offer more flexibility in terms of coverage options, they tend to be more expensive compared to Marketplace plans.

- Short-Term Health Insurance: If you're looking for temporary coverage or need something less expensive, short-term health insurance can be a viable option. However, keep in mind that these plans often offer limited coverage and may exclude essential health benefits.

- Health Sharing Plans: Health sharing ministries or co-ops offer an alternative to traditional insurance. Members contribute to a shared pool to help pay for healthcare costs, but these plans may not meet all ACA requirements.

- Spouse’s or Partner’s Plan: If your spouse or partner has health insurance through their employer, you may be able to join their plan as a dependent. This can often be a more affordable option for freelancers.

Each of these options has different costs, coverage levels, and eligibility requirements. It’s important to carefully evaluate which plan best suits your needs, especially if you’re managing a tight budget as a freelancer.

Also Read This: How to Get Clients on Fiverr: A Comprehensive Guide

How Freelancers Can Find Affordable Health Insurance

Finding affordable health insurance as a freelancer can seem overwhelming, but it’s definitely possible with the right approach. Here are a few steps to help you secure the coverage you need without breaking the bank:

- Compare Plans on the Marketplace: Start by exploring the Health Insurance Marketplace. It offers a variety of plans that cater to freelancers and small businesses. Use the marketplace to compare premiums, coverage, and out-of-pocket costs. You may also qualify for subsidies based on your income, which can lower your premium rates.

- Consider High-Deductible Plans: High-deductible health plans (HDHPs) generally come with lower monthly premiums. While you'll pay more out-of-pocket if you need care, these plans can help reduce your overall insurance costs if you are generally healthy and don’t visit the doctor often.

- Look for Health Savings Accounts (HSAs): Some HDHPs allow you to open a Health Savings Account (HSA). This allows you to save pre-tax money for medical expenses, which can be helpful if you want to set aside money for future healthcare needs. Plus, the money you put in an HSA rolls over year after year.

- Check Out Health Sharing Ministries: If you’re open to alternative health plans, consider health-sharing ministries. These are not insurance, but they help cover medical costs by pooling funds from members. These plans are often more affordable than traditional insurance, though they do have limitations in coverage.

- Consider State Programs: Some states offer affordable health insurance options for freelancers. If you're struggling to find affordable insurance, check if your state offers any unique options for residents.

By exploring these options and being diligent about comparing costs and benefits, you can find an affordable plan that meets your needs.

Also Read This: Should You Share Your Email with a Fiverr Buyer?

Health Insurance Plans and Their Coverage for Freelancers

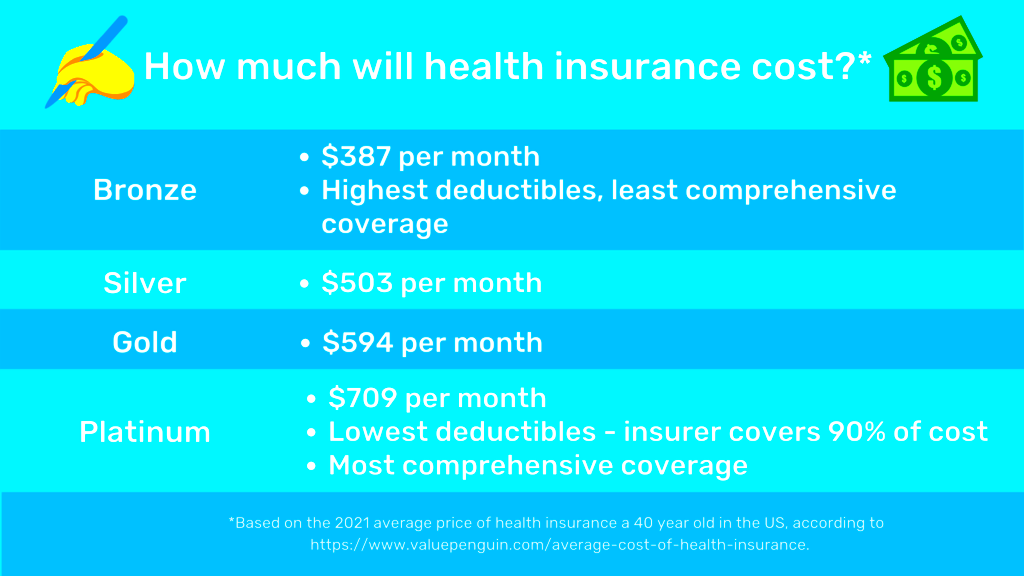

As a freelancer, it’s important to understand the different types of health insurance plans available and what each covers. The right plan for you depends on your healthcare needs, but here’s a breakdown of what most plans offer:

| Plan Type | Coverage |

|---|---|

| Health Maintenance Organization (HMO) | Generally lower premiums and out-of-pocket costs. Requires you to use in-network doctors and get referrals for specialists. |

| Preferred Provider Organization (PPO) | More flexibility in choosing healthcare providers and no referrals needed. Premiums tend to be higher than HMO plans. |

| Exclusive Provider Organization (EPO) | Similar to PPO but only allows in-network care (except in emergencies). Premiums are generally lower than PPOs. |

| Point of Service (POS) | Requires you to choose a primary care doctor and get referrals. Offers a mix of HMO and PPO features. |

| High-Deductible Health Plans (HDHP) | Lower premiums but higher deductibles. Often paired with a Health Savings Account (HSA) to save for medical expenses. |

When considering a plan, you should focus on what’s most important for you: monthly premiums, the doctor network, and out-of-pocket costs like copays and deductibles. Understanding the specific coverage of each plan can help you choose the one that will serve you best as a freelancer.

Also Read This: How to Report Freelance Income on Your Taxes

The Impact of Location on Health Insurance Prices for Freelancers

Your location can significantly impact the cost of health insurance, especially as a freelancer. Insurance premiums vary from state to state due to a number of factors:

- State Regulations: Each state has its own set of rules for health insurance, which can affect the prices of premiums. Some states have more competitive insurance markets, while others have fewer options, leading to higher costs.

- Access to Providers: In more urban areas, you may have a wider range of healthcare providers and insurance options, which could drive down costs. In rural areas, fewer insurance options and providers might increase prices due to limited competition.

- State Subsidies and Programs: Some states offer additional subsidies or have their own health insurance programs, making insurance more affordable for residents. For example, California has its own state-run marketplace, Covered California, which can provide more affordable options than the federal marketplace.

- Healthcare Costs in Your Area: The overall cost of healthcare in your location can also affect premiums. States or cities with higher healthcare costs (due to higher hospital rates or medical care availability) generally have higher insurance premiums.

Before purchasing health insurance, it’s important to research how your location affects both the availability of plans and the overall costs. This can help you determine if there are more affordable options nearby or if you need to consider other types of insurance plans to stay within budget.

Also Read This: Are Traffic Gigs from Fiverr Good?

How to Budget for Health Insurance as a Freelancer

As a freelancer, budgeting for health insurance is an essential part of your financial planning. Unlike employees with fixed health benefits, you are responsible for paying your premiums out-of-pocket, so it's crucial to set aside money every month. Here’s how you can manage health insurance costs effectively:

- Estimate Your Premiums: Start by researching the monthly premiums for various plans. Consider using the Health Insurance Marketplace or contacting private insurance providers to get quotes. Factor in the potential for higher premiums if you need more comprehensive coverage.

- Account for Out-of-Pocket Expenses: In addition to premiums, you should also budget for deductibles, copays, and other out-of-pocket expenses. Understand how much your plan will cost if you need medical care and how much you’ll pay before your insurance kicks in.

- Create a Health Insurance Fund: It’s a good idea to create a separate savings fund specifically for health insurance. Set aside a portion of your income each month to cover your health insurance premiums and any unforeseen medical expenses. Aim to save enough to cover several months of premiums in case of a lean period.

- Take Advantage of Tax Deductions: As a freelancer, you may be eligible for tax deductions on your health insurance premiums. Make sure to track your payments and consult with a tax professional to ensure you’re getting the most out of these deductions.

- Shop Annually: Health insurance premiums and options can change year-to-year, so it’s important to review your plan annually. Compare prices, coverage, and any changes to your health needs to ensure you’re getting the best value.

Budgeting for health insurance may take some effort, but with proper planning, you can maintain affordable coverage without it straining your finances.

Also Read This: Is It Against Fiverr TOS to Recommend a Non-Fiverr Colleague?

Frequently Asked Questions (FAQ)

Here are some common questions freelancers have when it comes to health insurance:

- How can I lower my health insurance premiums? Consider choosing a higher deductible plan, applying for subsidies through the Health Insurance Marketplace, or looking for state programs that offer lower-cost options.

- Can I get health insurance through my spouse’s employer? Yes, if your spouse has a health plan through their employer, you may be able to join as a dependent, often at a lower cost than purchasing individual coverage.

- Do freelancers qualify for tax credits or subsidies? Freelancers may qualify for tax credits or subsidies through the Health Insurance Marketplace, depending on their income level. Check with a tax professional to explore your options.

- What happens if I miss a health insurance enrollment period? Missing an enrollment period could result in you having to wait until the next open enrollment period, unless you qualify for a special enrollment due to life changes like marriage or having a baby.

- Is short-term health insurance a good option? Short-term health insurance can be an affordable solution for temporary coverage, but it often provides limited benefits. It’s a good option if you’re between plans, but not for long-term use.

Conclusion: Tips for Managing Health Insurance as a Freelancer

Managing health insurance as a freelancer doesn’t have to be a headache. With the right planning, you can find a plan that works for your budget and healthcare needs. Here are a few key takeaways:

- Shop Around: Don’t settle for the first plan you find. Compare different plans on the marketplace and from private insurers to find the best value for your needs.

- Consider Your Health Needs: If you rarely need medical care, a high-deductible plan may save you money in the long run. However, if you have ongoing medical needs, a more comprehensive plan might be better.

- Use Savings to Cover Costs: Save a portion of your income every month to cover health insurance premiums and other medical expenses. Having a financial cushion can help reduce stress during slow months.

- Review Your Coverage Annually: Health insurance costs and plans change regularly. Make it a habit to review your insurance every year to ensure you're getting the best coverage for your needs.

- Ask for Help: If navigating health insurance feels complicated, don’t hesitate to consult a health insurance broker or tax professional. They can help guide you toward the right plan and ensure you’re maximizing savings.

By being proactive and informed, you can effectively manage your health insurance and continue focusing on your freelance career with peace of mind.