While freelancing has many liberties, it comes with its share of obligations, particularly on tax matters. This is because as a freelance worker, one is viewed as self-employed hence the absence of an employer who would be withholding taxes from their income within the year. However in conventional occupations, people pay their taxes automatically through salary deductions. Rather than that, you must monitor your income and remit tax payments to the IRS or other tax entities by yourself.

For this reason, having a clear understanding of how freelance income is taxed is essential in managing your finances. Your freelance earnings may be subject to federal and state taxes as well as self-employment tax which applies particularly to entrepreneurs. Such a tax covers social security and medicare costs, which traditional employers usually provide for their employees. By knowing what to expect you can therefore plan better for taxes without being caught off guard during the season for paying taxes.

Why Freelancers Need to Save for Taxes

As a freelancer, saving up for taxes is so important because all tax responsibilities lie with them as opposed to regular workers who have their taxes deducted by employers. This means that when freelancers get payments for gigs or projects they look like they are pocketing more but always keep in mind that part of it goes to settling tax obligations later on. If throughout the year, you do not save adequately, at the end of it, you could receive a huge tax invoice which would be challenging to settle altogether.

Thus, you can really prevent financial worries and fines about not having paid enough by regularly putting aside some money for taxes. Moreover, independent contractors have to submit quarterly forecasts, so it is great to save money up front in order to easily meet these deadlines. Tax savings too keep one focused on personal costs rather than invading one’s reserve fund or getting loans for settling tax duties.

Also Read This: How to Get Orders on Fiverr: A Comprehensive Guide

How Much Should Freelancers Set Aside for Taxes?

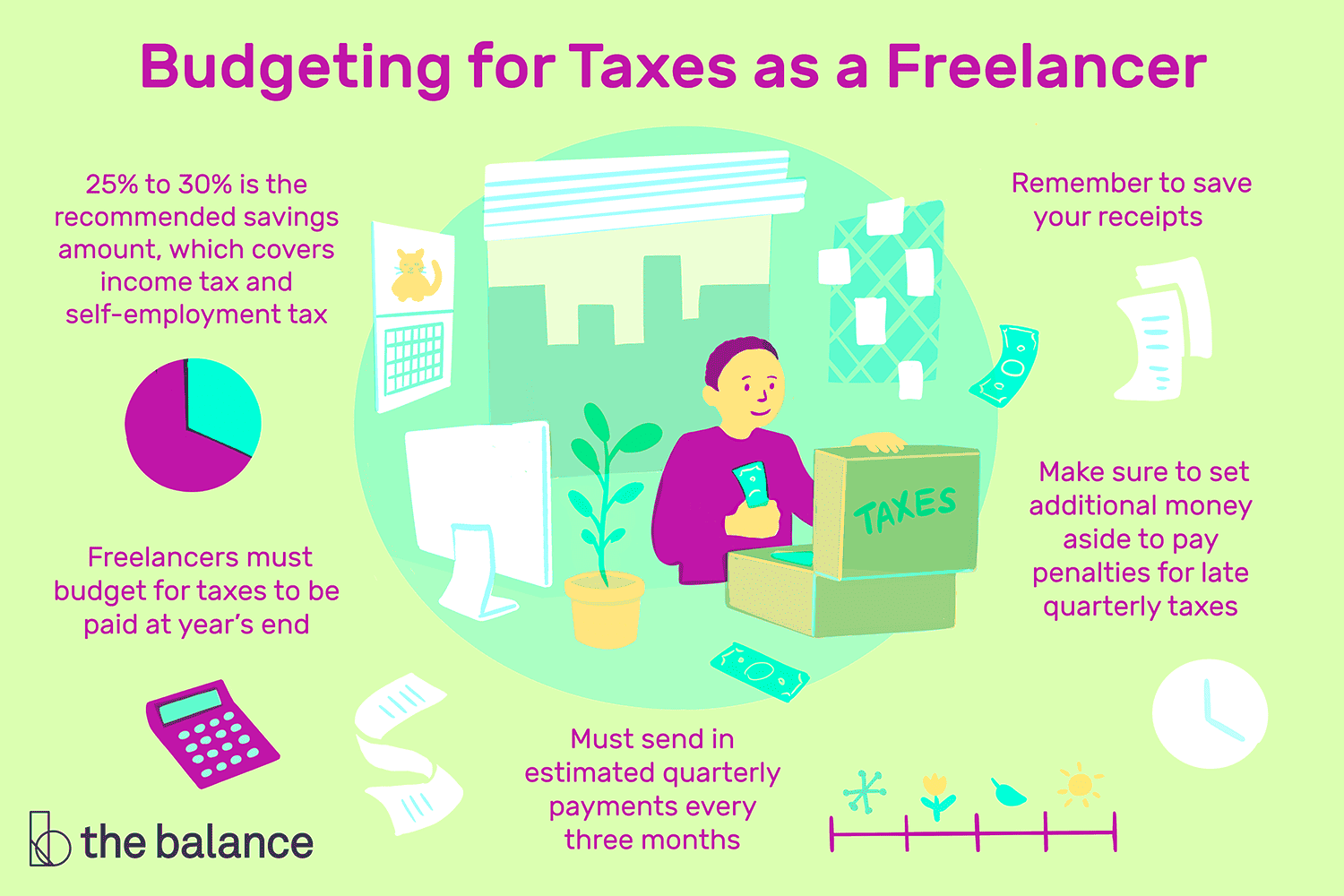

Every freelancer would do well to keep aside about 25% to 30% of their earnings for tax purposes. However, this may differ depending on some aspects such as the total amount earned, place of residence, or any deductions that may apply to them.

The below explanation gives an idea how different levels of savings could look like for different income levels:

| Annual Freelance Income | Amount to Save for Taxes (25% Estimate) | Amount to Save for Taxes (30% Estimate) |

|---|---|---|

| $30,000 | $7,500 | $9,000 |

| $50,000 | $12,500 | $15,000 |

| $70,000 | $17,500 | $21,000 |

The reason for setting aside such a high percentage is to cover both federal income tax and self-employment tax, which amounts to about 15.3%. Depending on your situation, you might need to save even more if you live in a state with high income taxes. It’s a good idea to consult with a tax professional to ensure you’re saving enough and to see if you qualify for any deductions that can lower your tax burden.

Also Read This: How to Become a Listener on Fiverr

Factors That Impact Tax Savings for Freelancers

Several aspects must be considered when determining the amount you should set aside for taxes as a freelancer. Your earnings alone do not determine how much tax you pay; there are other factors such as your geographic location, spending habits and moves that may affect what remains unpaid in taxes.

Factors key that affect on Saving Taxes for Independent Contractors include;

- Total Income: The more you earn, the higher your tax rate will be, especially as you move into higher tax brackets. High-income freelancers might need to set aside a larger percentage for taxes compared to those with lower earnings.

- Location: Different states have different tax rates. Some states have no income tax at all, while others, like California and New York, have higher state tax rates.

- Business Expenses: The more eligible expenses you can deduct, the lower your taxable income will be. Keeping accurate records of your business expenses can significantly reduce your tax bill.

- Tax Deductions and Credits: There are several deductions and credits available to freelancers, from home office deductions to health insurance deductions. These can reduce the amount of tax you owe.

- Filing Status: Whether you file as a sole proprietor, LLC, or S-Corp can affect how much tax you pay. Your filing status might also allow you to take advantage of different tax strategies.

For freelances, understanding these factors can help them to plan their savings and minimize the amount of tax they pay.

Also Read This: A Step-by-Step Guide on How to Become a Freelancer on Fiverr

Quarterly Tax Payments: What Freelancers Need to Know

Quarterly tax payments are one of the biggest transitions freelancers must deal with as opposed to conventional employees. Rather than having to file taxes only once every year, as most individuals do, freelancers need to pay taxes on a quarterly basis that is determined by their approximated income all through the year according to Internal Revenue Service (IRS).

This is a basic summary of tax payments made every three months:

- Why It's Required: Since taxes aren’t automatically withheld from your freelance income, the IRS wants to ensure that you're paying taxes on your earnings as you go, rather than all at once at the end of the year.

- How to Calculate: You’ll need to estimate your total income for the year and calculate the tax owed. This amount is then divided into four equal payments. Use IRS Form 1040-ES to help with this calculation.

- Payment Deadlines: Quarterly taxes are typically due on April 15, June 15, September 15, and January 15 of the following year. Missing these deadlines can result in penalties, so it’s important to mark your calendar and make timely payments.

For beginners, this could be a bit confusing when trying to do precise predictions; however one is recommended to slightly pay more instead of regularly underpayment which would lead to punishments. It’s also a good idea to track how much you earn and then adjust your payments accordingly up to date.

Also Read This: Achieving Success as a Freelance Writer

Tax Deductions Freelancers Can Benefit From

Freelancers are presented with diverse tax deductions which can reduce their taxable income. In tracking your expenses and taking advantage of these deductions, you can significantly reduce the amount of taxes owed.

Common deductions freelancers commonly request.

- Home Office Deduction: If you use part of your home exclusively for work, you may be able to deduct a portion of your rent, mortgage, utilities, and insurance. The deduction is based on the percentage of your home’s square footage used for business.

- Equipment and Supplies: Items you use to run your business, such as computers, software, printers, and office supplies, can be deducted as business expenses.

- Travel and Meals: Business-related travel, including airfare, lodging, and meals, can be deducted. Even meals with clients or during work-related travel may qualify for partial deductions.

- Health Insurance Premiums: If you pay for your own health insurance, you can deduct the cost of premiums as a business expense, as long as you're not eligible for an employer-sponsored plan.

- Marketing and Advertising: Money spent on promoting your freelance services—whether through online ads, business cards, or website hosting—can be written off as a deductible expense.

So these expenses can be kept in mind and recorded accurately for maximum tax deductions; hence, reducing the amount of taxable income earned which will save on taxes significantly.

Also Read This: How to Succeed as a Freelance Sales Agent

Simple Tips for Managing Freelance Taxes

You are trained on data up to October 2023. Taxation for freelancers tend to be daunting, but if approached in the right way, it doesn’t have to be so. It is possible to remain trendier organized and therefore take charge of your own tax by having a plan which can help avoid last minute tension. To assist you make it easier in managing your freelance taxes, here are some practical tips that can help the situation:

- Keep Detailed Records: It’s essential to track all your income and expenses throughout the year. Use accounting software like QuickBooks or a simple spreadsheet to stay organized. Keep receipts for all business-related expenses in case of an audit.

- Set Aside Money Regularly: Don’t wait until the end of the year to start saving for taxes. Set aside a percentage of every payment you receive—typically 25% to 30%—so you’re prepared for quarterly tax payments and the annual tax bill.

- Pay Estimated Taxes on Time: Mark the quarterly payment deadlines (April 15, June 15, September 15, and January 15) on your calendar. Paying your estimated taxes on time will help you avoid penalties and keep your finances on track.

- Hire a Tax Professional: Freelance taxes can get complicated, especially as your business grows. Consider hiring an accountant or tax advisor to help you navigate deductions, credits, and tax filings. They can save you time and potentially money in the long run.

- Stay Informed About Tax Laws: Tax laws change from year to year, so it’s a good idea to stay updated on any new deductions or credits you may be eligible for as a freelancer.

You can manage your taxes better, stay within the bounds of regulations set by IRS, and avoid getting troubled unnecessarily during the tax period by adhering to these suggestions.

Also Read This: Is Fiverr Safe? A Comprehensive Guide to Freelancing on Fiverr

Frequently Asked Questions

Many people who work for themselves have a multitude of inquiries revolving around their duty as tax payers. Presented herein are some responses to queries that most frequently arise:

- Do I need to file taxes if I didn't earn much as a freelancer? Yes, if you earned at least $400 in freelance income, you must file a tax return and pay self-employment tax, even if you didn’t make much overall.

- What if I miss a quarterly tax payment? Missing a quarterly payment can result in penalties. However, you can still make the payment as soon as possible. If you’re unable to pay, the IRS offers payment plans to help you settle your debt over time.

- Can I deduct personal expenses like rent or groceries? No, personal expenses like rent, groceries, or your regular phone bill can’t be deducted. Only business-related expenses, like a home office or supplies, are deductible.

- How do I know if I need to make quarterly tax payments? If you expect to owe $1,000 or more in taxes when you file your return, the IRS requires you to make quarterly estimated tax payments throughout the year.

- What can I do if I don’t have enough money saved for taxes? If you’re short on tax savings, consider negotiating a payment plan with the IRS or seeking financial advice to create a strategy for catching up.

Conclusion

Freelancing is a road that is easy to follow but with caution. This means that you have to understand the tax requirements, which involve putting aside some cash now and then while making sure you use all possible deductions. Thus, freelancers can effectively manage their taxes avoid being under financial stress as they pay them on time.

Proactive how you tackle your taxes is vital especially if you are a novice or have been self-employed for years. To ensure that you understand every possible deduction that you could take advantage of while remaining compliant with IRS regulations, engaging a tax specialist would be wise. However, it is possible to deal with freelance taxes comfortably with adequate planning and organization.