Freelance accounting has become a popular career choice for many professionals seeking more flexibility and independence. As a freelance accountant, you get to work with a variety of clients, manage your own schedule, and often choose the type of work that interests you. This can be incredibly rewarding, but it also comes with its own challenges. The ability to set your own rates, manage taxes, and handle different types of accounting services are essential aspects of freelancing in this field.

What Are the Charges for Freelance Accountants?

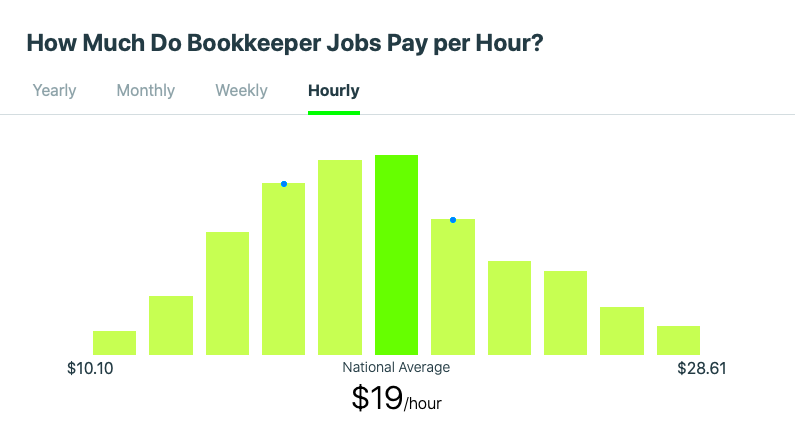

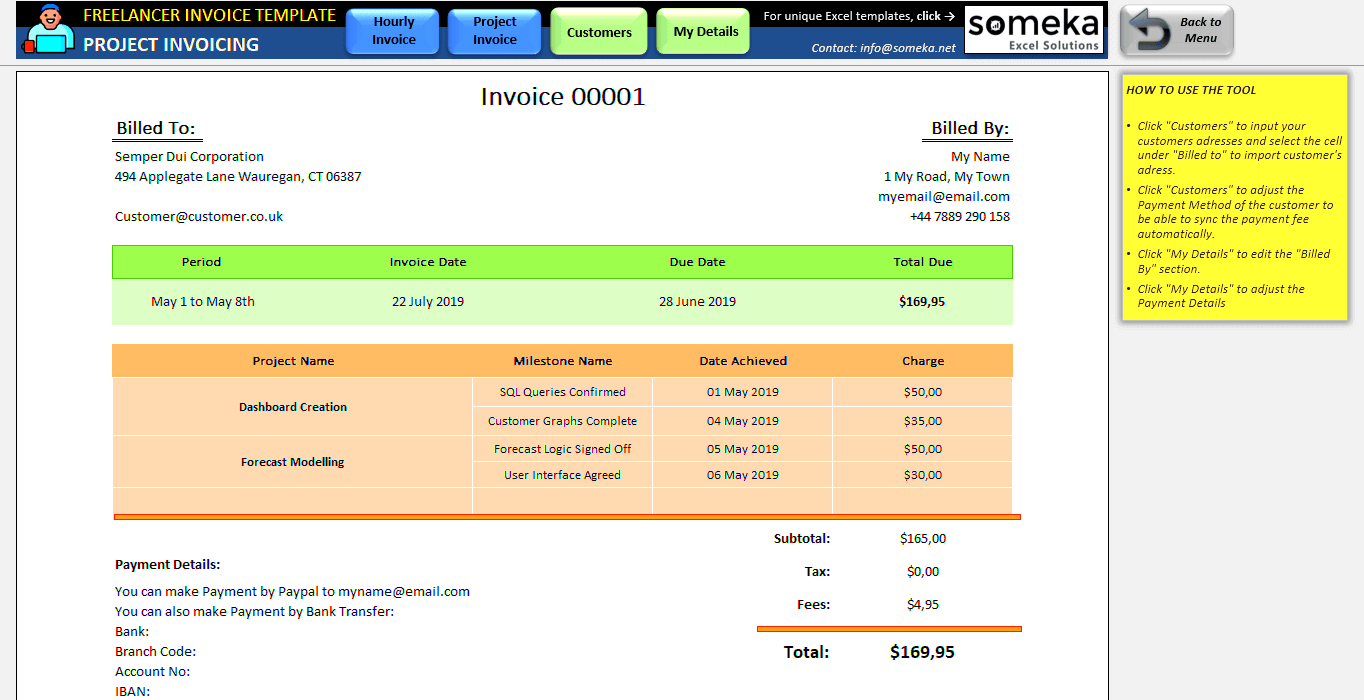

The charges of freelance accountants vary based on several factors including the type of services provided, the experience of the accountant, and the geographic location of the client. However, the most common way freelance accountants charge is through hourly rates or fixed project fees.

Here are some common types of charges freelance accountants may apply:

- Hourly Rate: This is the most common charging method. Rates typically range between $30 to $150 per hour, depending on experience and the complexity of the work.

- Fixed Project Fees: For tasks like tax returns, bookkeeping, or financial planning, accountants might set a fixed fee for the entire project. This fee varies widely depending on the complexity of the project.

- Monthly Retainer: Some accountants prefer to work on a retainer basis, where clients pay a set monthly fee for ongoing services like bookkeeping, tax advice, or payroll management.

The price also depends on other factors like the size of the client’s business, industry, and the specific skills required. For example, accountants with expertise in a niche area, such as international tax law, may charge higher fees.

Also Read This: How to Give Feedback on Fiverr

How Freelance Accountants Set Their Rates

Setting rates as a freelance accountant can be challenging, but it’s important to consider various factors to ensure you’re charging appropriately. Here are some key things that affect how freelance accountants determine their rates:

- Experience Level: The more experience you have, the higher the rate you can justify. Clients are often willing to pay more for seasoned professionals who can handle complex financial matters with ease.

- Scope of Services: Offering specialized services like forensic accounting or financial consulting may allow you to set higher rates compared to general accounting or bookkeeping tasks.

- Market Research: It’s important to research the going rates in your specific market and industry. You don’t want to set your rates too high or too low compared to what others in your area are charging.

- Geographic Location: Accountants in high-cost-of-living areas like New York or San Francisco may be able to charge higher rates compared to those in smaller or rural areas.

- Client Type: Larger businesses or corporations may have a higher budget and be willing to pay more for quality services, whereas small businesses or startups may have tighter budgets.

As a freelance accountant, it’s essential to be flexible and adjust your rates as your experience grows and market conditions change. Regularly revising your rates and being transparent with clients about what you offer will help ensure you’re fairly compensated for your work.

Also Read This: How to Write a Gig on Fiverr: A Comprehensive Guide

Factors Affecting the Earnings of Freelance Accountants

The earnings of freelance accountants can fluctuate based on several factors. It's not just about how much work you do but also about the types of clients, the complexity of the tasks, and even your reputation in the industry. Let’s dive into the main factors that play a role in determining freelance accountants’ income.

- Experience and Skill Level: Experienced accountants generally charge more because they offer a higher level of expertise and efficiency. Specializations in areas such as tax accounting, forensic accounting, or financial consulting can also increase earning potential.

- Type of Clients: Larger businesses and corporations tend to pay more than small businesses or startups. However, small businesses can offer steady, long-term work, which can help build consistent income over time.

- Industry Sector: Accountants who work in niche sectors like real estate, law, or international business often earn more due to the specialized knowledge required in those fields.

- Location: Where you live can affect how much you earn. Accountants in cities with high living costs may charge higher fees compared to those in less expensive areas. Additionally, working with clients from high-income countries or regions can increase your rates.

- Workload and Demand: The number of clients you work with and the demand for accounting services during tax season or year-end planning can affect your income. More work often leads to higher earnings, but too much can lead to burnout.

By understanding these factors, freelance accountants can strategically adjust their pricing, services, and client base to optimize their earnings.

Also Read This: Why Isn’t My Fiverr Gig Showing Up?

How Freelance Accountants Can Maximize Their Earnings

Maximizing earnings as a freelance accountant involves more than just increasing your rates. It's about working smarter, offering specialized services, and ensuring that clients find value in your work. Here are some tips for boosting your income:

- Specialize in Niche Areas: By specializing in a specific area of accounting (such as tax preparation for small businesses or forensic accounting), you can charge higher rates due to your expertise.

- Expand Your Services: Offering a broader range of services like financial planning, budgeting, or business consulting can help you tap into different revenue streams and attract more clients.

- Build Strong Relationships: Loyal clients are often willing to pay more for reliable, ongoing services. Focus on building long-term relationships with clients by consistently delivering high-quality work.

- Optimize Your Time: Efficiently managing your time will allow you to take on more clients or handle more complex tasks without burning out. Use accounting software, automate repetitive tasks, and streamline your workflow to improve your productivity.

- Set Clear Boundaries and Expectations: It's important to communicate your rates and terms upfront. Make sure clients understand the value you bring, so you can avoid underpricing yourself.

With the right strategies in place, freelance accountants can increase their earnings, make their work more rewarding, and improve client satisfaction at the same time.

Also Read This: How to Write a Compelling Gig Title on Fiverr

Common Challenges Faced by Freelance Accountants

While freelance accounting offers many benefits, it also comes with its own set of challenges. Understanding these challenges can help you navigate them more effectively and sustain your career in the long run. Here are some common obstacles freelance accountants face:

- Irregular Cash Flow: Unlike salaried positions, freelance accountants may face periods of low income between clients or seasons. This can make budgeting and financial planning more difficult.

- Client Management: Handling multiple clients with different needs and expectations can be time-consuming and stressful. You need to stay organized and be proactive in managing client relationships to avoid conflicts.

- Legal and Tax Obligations: As a freelancer, you’re responsible for your own taxes and legal requirements. Understanding tax laws and ensuring you comply with local regulations is essential but can be complicated.

- Marketing and Business Development: Finding new clients and keeping a steady stream of work can be challenging. You may need to spend significant time on marketing, networking, and client outreach, which can take away from your actual accounting work.

- Work-Life Balance: Freelancers often struggle with maintaining a healthy work-life balance, especially when handling multiple clients or working on complex projects. It’s easy to overwork yourself without the structure of a traditional office environment.

By recognizing these challenges early on, you can develop strategies to overcome them and enjoy a successful freelance accounting career.

Also Read This: How to Promote Etsy Shops on Fiverr

Frequently Asked Questions

As a freelance accountant, you may encounter various questions from clients or potential clients. It’s essential to be prepared with clear answers to build trust and establish your credibility. Below are some of the most common questions asked by both freelance accountants and clients in this field:

- How do I set my rates as a freelance accountant?

Setting rates can be based on your experience, location, specialization, and the complexity of the services you offer. Researching competitors’ rates and considering your level of expertise can guide you in determining a competitive yet fair price.

- What services can I offer as a freelance accountant?

Freelance accountants can provide a variety of services, including bookkeeping, tax preparation, financial consulting, payroll management, budgeting, and auditing. Offering specialized services, such as forensic accounting or financial planning, can help you stand out.

- How do I find clients as a freelance accountant?

Networking, online platforms like Fiverr, LinkedIn, or freelancing websites, and word-of-mouth referrals can help you find clients. Building a professional online presence and showcasing your work are key to attracting new business.

- What are the common mistakes to avoid as a freelance accountant?

Some common mistakes include undercharging for services, not setting clear expectations with clients, overcommitting, and neglecting the importance of contracts. Always ensure you have a written agreement, track your time, and avoid burnout by setting realistic goals.

- How do I manage taxes as a freelance accountant?

As a freelancer, you are responsible for your taxes. Keep track of your income and expenses, set aside a portion for taxes, and consider working with a tax professional to ensure you file correctly. Make sure to save receipts and maintain good records throughout the year.

Conclusion: Key Takeaways for Freelance Accountants

Being a freelance accountant comes with both rewards and challenges. By understanding the factors that influence your earnings, setting clear rates, and offering specialized services, you can grow your freelance accounting career. Maintaining good client relationships, staying organized, and continuously developing your skills will help ensure long-term success in this flexible and rewarding profession.