While creating an invoice may appear to be a task, it plays a role in running your freelance business. Its not just about receiving payment; it also involves upholding professionalism and keeping a record of your work. When I embarked on my freelancing journey I found the invoicing process rather daunting. I was unaware of its impact on my cash flow and client relationships. However with time and experience I discovered that a thoughtfully crafted invoice could truly make a difference. Its an opportunity to showcase your work professionally and ensure timely payment.

Why Invoices Are Important

Invoices go beyond being a simple payment reminder. They play a role in various aspects such as.

- Professionalism: A detailed invoice reflects your commitment to professionalism, showing clients that you value their business and take your work seriously.

- Legal Record: Invoices act as a legal document, proving that work was completed and payment is due. They can be crucial if disputes arise or for tax purposes.

- Financial Tracking: Keeping a record of invoices helps you track your earnings and manage your finances more effectively. It also makes it easier to handle your taxes.

In my view lacking a transparent invoicing system can result in confusion and delayed payments. An invoicing procedure helps keep you and your clients aligned minimizing the chances of encountering payment problems.

Also Read This: Does Fiverr Track IP Addresses? Exploring Privacy and Security

Essential Components of an Invoice

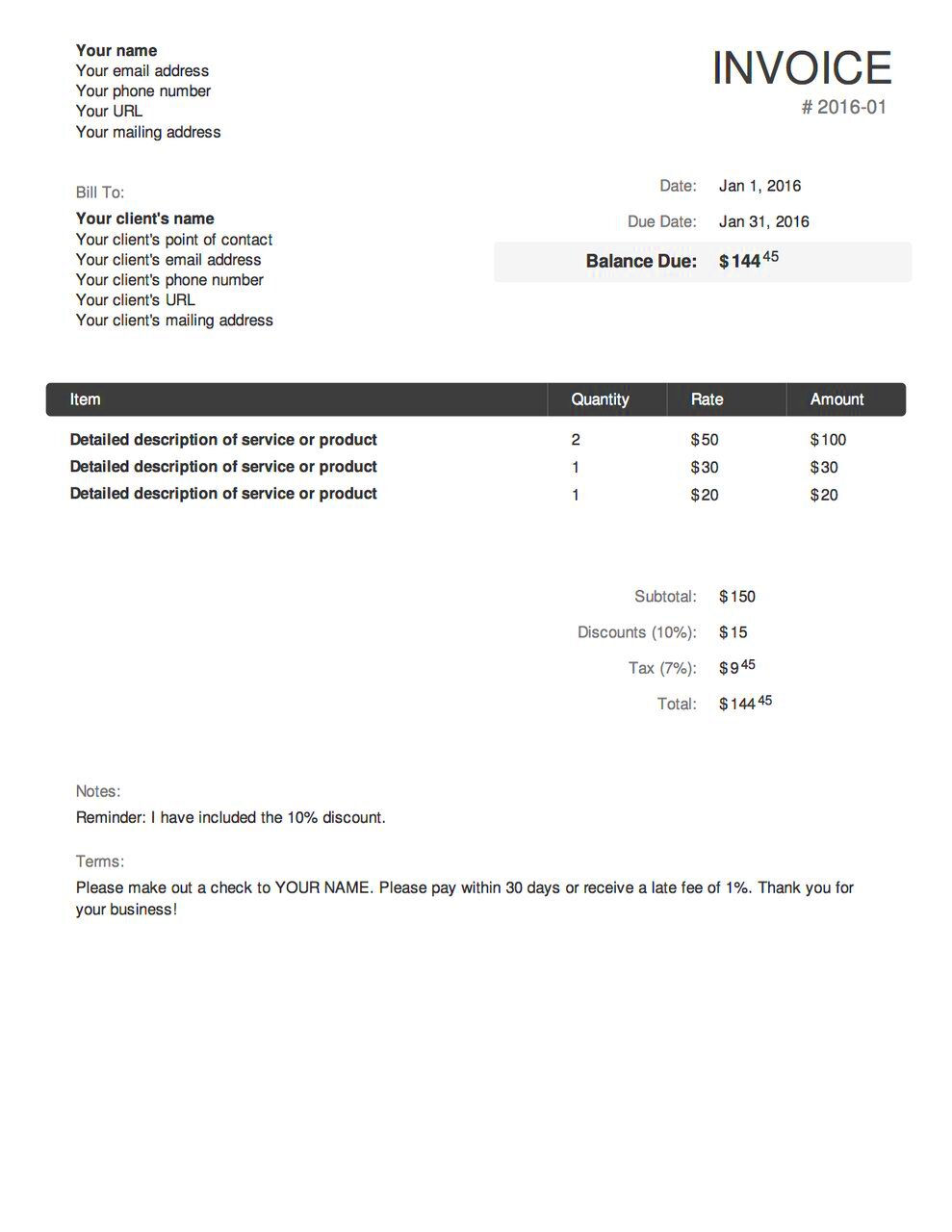

An invoice that covers everything includes important details to make sure its clear and thorough.

- Your Contact Information: Include your name, address, phone number, and email. This helps clients reach you if they have any questions.

- Client’s Contact Information: Similarly, list the client’s details so there is no confusion about who the invoice is for.

- Invoice Number: Each invoice should have a unique number for tracking purposes. It helps in organizing and referencing your invoices.

- Date of Issue: The date when the invoice is issued. This is important for tracking payment terms and deadlines.

- Detailed Description of Services: Clearly outline the services or products provided, including quantities and rates. This helps the client understand what they are being billed for.

- Total Amount Due: Provide a clear total of the amount owed, including any applicable taxes or discounts.

- Payment Terms: Specify the payment due date and any terms related to late fees or early payment discounts.

- Payment Instructions: Include details on how the client can pay you, whether by bank transfer, PayPal, or another method.

When I began including these specifics in my invoices I noticed it cleared up any misunderstandings and streamlined the payment process for both my clients and myself. These small touches play a role in establishing trust and ensuring that you receive your payments promptly.

Also Read This: What is a Seller Account on Fiverr?

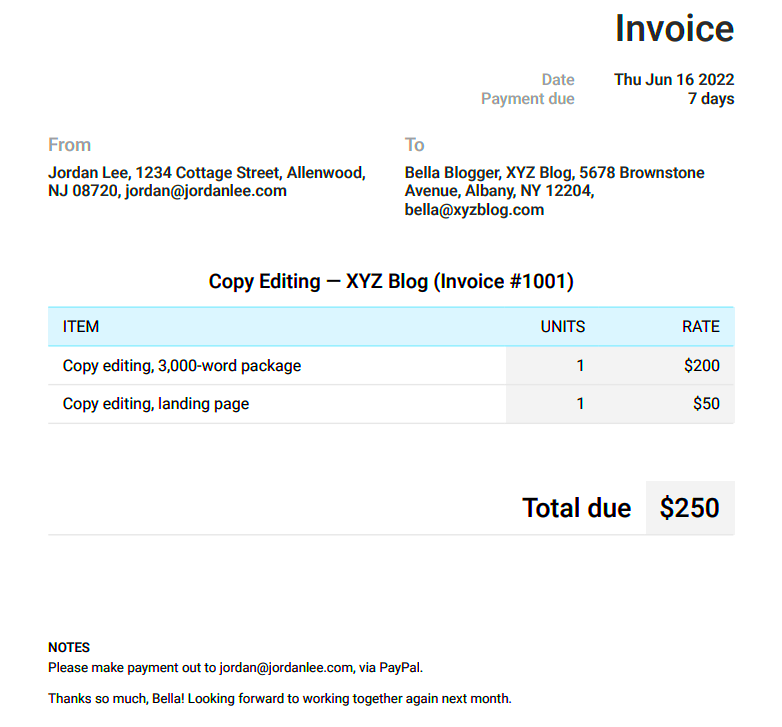

How to Create an Invoice Using Templates

Starting an invoice from can be a task but using a template can make things much easier. When I first began I felt intimidated by the idea of creating my own invoice. That was when I stumbled upon the convenience of templates. They provide a layout that helps you remember all the important information.

Here a straightforward method to generate an invoice using pre designed templates

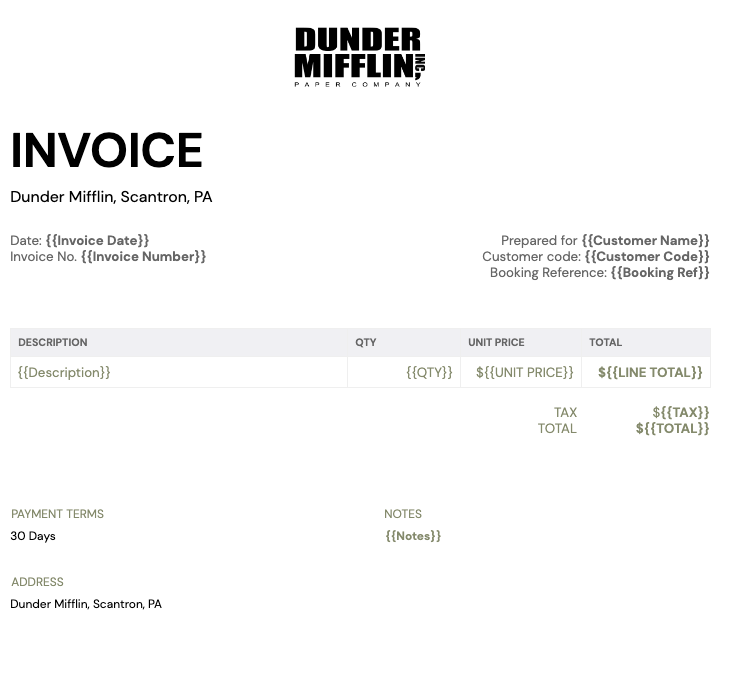

- Choose a Template: There are many free and paid invoice templates available online. Platforms like Microsoft Word, Google Docs, and various accounting software offer ready-made templates. Pick one that suits your style and business needs.

- Fill in Your Details: Replace placeholder text with your business information. Ensure your contact details, logo, and any other branding elements are added to make the invoice look professional.

- Enter Client Information: Input the client's name, address, and contact information. Accuracy here is key to avoid any mix-ups.

- Add Invoice Details: Include the invoice number, issue date, and a clear description of the services or products provided. Make sure to add quantities, rates, and the total amount due.

- Review and Save: Double-check all information for accuracy. Save the invoice in a format that’s easily shareable, like PDF.

Back in the day I found it challenging to make invoices by hand. Turning to templates not only streamlined the process for me but also ensured that my billing stayed consistent. It’s similar to having a dependable ally that handles the layout so you can concentrate on your tasks.

Also Read This: How Much to Translate on Fiverr: A Comprehensive Guide

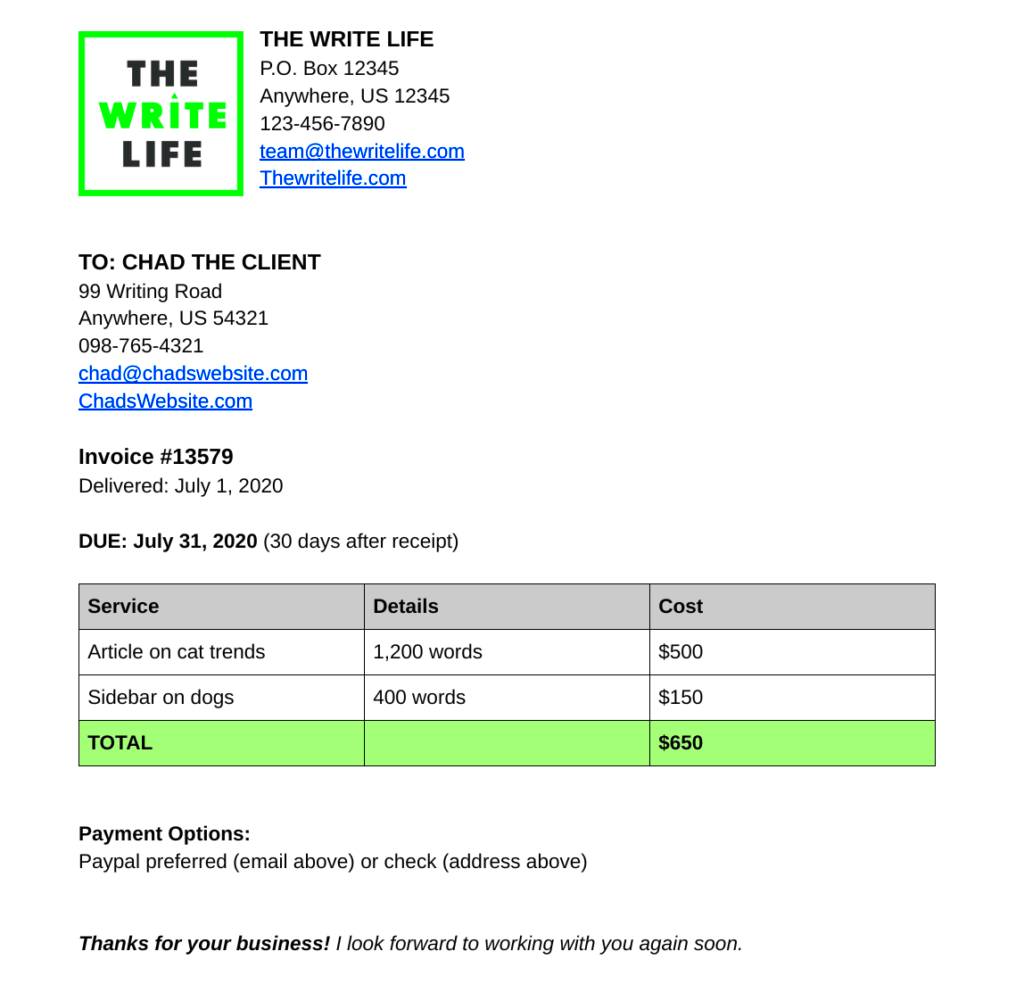

Customizing Your Invoice for Different Clients

Personalizing your invoice for each client may seem like a hassle but it pays off. Each client is unique and a customized invoice can leave a lasting impression. I recall my early freelance jobs when I sent out the same standard invoice to everyone. It wasn't until I began personalizing them that I noticed an improvement in my interactions with clients.

Here’s how you can customize your invoice:

- Personalized Greeting: Start with a friendly greeting that addresses the client by name. A simple "Dear [Client’s Name]" can make a huge difference in how personal your communication feels.

- Specific Service Descriptions: Adjust the description of the services based on the client's specific needs. Highlight any special requests or unique aspects of the project.

- Customized Payment Terms: Tailor the payment terms to fit each client’s preferences or the agreement you’ve made with them. For instance, some clients might prefer net 30 days, while others might need a different arrangement.

- Special Notes: Include any notes that might be relevant to the client, such as reminders about the next steps or a thank you for their business.

Tailoring your invoices can strengthen your relationships with clients. It demonstrates your attentiveness to details and appreciation for their support. In the long run this personal touch can enhance communication and encourage customers to come back for more.

Also Read This: How to Build a Career as a Freelance Online Sales Consultant

Setting Payment Terms and Conditions

Establishing payment terms and conditions is essential for seamless transactions. During my initial freelance journey I encountered situations where I had to follow up on payments and handle late fees due to not clearly outlining my terms. This experience taught me the importance of having payment terms in ensuring a business operation.

Here’s a guide on establishing payment terms and conditions.

- Define Payment Due Dates: Clearly state when payment is due. Typical terms include "Net 30," meaning payment is due within 30 days of the invoice date, but you can adjust this based on your needs and client preferences.

- Specify Accepted Payment Methods: Let clients know how they can pay you. Whether it’s bank transfer, PayPal, or another method, listing these options makes the process smoother.

- Outline Late Fees: If applicable, mention any late fees that will be charged if payment is not made on time. This encourages clients to pay promptly and helps manage cash flow.

- Include Early Payment Discounts: Offering a small discount for early payment can be an incentive for clients to pay sooner. For example, a 2% discount if paid within 10 days can be a good motivator.

Having clear payment terms and conditions helps avoid confusion and ensures that you receive your payments promptly. It also positions you as a professional who is well versed in their field. By establishing these expectations from the outset you can concentrate more on your tasks and worry less about following up on payments.

Also Read This: What is SEO in Fiverr?

Best Practices for Sending Invoices

While sending invoices may appear to be a task adhering to certain best practices can significantly impact prompt payment and fostering positive relationships with clients. In my early days as a freelancer I encountered payment delays due to my lack of a organized approach. However over time I embraced some proven strategies that not made my invoicing process more efficient but also enhanced my interactions with clients.

Here are a few tips for invoicing that might be helpful.

- Send Invoices Promptly: Don’t delay sending out invoices. As soon as a project is completed or a milestone is reached, send out your invoice. Timely invoicing ensures that payments are processed without unnecessary delays.

- Use a Professional Format: Ensure that your invoice is clear and professional. Use a consistent format and include all essential details. A well-organized invoice reflects well on your business and helps in reducing confusion.

- Follow Up: If a payment is overdue, don’t hesitate to send a polite reminder. I used to shy away from following up, but I learned that gentle reminders are often necessary and appreciated by clients.

- Keep Records: Maintain records of all invoices sent and payments received. This helps you keep track of your finances and makes it easier to handle any discrepancies or disputes that might arise.

- Provide Multiple Payment Options: Offering various payment methods can make it easier for clients to pay you. Whether it’s bank transfer, credit card, or an online payment platform, flexibility can be a significant advantage.

By putting these strategies into action, I was able to enhance my image and facilitate smoother interactions. The goal is to streamline the experience for both yourself and your clients.

Also Read This: How to Create a Fiverr Agency Account

Common Mistakes to Avoid

When it comes to sending invoices even small errors can cause major problems. During the early days of my freelancing journey I made a few blunders that taught me important lessons. Here’s what I discovered to steer clear of and what you should keep in mind.

- Missing Information: One of the biggest mistakes is not including all the necessary details. An incomplete invoice can lead to confusion and payment delays. Always double-check that you’ve included your contact information, the client’s details, a clear description of services, and the total amount due.

- Unclear Payment Terms: Vague payment terms can result in misunderstandings. Be explicit about when payment is due, any late fees, and the accepted payment methods. Clarity here is key to avoiding disputes.

- Errors in Amounts: Double-check all calculations. Incorrect amounts can cause significant issues and delay payments. Always review your invoice before sending it out to catch any mistakes.

- Ignoring Follow-Ups: Don’t ignore overdue payments. Following up in a timely and professional manner is essential. I used to avoid chasing payments, but now I see it as an important part of maintaining a healthy cash flow.

- Using Inconsistent Formats: A consistent format helps in maintaining professionalism and makes it easier for clients to process payments. Avoid changing formats frequently, as it can create confusion.

By steering clear of these pitfalls you can save precious time ease your stress levels and streamline your financial processes. The key lies in being thorough and taking the initiative when it comes to handling invoices.

Also Read This: Rates for Freelance Writing Projects

FAQ

What should I include in an invoice?

An invoice should include your contact information, the client’s contact details, invoice number, date of issue, description of services or products, total amount due, payment terms, and payment instructions.

How often should I send invoices?

Send invoices promptly after completing a project or reaching a milestone. Regular invoicing helps ensure timely payments and keeps your cash flow steady.

What if a client doesn't pay on time?

If a client misses a payment deadline, send a polite reminder. If necessary, follow up with additional reminders. Make sure to clearly state the overdue amount and any late fees in your communications.

Can I use free invoice templates?

Yes, there are many free invoice templates available online that can be customized to suit your needs. They are a great starting point for creating professional-looking invoices.

How can I make my invoice stand out?

Personalize your invoice with your logo and branding. Include a friendly note or thank you message. A well-designed and personalized invoice can leave a positive impression on your clients.

Conclusion

Generating and handling invoices goes beyond being a requirement—it's a showcase of your professionalism and meticulousness. Based on my experiences I've witnessed how an invoice not only streamlines the payment process but also fosters trust with clients. While it may appear as a task every aspect from selecting a template to establishing transparent payment terms plays a role in enhancing workflow efficiency and managing finances. By adopting these practices you'll discover that invoicing seamlessly integrates into your freelance journey. A bit of effort in this aspect can significantly contribute to the success of your freelance venture.