So, you've been leveraging Fiverr to get some freelance work done, and you're wondering about the tax implications. Can you write off those Fiverr expenses come tax time? This is a common question for freelancers, small business owners, and anyone utilizing online platforms for services. Let’s dive into the nitty-gritty of tax deductions and clarify whether these expenses can reduce your taxable income.

Understanding Tax Deductions

Tax deductions can be a game-changer when it comes to lowering your tax bill. They reduce your taxable income, meaning you pay taxes only on the income after deductions. But not all expenses qualify as tax-deductible. So, how does this work with Fiverr? Let's break it down!

A tax deduction is essentially a legitimate expense that you can subtract from your total income to reduce the amount of income that is subject to taxation. As a freelancer or small business owner, you likely have several expenses that qualify. Here are the fundamentals:

- Ordinary and Necessary: The IRS states that for an expense to be deductible, it must be both ordinary and necessary for your business. If you're hiring graphic designers for your marketing materials or obtaining voiceover services for a video, these could qualify as necessary expenses.

- Documentation is Key: Always keep detailed records of your Fiverr transactions. This includes invoices and receipts. Documentation will be crucial if ever audited by the IRS.

- Types of Deductible Fiverr Expenses: Consider services like copywriting, graphic design, website development, and video editing. If these services help you generate income, they're generally deductible.

In essence, if the services you procure from Fiverr are directly related to your business and help you earn income, you can likely write them off on your taxes. The key is to be diligent in tracking your expenses and ensuring that they meet the IRS guidelines for deductions!

Also Read This: How to Find a Job on Fiverr

What Expenses Can Be Deducted?

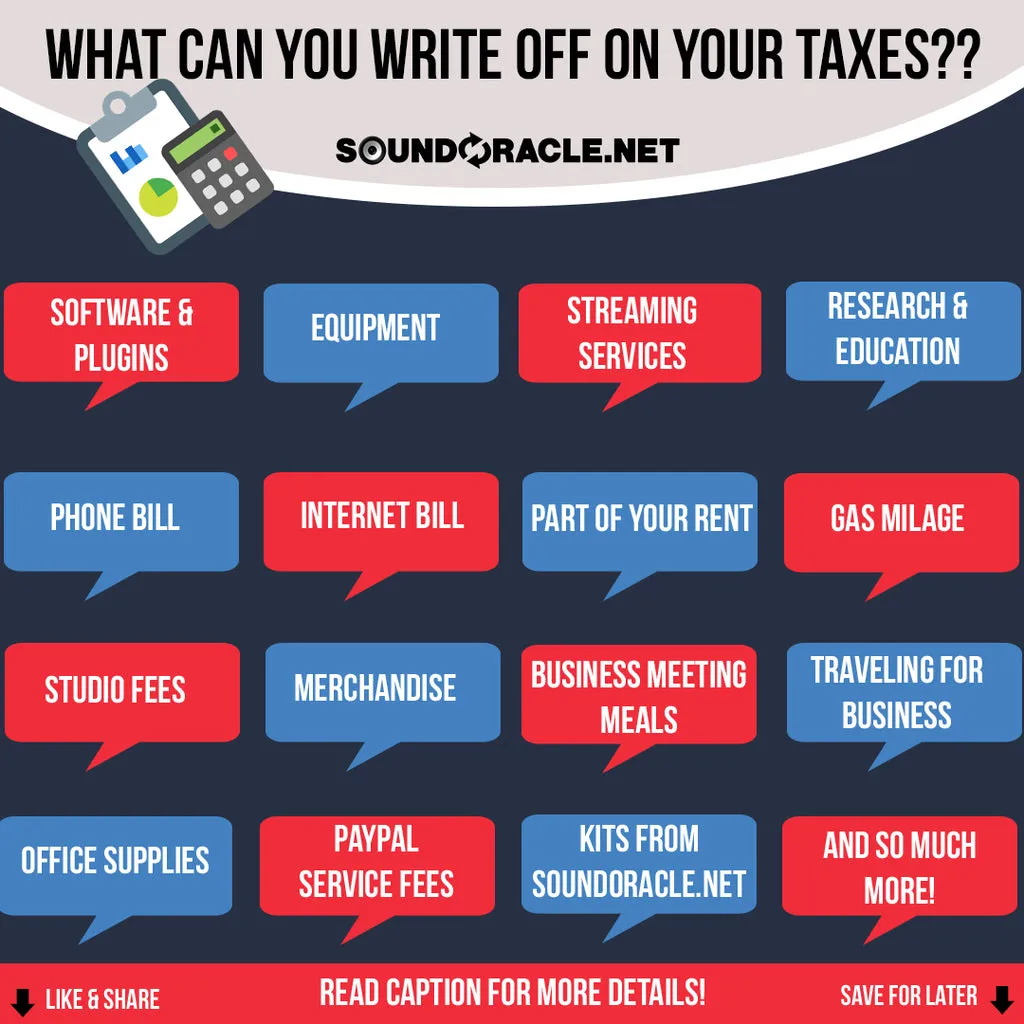

When it comes to taxes, knowing what you can and can’t deduct is crucial for maximizing your savings. If you’re using Fiverr for your business, a range of expenses can be deducted, potentially lowering your taxable income. Here’s a rundown of the expenses you might consider:

- Fiverr Fees: The service fees that Fiverr charges for each transaction can typically be deducted. This includes both the commission taken from your earnings and any fees you paid for services rendered.

- Cost of Services: If you hire freelancers on Fiverr to assist with your projects, these costs are usually deductible. This includes paying for graphic design, writing, marketing services, and more.

- Software and Tools: If you use software or tools in conjunction with Fiverr services (like design or project management tools), these costs can also be deducted as business expenses.

- Online Marketing Costs: Any expenses related to promoting the services you receive from Fiverr, such as advertising on social media or Google, are also generally deductible.

Remember, to qualify for these deductions, you must keep neat records, including receipts and invoices. It's always a good idea to consult with a tax professional to ensure you're maximizing your deductions legally and efficiently. After all, saving some money on your taxes is always a win!

Also Read This: Can I Share a Zoom Link on Fiverr?

Using Fiverr for Business

Fiverr has revolutionized the way businesses operate by providing a platform where they can access freelance talent at affordable rates. Whether you're a small startup or an established company, using Fiverr can offer significant advantages:

- Cost-Effective Solutions: Compared to hiring full-time employees, freelancers on Fiverr offer a cost-effective way to get specific tasks done without the long-term commitment.

- Diverse Skill Sets: The platform boasts freelancers with a plethora of skills ranging from graphic design to coding and marketing. This diversity allows businesses to find exactly what they need without sifting through endless resumes.

- Flexibility: With Fiverr, businesses can scale their workforce up or down based on project requirements. This means you can hire help for a single project or ongoing support without any hassle.

When using Fiverr for your business, consider developing clear project guidelines and communication protocols to get the best results from your freelancers. And don’t forget, keeping track of all these expenses can not only help you during tax season, but it also provides insight into your business spending for future budgeting!

Also Read This: How to Effectively Advertise Your Fiverr Services

5. Documenting Your Fiverr Expenses

When it comes to writing off Fiverr expenses on your taxes, documentation is key. Keeping track of your expenses not only helps you stay organized but also ensures that you’re prepared if you ever face an audit from the IRS. Here are some important steps to consider:

- Keep Receipts: Always save your Fiverr receipts. You can find them in your account under "Orders". Take screenshots or save the PDF versions to have them at your fingertips.

- Record Dates and Amounts: Next to each receipt, jot down the date of the transaction and the total amount you spent. Be diligent about this; it makes your life easier come tax season.

- Document the Purpose: Note why you made the purchase. Did you hire a graphic designer for your freelance project? Make a note of it! This will help justify your expense as a business-related deduction.

- Use Accounting Software: Consider using tools like QuickBooks, FreshBooks, or even simple spreadsheets to keep everything organized. Create a dedicated category for Fiverr expenses to simplify your accounting.

- Stay Consistent: Make it a habit to document your expenses monthly. A little discipline goes a long way in ensuring that you don’t forget any crucial details.

By establishing a thorough system for documenting your Fiverr expenses, you can rest easy knowing you’re on the right side of tax season!

Also Read This: How to Optimize Your Fiverr Profile

6. Tips for Writing Off Fiverr Expenses

Writing off Fiverr expenses doesn’t have to be daunting. Here are some handy tips to make the process smoother and more efficient, ensuring you get the most out of your deductions:

- Know What Qualifies: Familiarize yourself with what qualifies as a deductible business expense. Generally, anything that is necessary and ordinary for your business can be written off.

- Consult the IRS Guidelines: The IRS provides guidelines on deductible expenses. Check their website for resources or manuals that pertain to your specific business type.

- Consider Your Income Level: Only write off what you can justify. A good rule of thumb is to keep your deductions proportional to your income. If you’re not generating significant revenue, large deductions might raise eyebrows.

- Seek Professional Help: If tax season feels overwhelming, don’t hesitate to seek advice from a tax professional. They can provide personalized guidance based on your individual circumstances.

- Review Annually: At the end of each tax year, take some time to review your Fiverr expenses. Look for patterns and see if you're maximizing your deductions.

These tips can equip you to make the most of your Fiverr expenses when tax season rolls around, ultimately helping you keep more of your hard-earned money in your pocket!

Also Read This: How to Become a Freelance Sales Agent

7. Common Mistakes to Avoid

When it comes to deducting Fiverr expenses from your taxes, there are several common pitfalls that many freelancers and small business owners fall into. Let's explore these mistakes so you can steer clear of them and make the most of your tax deductions.

- Not Keeping Accurate Records: One of the biggest mistakes is failing to keep detailed records of your Fiverr expenses. Always save your invoices and any other documentation related to your purchases. This will serve as proof if you're ever audited.

- Deducing Personal Expenses: Be cautious not to mix personal and business expenses. Only expenses directly related to your work—like graphic design, writing, or programming services—should be claimed. Personal use is a no-go!

- Missing Out on Other Possible Deductions: Fiverr is just one of many resources you might use. Don't forget to consider other expenses related to your business such as internet costs, software subscriptions, and office supplies.

- Wait Until Tax Season: Procrastinating until tax season can lead to missed opportunities. Regularly reviewing your Fiverr expenses throughout the year can ensure you're not leaving money on the table.

- Assuming All Expenses Are Deductible: Not all services on Fiverr may qualify as deductible. For example, if you're hiring someone for a personal project, that's not deductible. Make sure you understand the nature of the service and how it relates to your business.

8. Conclusion

So, can you write off Fiverr on your taxes? The answer is often yes, but it requires a bit of due diligence on your part! It’s essential to remember that as a freelancer or small business owner, every expense must be carefully considered in terms of its business relevance.

Ultimately, approaching your Fiverr transactions with an organized and informed mindset can significantly reduce your taxable income. Just remember to keep those receipts and maintain accurate records—these little steps can make a big difference come tax time.

Here’s a quick recap:

| Tip | Explanation |

|---|---|

| Keep Good Records | Save all invoices and paperwork related to your Fiverr expenses. |

| Avoid Mixing Expenses | Only claim expenses that are strictly business-related. |

| Diversify Your Deductions | Don’t forget to consider all related business expenses. |

By being mindful of these key factors and avoiding common mistakes, you’ll set yourself up for tax success, helping you keep more of your hard-earned money. Happy freelancing!