Freelance accountants offer a wide range of services to businesses and individuals. They work independently, providing financial expertise without being tied to a specific company. Many people choose to hire freelance accountants due to their flexibility, cost-effectiveness, and personalized approach. Whether it’s preparing tax returns, managing payroll, or offering financial advice, freelance accountants are a valuable resource for those who need expert help without the long-term commitment of a full-time employee.

Factors Affecting Freelance Accountant Charges

The rates freelance accountants charge can vary significantly based on several factors. Understanding these factors can help clients get an idea of what to expect when hiring a freelance accountant. Here are the key elements that influence charges:

- Experience and Expertise: More experienced accountants with specialized skills tend to charge higher rates due to their expertise.

- Scope of Work: A more complex task, like preparing corporate tax filings or managing large accounts, will generally cost more than basic services.

- Location: Accountants in larger cities or regions with higher costs of living typically charge more for their services.

- Industry: Some industries require accountants with niche knowledge (e.g., healthcare or real estate), which can influence pricing.

- Time Commitment: Longer projects or ongoing monthly work may have different rates compared to one-off tasks.

Ultimately, the more specialized the service and the higher the demand for the accountant’s expertise, the higher the charges will be. It's important to discuss the scope and specifics of your needs upfront to avoid any surprises in pricing.

Also Read This: How to Change Your Email for Fiverr

How Freelance Accountants Set Their Rates

Freelance accountants set their rates based on a combination of market trends, personal expertise, and client requirements. Here's a closer look at how they decide on pricing:

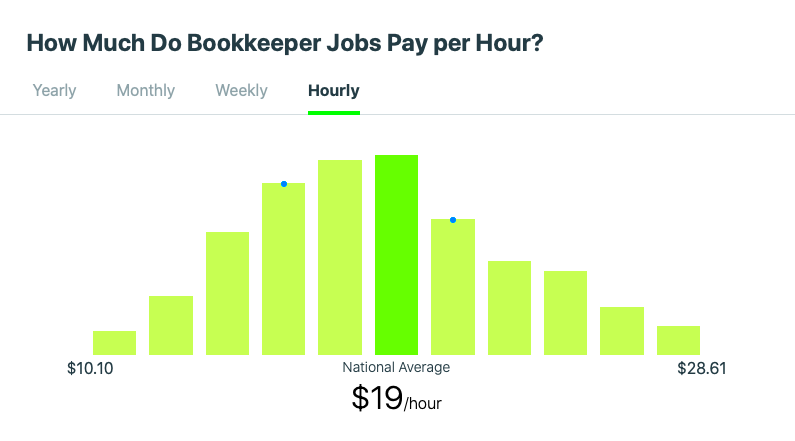

- Hourly Rate: Many accountants charge by the hour. They calculate an hourly rate based on their experience, skill set, and the complexity of the work involved. On average, freelance accountants charge between $30 to $150 per hour, depending on their location and expertise.

- Fixed Price: For specific projects, such as preparing tax returns or creating financial reports, accountants may offer a fixed price. This allows clients to know exactly what to expect, regardless of how long the project takes.

- Retainer Fees: Some accountants work on retainer, which involves a monthly fee in exchange for ongoing services. This arrangement works well for clients who require regular financial assistance but don’t need a full-time employee.

- Market Demand: Accountants may adjust their rates depending on the demand for their services. If there’s a high need for accounting services in a particular region or industry, they may charge more.

Freelance accountants should regularly assess the market, adjust their rates based on client feedback, and stay updated on industry trends to remain competitive. The goal is to balance fair compensation with offering value to clients.

Also Read This: How to Create a Fiverr Account in 2020

Common Services Offered by Freelance Accountants

Freelance accountants offer a broad range of services, tailored to meet the needs of individuals, small businesses, and even larger companies. Their work goes beyond just crunching numbers and extends to offering strategic advice and ensuring financial compliance. Here are some of the most common services provided by freelance accountants:

- Tax Preparation and Filing: One of the most sought-after services, freelance accountants help individuals and businesses prepare and file their taxes efficiently, ensuring that everything is compliant with current tax laws.

- Bookkeeping: Freelance accountants manage daily financial records, tracking income, expenses, and ensuring that all transactions are properly documented for reporting purposes.

- Financial Planning and Advice: Many clients hire freelance accountants for financial consultations, where they provide advice on budgeting, saving, and investing.

- Payroll Management: For small businesses that don't have an in-house HR team, freelance accountants can handle payroll, including calculating wages, taxes, and ensuring employees are paid on time.

- Business Incorporation and Setup: Freelance accountants assist with the paperwork and legal aspects of setting up a new business, from choosing the right business structure to filing the necessary documentation.

- Audit Services: Freelancers may also offer audit services, helping businesses ensure their financial records are accurate and compliant with legal standards.

These services allow freelancers to offer comprehensive solutions to their clients, ranging from startups to well-established businesses.

Also Read This: Why Is No One Clicking on My Gig on Fiverr?

Understanding Earnings for Freelance Accountants

Freelance accountants' earnings can vary significantly based on several factors, including their experience, location, the type of services offered, and the number of clients they serve. Here’s an overview of how freelance accountants can earn:

- Hourly Earnings: As mentioned earlier, freelance accountants typically charge hourly rates. On average, they can earn between $30 to $150 per hour, depending on expertise and location. For specialized services like tax filing or financial consulting, the rates may be higher.

- Project-Based Earnings: For tasks like preparing annual financial statements or tax returns, accountants often set a flat fee. A simple tax return might cost between $150 to $500, while more complex business filings may run higher.

- Ongoing Retainers: Freelance accountants who offer ongoing bookkeeping, payroll, or business advisory services might work on retainer agreements. These can range from $500 to $3,000 per month, depending on the size of the client and the scope of services.

- Income Variation by Industry: Accountants specializing in niche industries, such as healthcare or real estate, may earn higher rates due to the complexity of the financial records in these fields.

- Market Demand: The demand for freelance accountants also affects earnings. Accountants with a strong network or those who are well-known in their field may be able to charge higher rates or take on more clients, leading to increased earnings.

Overall, freelance accountants have the potential to earn a good income, especially with a steady stream of clients and a diversified service offering.

Also Read This: How to Earn Money on Fiverr in Urdu

Tips for Maximizing Earnings as a Freelance Accountant

Maximizing earnings as a freelance accountant requires more than just offering quality services. It's about setting yourself up for long-term success by attracting high-value clients, improving your skills, and finding ways to scale your business. Here are some tips to help freelance accountants boost their income:

- Specialize in a Niche: Instead of offering generic accounting services, consider specializing in a specific industry, such as real estate, healthcare, or technology. Clients are often willing to pay more for accountants with expertise in their field.

- Raise Your Rates Gradually: As your skills and reputation grow, don’t be afraid to raise your rates. Small, incremental increases will help you remain competitive while ensuring you're fairly compensated for your work.

- Offer Additional Services: Adding services like financial planning, business consulting, or audit preparation can help you earn more per client. Think about the additional needs your clients might have and offer solutions to meet them.

- Build a Strong Online Presence: Marketing yourself online through platforms like LinkedIn, your own website, or freelancing sites like Fiverr can attract more clients. Building a strong online presence makes it easier for clients to find and hire you.

- Focus on Client Retention: Happy clients are likely to return for repeat business. Providing excellent customer service, meeting deadlines, and offering personalized advice will help you build long-term relationships with clients, ensuring steady earnings.

- Stay Updated with Trends: The accounting industry is always evolving, with new tools, regulations, and software emerging regularly. Stay up to date with these changes to offer the most current services and stay competitive in your field.

By focusing on these strategies, freelance accountants can increase their income potential while providing high-quality service to their clients.

Also Read This: How to Find the Best Keywords for Fiverr

Challenges Freelance Accountants Face with Charges and Earnings

Freelance accountants face several challenges when it comes to setting their rates and managing their earnings. While the freedom and flexibility of freelancing are appealing, there are obstacles to maintaining a steady income. Here are some of the key challenges freelance accountants often face:

- Inconsistent Income: Unlike salaried positions, freelance accountants often experience fluctuations in income. While some months may be busy with multiple clients, other months may have fewer projects, leading to unpredictable earnings.

- Setting Competitive Rates: Determining how much to charge can be tough. Freelancers must balance competitive pricing with fair compensation for their skills. Charging too little can undervalue their work, while charging too much might turn potential clients away.

- Client Payment Delays: Freelance accountants sometimes face delays in receiving payments. Clients may miss deadlines or negotiate lower fees after the work is completed, making it harder for freelancers to maintain a steady cash flow.

- Tax and Financial Management: Freelance accountants are responsible for their own taxes, retirement savings, and healthcare. Managing personal finances can be a challenge when you're also running a business.

- Managing Multiple Clients: Juggling various clients and projects can lead to burnout, especially when working with tight deadlines. Freelance accountants must be organized and disciplined to meet client expectations while maintaining quality work.

Despite these challenges, many freelance accountants find success by learning to navigate these obstacles, creating a solid business plan, and continually improving their skill set.

Also Read This: How to Promote Your Fiverr Gig for Free

Frequently Asked Questions

Here are some common questions freelance accountants often receive, along with helpful answers to guide those considering the freelance accounting path:

- How much do freelance accountants charge? Rates vary depending on experience, location, and the complexity of the work. On average, hourly rates range from $30 to $150, but specialized services may cost more.

- How can I find clients as a freelance accountant? Networking, using freelancing platforms like Fiverr or LinkedIn, and building a strong online presence are great ways to attract clients. Word-of-mouth referrals also play a big role in growing your client base.

- What services can I offer as a freelance accountant? Freelance accountants can offer tax preparation, bookkeeping, payroll management, financial consulting, and even business incorporation services. Specializing in certain industries can also help you stand out.

- How do I manage my taxes as a freelancer? Freelancers are responsible for their own tax filings. This includes paying self-employment taxes, setting aside money for income tax, and making quarterly payments to avoid penalties. Consider consulting with a tax professional to ensure everything is filed correctly.

- Is freelancing a stable career choice for accountants? Freelance accounting can be stable, but it requires strong self-discipline and effective client management. Building a solid reputation and client base can lead to steady work and long-term success.

Conclusion: Key Takeaways for Freelance Accountants

Freelance accounting offers the opportunity for independence, flexibility, and the potential for a lucrative career. However, it also comes with its set of challenges, including managing fluctuating income, setting fair rates, and staying organized with multiple clients. To succeed in this field, freelancers need to develop a clear pricing strategy, specialize in high-demand services, and focus on building lasting relationships with clients.

Key takeaways for freelance accountants include:

- Specializing in niche services can set you apart from competitors and help you charge higher rates.

- Consistent marketing through online platforms and networking is essential for attracting new clients.

- Effective time management and the ability to juggle multiple clients will help you avoid burnout and maintain a steady stream of income.

- Staying updated with industry trends ensures you remain competitive and can offer the most current services to your clients.

By focusing on these areas, freelance accountants can build a successful career with the right balance of strategy, skills, and client relationships.