So, you've been hustling on Fiverr, raking in some extra cash on the side, and now you're wondering, "Do I have to pay taxes on my Fiverr income?" You’re not alone! Many freelancers find themselves in the same boat. Let’s break down what this means for you.

Understanding Fiverr as an Income Source

Fiverr is a leading online marketplace where freelancers can offer their services to buyers worldwide. Whether you're a graphic designer, writer, programmer, or voiceover artist, Fiverr provides a platform to showcase your skills and connect with clients. However, as you start pocketing those earnings, it’s crucial to understand the tax implications involved.

First off, let’s clarify how Fiverr works:

- Setting Up: You create a profile, list your services (or "gigs"), set your prices, and start attracting clients.

- Payment Structure: Fiverr takes a 20% commission from your earnings. So, if you charge $100 for a gig, you'll actually take home $80.

- Withdrawal Options: You can withdraw your earnings via PayPal, bank transfer, or Fiverr Revenue Card once they are available for withdrawal.

Now, here’s the kicker: even though Fiverr makes it easy to earn money, you still have responsibilities when it comes to taxes.

| Aspect | Details |

|---|---|

| Type of Income | Fiverr income is considered self-employment income. |

| Tax Obligations | You may need to pay both federal and state taxes. |

| Documentation | Keep track of your earnings, expenses, and any Fiverr fees. |

By understanding how Fiverr operates and recognizing it as a legitimate source of income, you can better prepare for any tax obligations that may come your way. Remember, being informed is your best tool in navigating the world of freelancing!

Also Read This: What’s Your Story in One Line? Fiverr Ideas to Transform Your Narrative

Tax Obligations for Freelancers

When you step into the world of freelancing, especially on platforms like Fiverr, it’s essential to understand that tax obligations become a part of your new reality. As a freelancer, you're often classified as self-employed, which means you're responsible for reporting your income and paying taxes on it. Sounds a bit daunting, right? But let’s break it down!

First off, one of the key things to remember is that any money you make through Fiverr must be reported to the IRS. This includes all earnings, tips, and any bonuses. Here are a few important points to consider:

- Self-Employment Tax: As a freelancer, you’ll need to pay self-employment tax, which covers Social Security and Medicare. If your net earnings are over $400 in a year, you’ll need to file a Schedule SE.

- Estimated Taxes: Unlike traditional employees, freelancers typically don’t have taxes withheld from their earnings. This means you may need to make quarterly estimated tax payments to avoid penalties.

- Business Deductions: One of the perks of freelancing is that you can deduct necessary business expenses. This may include software subscriptions, marketing costs, or even a portion of your home office. Keep track of all these receipts!

It’s crucial to stay informed about local and state tax obligations as well, as these can add another layer to your responsibilities. This might involve sales taxes if you're selling products or additional state income taxes based on your earnings.

Also Read This: How Much Do You Get Paid on Fiverr?

Income Reporting for Fiverr Earnings

So, you've made some money on Fiverr—great! Now comes the part that most freelancers dread: reporting that income. The good news? Most of the process is straightforward, and with a little organization, you’ll be on top of your tax game in no time.

Every time you cash out from Fiverr, it’s a good idea to keep a record. This can be done through spreadsheets or even apps designed for freelancers. Here are a few steps to guide you:

- Keep Records: Document all your earnings, including dates, amounts, and services provided. This helps when it’s time to file your taxes!

- Understand 1099 Forms: If you earn over $600 in a year from Fiverr, you should receive a 1099 form from them. However, whether you get it or not, you’re still responsible for reporting that income. Keep an eye out for forms from Fiverr!

- Use Tax Software: Consider using tax software that can simplify the reporting process, or enlist the help of a tax professional if your income is substantial. They can help navigate the complexities.

Remember, failing to report your Fiverr income can lead to penalties and interest, so it’s always best to err on the side of caution. By diligently keeping track of your earnings and reporting them accordingly, you can enjoy your freelancing journey without the looming stress of tax season!

Also Read This: Unlocking the Potential of Fiverr: A Comprehensive Guide to Designing Custom Shoes with gshoes

How to Calculate Your Fiverr Income Tax

Calculating your Fiverr income tax can seem daunting at first, but with a little guidance, you'll find it's not as complicated as it appears. First, it’s crucial to understand that the income you generate from Fiverr is considered self-employment income, which means it is subject to income tax and self-employment tax. Here's a step-by-step approach to help you get started:

- Determine Your Total Earnings. Start with the total amount you’ve earned through Fiverr. You can find this in your Fiverr account under your earnings section. Make sure to account for any services, gigs, or projects completed.

- Subtract Fiverr Fees. Fiverr takes a cut from each transaction (typically 20%). Deduct this fee from your total earnings to find your net income. For instance, if you earned $1,000, you would subtract $200 in fees, leaving you with $800.

- Keep Track of Additional Income. If you have income from other sources, such as other freelance work or a side job, make sure to add that to your total income for the year.

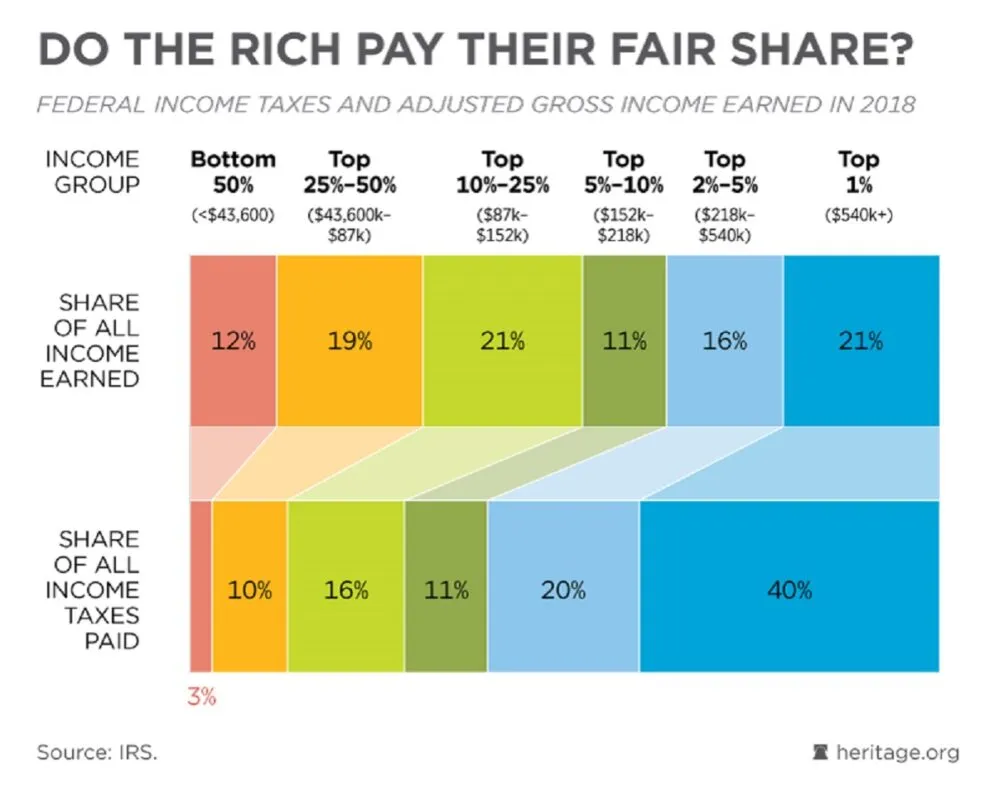

- Consider Your Tax Bracket. Your income tax rate will depend on how much you earn overall. Familiarize yourself with the IRS tax brackets for self-employed individuals to estimate your taxes accurately.

- Self-Employment Tax. Additionally, you’ll need to pay self-employment tax, which is around 15.3% on your net earnings. This tax covers your contributions to Social Security and Medicare.

Always consider consulting with a tax professional, especially when dealing with self-employment income, to ensure you’re compliant with all tax regulations.

Also Read This: How to Start Getting Orders on Fiverr: Insights from Reddit

Deductible Expenses When Freelancing on Fiverr

One of the great perks of being a freelancer on platforms like Fiverr is that you can deduct certain business-related expenses from your taxable income. This not only reduces your taxable income but also helps you keep more of your hard-earned cash. Let’s break down some common deductible expenses:

- Software and Tools: Any software or tools you use to create, edit, or manage your gigs can be considered deductible. This might include graphic design software, accounting programs, or project management tools.

- Internet and Phone Bills: If you use a portion of your internet and phone for business purposes, you can deduct that percentage of your bills. Keep a log of business-related calls or internet usage to support your claims.

- Home Office Expenses: If you work from a dedicated space in your home, you might be eligible to deduct some related expenses, like a portion of your rent or mortgage interest, utilities, and repairs.

- Marketing Costs: Any costs related to advertising your services, including running ads on social media or creating promotional materials, can be deductible.

- Education and Training: Costs associated with courses or webinars that help you improve your skills are also typically deductible. Investing in your education is a smart business move!

Remember to keep receipts and documentation for any expenses you plan to deduct. Good record-keeping is key! Deductible expenses can significantly lower your taxable income, so take advantage of them to maximize your savings.

Also Read This: How to Delete Fiverr Account on Mobile

7. State and Local Taxes Considerations

When you’re earning money through Fiverr, it’s crucial to keep in mind that your tax responsibilities don’t end at the federal level. State and local taxes can also come into play, depending on where you live. Here’s what you need to know:

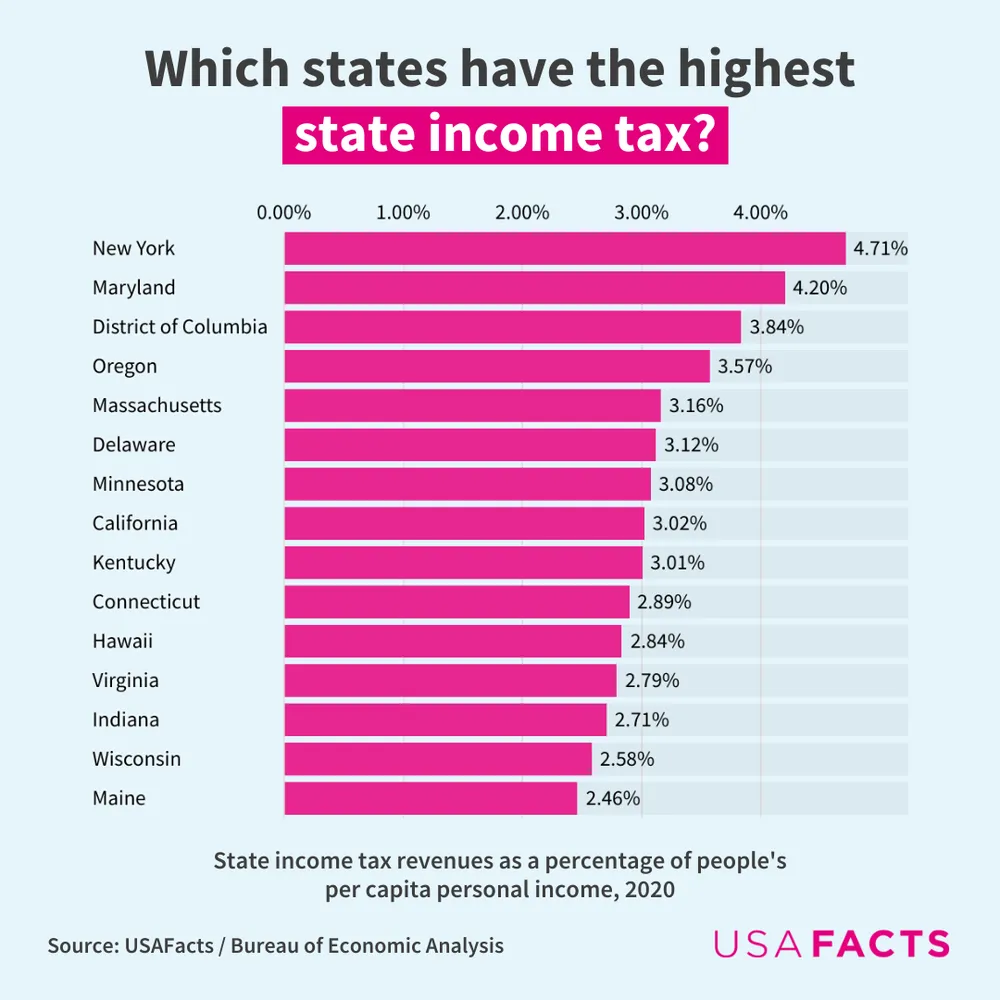

- State Income Tax: Many states require you to pay state income tax on your earnings, including income from freelance gigs like Fiverr. Each state has its own tax rates and rules, so it’s important to check your state’s tax regulations to see how much you need to set aside.

- Local Taxes: In addition to state income taxes, some cities or counties impose local taxes. These are often based on your income and can vary widely. Make sure you research whether your locality has its own tax obligations.

- Sales Tax: If you’re providing taxable goods or services (like graphic design or consulting), you might also need to charge sales tax to clients in certain states. Understanding where your services are taxable can prevent you from facing penalties later on.

- Estimated Tax Payments: Depending on your income, you may be required to make quarterly estimated tax payments to both the state and local tax authorities, just like you do for federal taxes. This helps avoid a hefty tax bill at the end of the year.

In summary, keep an eye on your state and local tax obligations. It’s a good practice to consult a tax professional who can guide you through your specific situation, ensuring you stay compliant and avoid future tax headaches.

Also Read This: How to Add Items to Your Cart on Fiverr: A Step-by-Step Guide

8. Tips for Managing Your Fiverr Income Taxes

Managing your Fiverr income taxes doesn’t have to be a daunting task! Here are some practical tips to keep you organized and informed:

- Keep Detailed Records: Make it a habit to track all your Fiverr income and expenses meticulously. Use spreadsheets or accounting software to log every transaction, as this will help you accurately report your income come tax time.

- Understand Deductions: Familiarize yourself with the types of expenses you can deduct as a freelancer. Common deductions include software subscriptions, equipment, internet costs, and even a portion of your home office if you work from home.

- Set Aside Money for Taxes: As you earn, make it a point to set aside a percentage of your income for taxes. A common rule of thumb is to save around 25-30% of your earnings to cover federal, state, and local taxes.

- Consult a Tax Professional: If you’re feeling overwhelmed, don’t hesitate to reach out to a tax consultant, especially if your income is significant or if you have a lot of deductions. They can provide tailored advice and may help you save money in the long run.

- Stay Updated: Tax laws can change frequently. Stay informed about changes in tax regulations that may affect your Fiverr earnings, and be proactive about adjusting your planning accordingly.

Incorporating these tips into your routine can make managing your Fiverr income taxes a whole lot easier. Remember, staying organized and informed is key!

Do I Have to Pay Taxes on Fiverr Income?

As a freelancer on platforms like Fiverr, it's essential to understand your tax obligations. The income you earn from providing services can be subject to taxation, depending on various factors. Here’s a detailed breakdown of what you need to know:

Understanding Fiverr Income

Fiverr is a platform where freelancers can offer services in various categories such as graphic design, writing, programming, and more. When you earn money from these services, it is considered taxable income. Here are some key points to consider:

- Self-Employment Income: Income earned on Fiverr is classified as self-employment income, which the IRS requires you to report on your tax return.

- Income Threshold: Regardless of the amount earned, all self-employment income must be reported. However, if you earn more than $400 in a year, you will need to file Form 1040 and pay self-employment tax.

- Business Expenses: You can deduct allowable business expenses associated with your Fiverr income, such as software, equipment, or marketing costs, which can lower your taxable income.

Tax Responsibilities by Location

Your tax responsibilities may vary depending on your country and local taxes. Below is a brief overview for different regions:

| Region | Tax Requirement |

|---|---|

| United States | Report income on Form 1040; self-employment tax applies. |

| Canada | Report income on T1 tax return; eligible for business expense deductions. |

| United Kingdom | Report on Self Assessment; pay tax based on profits. |

In summary, yes, as a Fiverr seller, you must pay taxes on your income earned from the platform. Keep meticulous records and consult with a tax professional to ensure compliance and maximize deductions.