Flexibility of being one’s own boss is often enjoyed by freelancers, however this independence comes with certain responsibilities, especially when it comes to taxes and stuff. You have to know what you owe and when you need to pay. Because freelancers are not like regular employees, who have taxes deducted from their salaries, managing tax obligations requires an active approach on the part of freelancers.

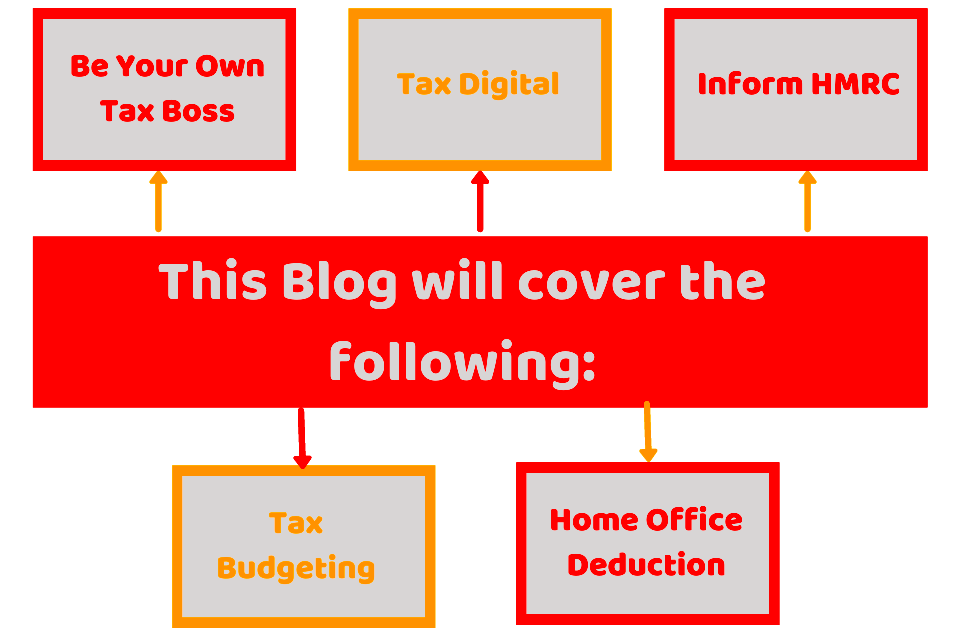

Here are certain points you should take into account:

- Self-Employment Tax: As a freelancer, you're responsible for both income tax and self-employment tax, which covers Social Security and Medicare. This is generally calculated on your net earnings.

- Estimated Taxes: Freelancers typically need to pay estimated taxes quarterly. This helps you avoid a hefty tax bill at the end of the year.

- State and Local Taxes: Depending on where you live, you may also need to account for state and local taxes, which can vary significantly.

Tax obligations most definitely help escape penalties and keep your finances organized.

Identifying Tax Deductions for Freelancers

A perk of being a freelancer is that you get the chance to deduct some business-related expenses from your taxable earnings. Recognizing these deductions can have a huge impact on your taxes. The following are several popular deductions accessible by freelancers:

- Home Office Deduction: If you use part of your home exclusively for business, you may qualify for this deduction.

- Business Expenses: This includes costs for supplies, software, and equipment that are necessary for your work.

- Professional Services: Fees paid to accountants, consultants, or other professionals can also be deducted.

- Travel Expenses: If you travel for work, you can deduct expenses like airfare, lodging, and meals.

- Education and Training: Courses, workshops, and training sessions that enhance your skills may also be deductible.

Always ensure that every expense is recorded in detail and get advice from an accountant to make sure that you get the maximum possible deductions.

Also Read This: How to Start a Career as a Freelance 3D Artist

Keeping Track of Income and Expenses

Freelancers must learn to keep precise records of their revenue and outgoings. It assists one in being orderly while also aiding in the less complicated process of completing income tax returns. The following are practical ways for tracking financial records:

- Use Accounting Software: Programs like QuickBooks or FreshBooks can automate tracking and generate reports.

- Create a Dedicated Bank Account: Separating personal and business finances makes it easier to track your income and expenses.

- Keep Receipts: Store all receipts related to your business expenses. Consider using apps that allow you to scan and store receipts digitally.

- Monthly Reviews: Set aside time each month to review your financial records and make any necessary adjustments.

Tax season becomes less complicated when one is well-organized, watches over finances closely; hence, enabling that person to have a better understanding of the financial status of their business.

Also Read This: What Happens When Your Completion Rating Drops on Fiverr?

Choosing the Right Tax Form for Freelancers

Selecting appropriate tax forms may appear to be a complex issue for independent contractors. Nonetheless, this is an essential stage to file taxes in compliance with laws. Accurate reporting of your income, will require use of certain forms based on your business structure. Therefore, let’s simplify things.

Lets take a look at some of the more important tax forms that freelancers should know about:

- Form 1040: This is the standard individual income tax return. If you’re a sole proprietor, you’ll use this form to report your income.

- Schedule C (Form 1040): This is where you report your income and expenses as a freelancer. It helps determine your net profit or loss.

- Schedule SE (Form 1040): This form is used to calculate your self-employment tax based on your net earnings from self-employment.

- Form 1099-MISC: If you earn more than $600 from a client, they should issue you this form. You’ll use it to report that income.

Tax forms selections and accurate filling matters a lot so that no fines are imposed as well as ensuring compliance with all your tax responsibilities. If you do not know what forms to use, don’t shrink from asking an expert in tax matters.

Also Read This: How to Ask People to Leave Feedback on Fiverr

Important Deadlines for Tax Payments

In the event that you’re a freelancer, it is very important to remain alert with regards to tax deadlines. Failing to meet a deadline may attract some costs and interests that every person would wish to avoid. Below are some of the dates that are supposed to be noted carefully.

| Deadline | Description |

|---|---|

| January 15 | Due date for the fourth quarter estimated tax payment for the previous year. |

| April 15 | Deadline for filing your individual tax return and paying any taxes owed. |

| June 15 | Due date for the second quarter estimated tax payment. |

| September 15 | Due date for the third quarter estimated tax payment. |

| October 15 | Deadline to file for an extension on your tax return. |

Do not forget that these dates should be in red in your calendar! Staying organized and not having any last minute stress can be achieved by setting reminders.

Also Read This: How to Get a List Sourced on Fiverr

Dealing with Estimated Taxes

As a lone wolf on tasks, a freelance profession entails calculated taxes as part of managing finance. Given that nothing is deducted from your earnings, all year long you should be able to pay estimated tax payments on time. Be enlightened on ways to manage well.

To begin with, we should have a word about how to arrive at your tax estimations:

- Estimate Your Annual Income: Start by estimating your total income for the year based on past earnings.

- Determine Deductions: Subtract any business-related expenses from your estimated income to find your net profit.

- Use the Tax Rate: Apply the appropriate tax rate to your net profit to estimate your tax liability.

After determining your expected tax amounts, it is important that you begin making payment quarterly. Below is a reminder on how to do it:

- 1st Quarter: April 15

- 2nd Quarter: June 15

- 3rd Quarter: September 15

- 4th Quarter: January 15 (of the following year)

Paying up promptly helps you stay free from prompt payment penalties and to effectively cope with your tax obligation. However, the procedure may become quite complex for some individuals; therefore, it is advisable that one seeks assistance from a tax expert to navigate through the process.

Also Read This: How to Get Invoices from Fiverr

Common Mistakes Freelancers Make with Taxes

When it comes to freelancing, there’s a lot of advantages along with some drawbacks on the taxation aspect. Several freelancers, in the course of their work, make costly mistakes or have problems with IRS. Here are some common tax mistakes that freelancers do when filing their taxes and how you can avoid them.

- Not Keeping Accurate Records: One of the biggest mistakes is failing to keep organized records of income and expenses. Using accounting software can help simplify this process.

- Ignoring Estimated Taxes: Many freelancers overlook their obligation to pay estimated taxes quarterly, leading to penalties. Staying on schedule is key!

- Mixing Personal and Business Finances: Using the same bank account for personal and business expenses can complicate things. Consider opening a dedicated business account.

- Missing Deductions: Freelancers sometimes miss out on valuable deductions simply because they aren't aware of them. Always research and consult a tax professional if unsure.

- Filing Late: Missing deadlines can lead to penalties and interest charges. Setting reminders can help keep you on track.

Such common errors are what you should be mindful about when it comes to smoothly going through your tax obligations. In this way, you will avoid losing money which would have otherwise gone to taxes or incurring unwanted penalties.

Also Read This: Potential Earnings of Freelancers

Frequently Asked Questions

Freelancers have many questions about taxes and that is completely understandable! Here are some frequently asked questions to help you understand this better.

- Do I need to file taxes if I earned less than $600? Yes, all income must be reported, regardless of the amount.

- Can I deduct my home office expenses? Absolutely, as long as you use that space exclusively for business purposes.

- What happens if I miss an estimated tax payment? You may face penalties, but you can pay the owed amount at any time to reduce the fines.

- Should I hire a tax professional? If your tax situation feels complicated, hiring a professional can save you time and money in the long run.

These inquiries are merely an initiation. Do not hesitate to inquire about help that goes with you situation!

Conclusion

Freelancing might be a strange way of making money, but it brings a lot of liberty unlike any other job and at the same time, responsibilities like other incomes and taxation that you have to deal with. To do this, you will need to know what your tax obligations are, keep good records and avoid common mistakes. You should always be aware of the deductions you can apply for, deadlines and forms involved in filing taxes.

In case you feel too much load over your shoulders do not forget that going for free consultancy with a tax expert is something admirable. They offer assistance in understanding complicated concepts; hence, ensuring compliance with most regulations. Tax season may thus become an easy period through proper planning and well-organized activities enabling you pursue things that make you happy like your career!